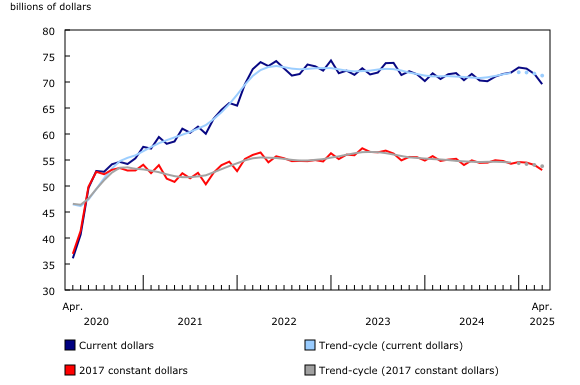

Canada’s manufacturing sector recorded its sharpest monthly decline since late 2023, as Statistics Canada reported Friday that sales fell 2.8 percent in April to $69.6 billion. This marks the lowest level for the industry since January 2022 and extends a three-month streak of falling sales, underscoring the mounting pressures from an escalating tariff dispute with the United States.

The downturn was led by steep drops in petroleum and coal products, which fell 10.9 percent, motor vehicles down 8.3 percent, and primary metals off by 4.4 percent. Statistics Canada attributed much of the weakness to the first full month of United States tariffs targeting Canadian steel, aluminum, and automotive goods, as well as broader global trade tensions that weighed on prices and volumes—particularly in energy-related sectors.

Ontario, home to much of Canada’s auto manufacturing, saw the most pronounced decline, with several assembly plants partially shutting down in response to tariff uncertainty. In total, eight provinces experienced lower manufacturing sales in April. About half of Canadian manufacturers surveyed said they were affected by tariffs, reporting higher costs for raw materials, shipping, and labour, as well as shifts in product demand. The impact was also felt in wholesale, where sales fell 2.3 percent, with motor vehicle parts and accessories leading the drop.

The trade dispute, which began in March, has already prompted some relief measures. The United States has offered carveouts for certain North American trade agreement-compliant goods, while Canada has eased some of its own counter-tariffs for critical sectors.

The manufacturing slump contributed to Canada’s largest-ever monthly merchandise trade deficit, at $7.1 billion in April. With inventories falling and both manufacturing and wholesale sales below expectations, CIBC senior economist Andrew Grantham warned that the economy may have started the second quarter with flat or slightly negative growth.

Statistics Canada is set to release formal gross domestic product figures for April on June 27.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.