Canada Nickel Company (TSXV: CNC) has finally completed an updated mineral resource estimate for its flagship Crawford Nickel property. The results of the update were positive, with measured and indicated mineral resources more than doubling from their previous estimate.

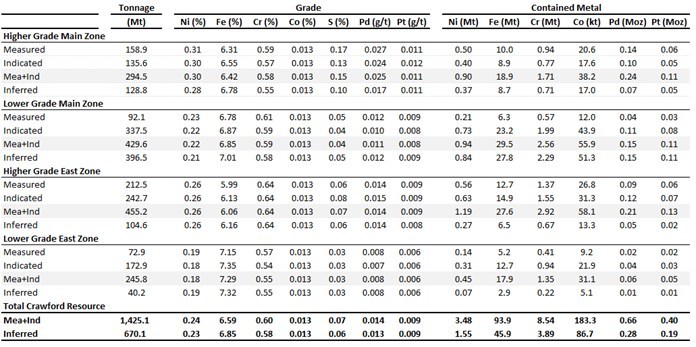

The refined filing now estimates that the company has 1,425.1 million tonnes of 0.24% nickel, resulting in 3.48 million tonnes of nickel on a measured and indicated basis. Inferred resources meanwhile sit at 670.1 million tonnes at 0.23% nickel, or 1.55 million tonnes of nickel. Combined, the company is claiming that it is the fifth largest resource of contained nickel sulphide in the world.

The estimate also contains credits for iron, chromium, cobalt, sulfur, palladium, and platinum.

The improved estimate figures are said to largely come from the firms East Zone, where the resource increased more than 14-fold, while certain assays were not included in the estimate as a result of not being completed by the cut off date. The company believes this provides further opportunity for growing the resource, with the firm commented that they “expect the final feasibility study resource to support the upper end of our mine plan target of 1.3 to 1.8 billion tonnes.”

The company’s previous resource estimate consisted of 1.7 million tonnes of contained nickel on a measured and indicated basis, and 1.2 million tonnes contained nickel on an inferred basis. Notably, grades declined from 0.26% nickel on a measured and indicated basis, and from 0.24% nickel on an inferred basis.

The data to compile the resource estimate consisted of 113 drill holes for an aggregate 56,286 metres of drilling.

Canada Nickel last traded at $1.58 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.