The Bank of Canada has recently released a report outlining the current business sentiment that exists across the country.

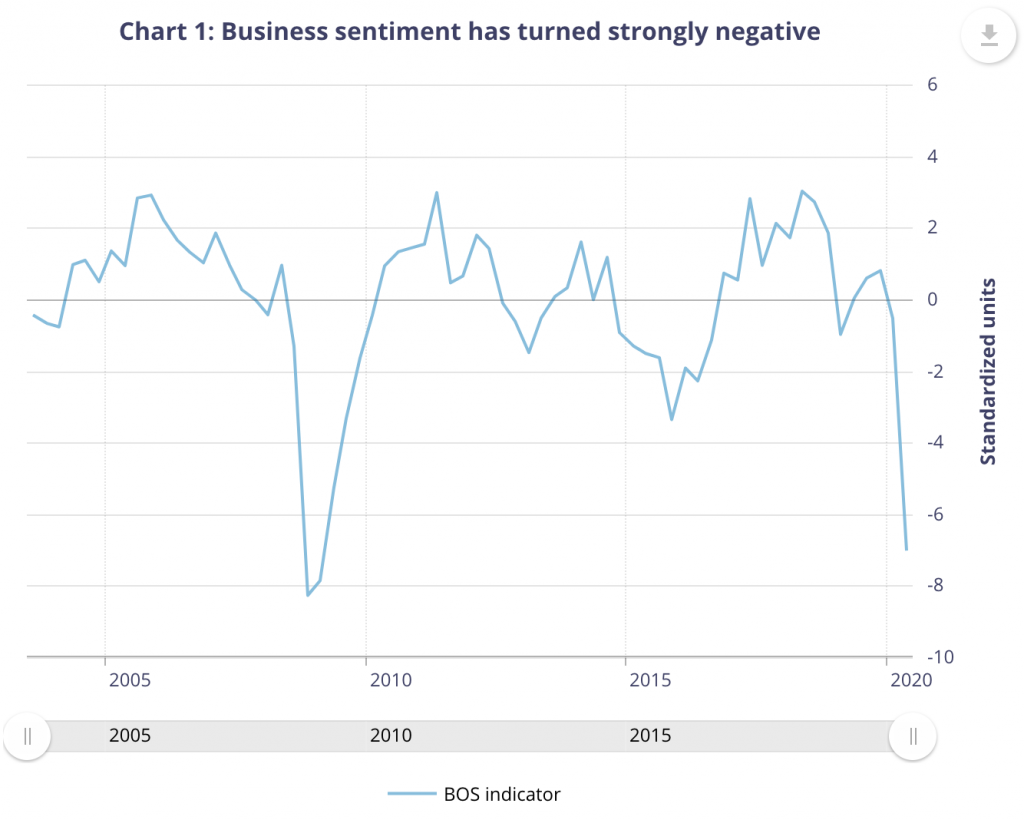

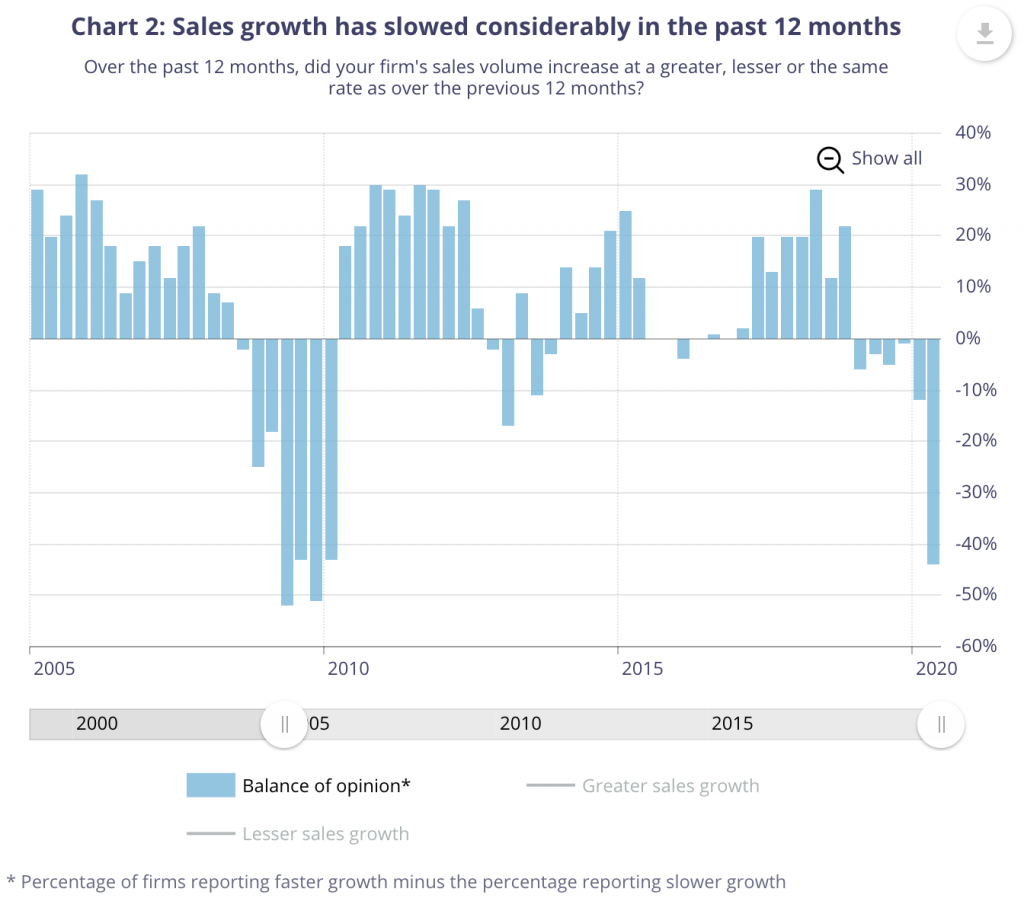

According to a BoC report which surveyed various business executives between May 12 and June 5, there is a strong, negative business sentiment across many provinces and various sectors stemming from the coronavirus pandemic and the fallout of oil prices. Despite the lifting of lockdowns, many businesses that are returning to work have been subject to a slow turnaround in sales growth resulting from reduced demand, easing price pressures, as well as crumbling forward-sales expectations.

The survey found that at least half of businesses across Canada have seen a decrease in sales as a direct result of the pandemic. Moreover, the same businesses are expecting the trend to continue into at least next year. Although many firms have laid off their employees during the height of the pandemic in March and April, they are planning on bringing back some of their workforce, but certainly not to full capacity for the time being.

The survey also found that many Canadian businesses have been significantly reducing their capital expenditures, and plan to continue doing so for the next 12 months. Consequently, if a sudden surge in demand was to ensue, the same businesses signalled that they would be ill-prepared as a result. Nonetheless, at least half of those that are classified as exporters are expecting abroad sales to continue falling over the next 12 months, suggesting that aggregate demand will only increase gradually as restrictions continue to be lifted.

Information for this briefing was found via Bloomberg and Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.