In a surprising move, one of the five members of the California Public Utilities Commission (CPUC) proposed on December 13 that the state should dampen the solar energy incentives it gives to customers which install the devices on their homes.

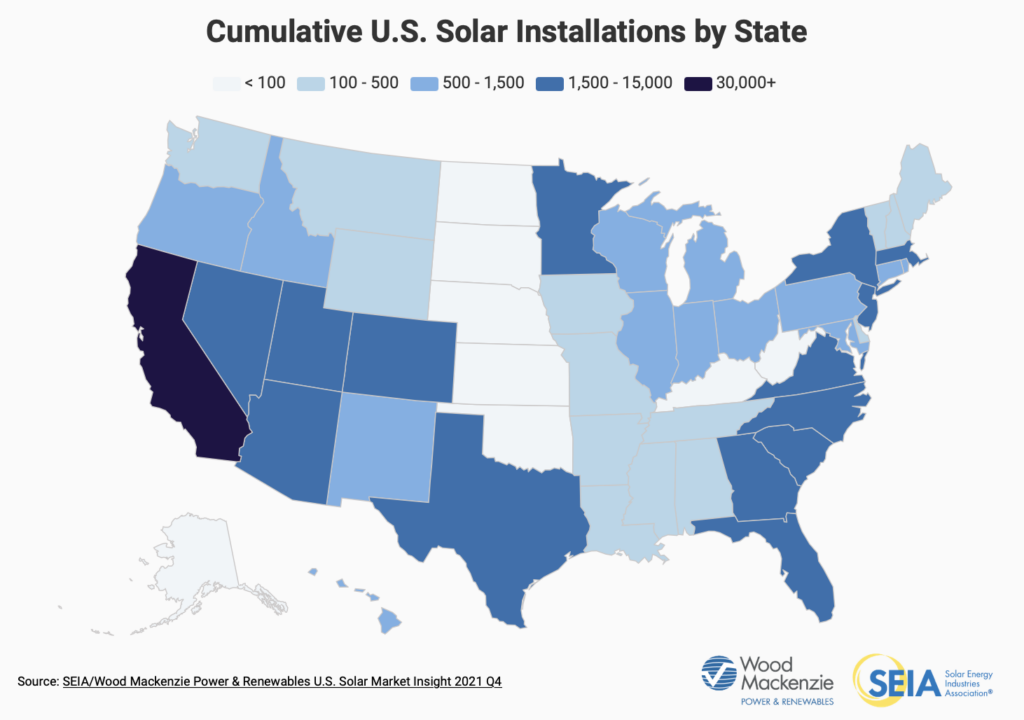

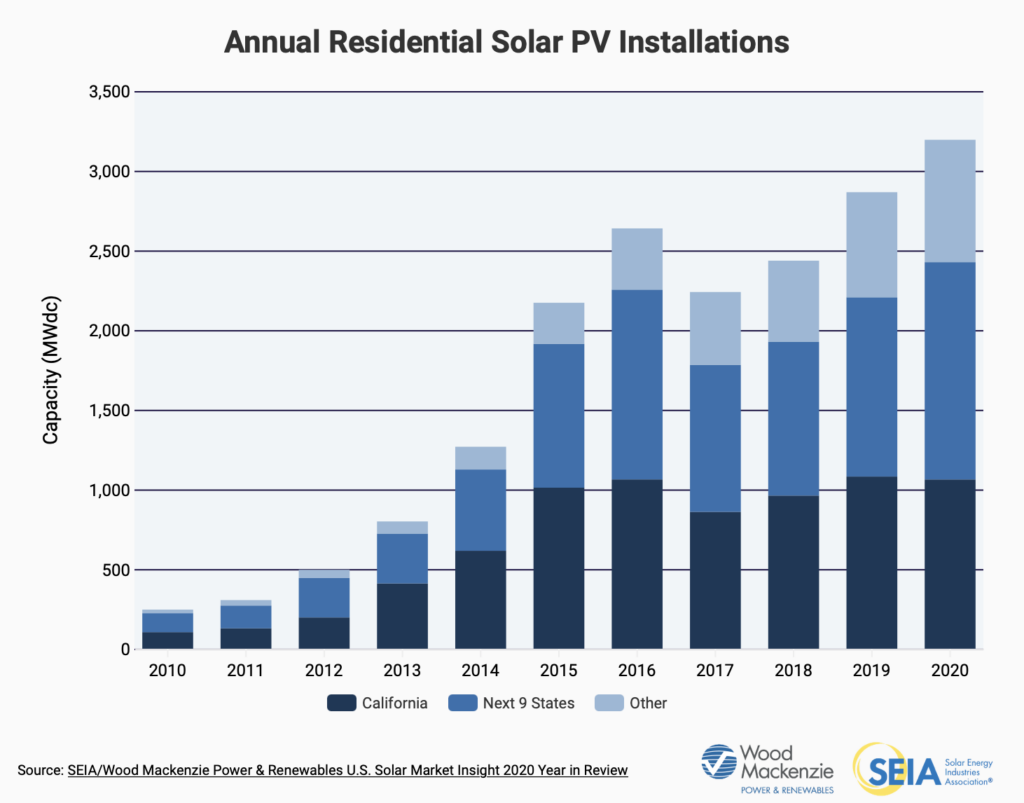

The proposal, which is a rare step in that it does not prioritize essentially any form of renewable energy regardless of the costs entailed, is a clear negative for solar power manufacturers such as Sunrun Inc. (NASDAQ: RUN), Sunnova Energy International Inc. (NYSE: NOVA), and SunPower Corporation (NASDAQ: SPWR). More than 1.3 million rooftop and small solar generation systems are installed in California, dwarfing that of any other state.

The full CPUC cannot vote on the proposed decision until January 27, 2022 at the earliest, so it is possible that the final ruling could differ from Commissioner Martha Aceves’ articulated strategy. It should be noted that the actions of California utility regulators are frequently adopted by other state commissions, so the CPUC’s actions tend to reverberate in many other jurisdictions.

Commissioner Aceves wants to make changes to the state’s net metering policies. Net metering is a billing tool that utilizes the electric grid of a region (like California) to store excess energy produced by a customer’s solar panel system. Importantly, energy which a customer’s solar panel produces, but does not use in the home, is credited back to the ratepayer. In many ways, net metering is a foundational economic policy for solar power.

Typically, California’s electric grid receives huge amounts of electricity generated by solar installations in the afternoon, but that electricity is cut to low levels on peak summer evenings forcing the state to turn to fossil-fired generation at those times.

The commissioner’s solution to this problem is to slash the credits an owner of a solar system would receive for over-producing to an “avoided cost” rate of about US$0.05 per kilowatt-hour (Kwh), down dramatically from the current retail rate of US$0.20-$0.30 per Kwh. Furthermore, new solar customers would be required to pay a monthly “grid participation charge” of US$8 per kilowatt of solar energy capacity to help maintain the integrity of the state’s electric grid. Finally, the plan would encourage existing solar customers to add battery storage to their homes which would allow them to store clean energy for use when the sun is not shining – which could prove beneficial to names such as Tesla (NASDAQ: TSLA) and Eguana Technologies (TSXV: EGT), whom currently provide battery storage solutions for solar installations.

This drastic rate shift is designed to reverse an estimated US$3.4 billion annual “cost shift.” This shift represents the net benefit received by richer households in California from net metering policies, versus the extra costs incurred by lower income ratepayers who cannot afford to install solar panels at their homes.

As one might imagine, the state’s investor-owned utilities and consumer advocates have embraced Commission Aceves’ position, as the change will limit utilities’ payments for excess solar-generated energy when it is not needed. The chief consumer advocate believes the plan will lower the burdens on low-income households “who have been left behind under the current program.”

Solar manufacturers are far less pleased. A Sunrun representative said the plan would “impose the highest discriminatory charges on solar and energy storage customers in the U.S.” and that it is “contrary to the state’s objectives of addressing climate change and eliminating frequent blackouts.”

Given the huge financial — and indeed overall investor sentiment — implications of the California proceedings on solar companies, investors may want to steer clear of this space until the dust settles. This issue will be further complicated by key changes in personnel at the CPUC. Commissioner Aceves plans to leave the regulatory body this month to take a position as head of the southwestern region of the U.S. Environmental Protection Agency. In addition, the president of the five-member CPUC will be replaced on January 1, 2022 by the California governor’s chief energy advisor.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The firm has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.