The Office of the Superintendent of Financial Institutions (OSFI) is preparing to enforce Basel IV standards, which could significantly impact commercial bank lending in Canada. Basel IV is the latest iteration of international banking regulations aimed at strengthening global financial stability by requiring banks to hold more capital against risk-weighted assets. This move, however, may have unintended economic consequences, particularly in the housing and lending sectors.

Industrialized nations have been coordinating banking systems for decades, with the Basel Accords serving as a cornerstone of global financial stability. These accords, developed in Basel, Switzerland, aim to ensure banks maintain adequate capital reserves to withstand economic shocks. Basel IV, the latest round, mandates that banks hold more capital relative to their risk-weighted assets, a measure intended to curb excessive risk-taking.

In the UK, full implementation is set for 2030, while Europe plans to complete the transition by 2032. The United States remains uncertain about its timeline. In contrast, Canada has decided to fully implement Basel IV by mid-2026, a rapid pace that could strain the country’s financial system.

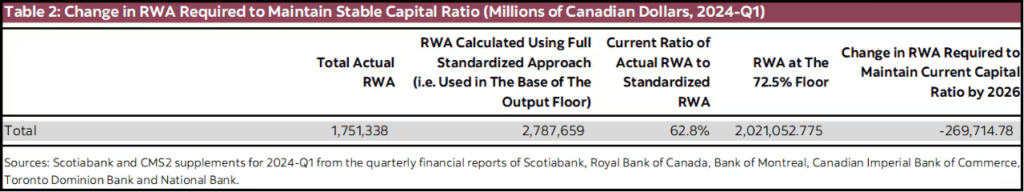

Scotiabank’s chief economist Jean-François Perrault, in a recent report, highlighted the potential consequences: “Banks would have to shed about $270 billion in assets by 2026 if capital ratios remain unchanged and banks do not raise capital.” This reduction, representing about 9% of Canada’s nominal GDP, would likely lead to decreased lending to both corporations and individuals, including fewer residential mortgages.

As Canada moves toward full implementation of Basel IV by mid-2026, banks face a critical challenge: how to increase their capital reserves without destabilizing their operations. One suggested method is for banks to raise capital by issuing equity. However, this option is seen as unappealing given current market valuations.

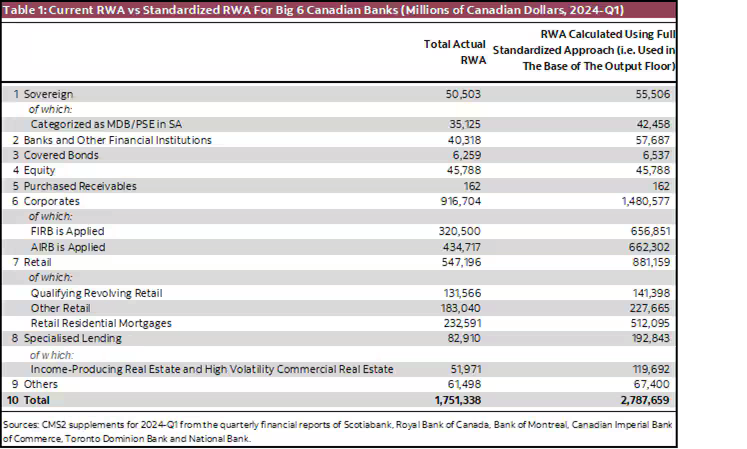

In comparing current risk-weighted assets (RWA) for Canadian banks to the standardized RWA approach, Perrault noted that the transition from a 65% to a 72.5% output floor by 2026 will necessitate significant adjustments.

“Banks can always raise capital by issuing equity, but this option is unappealing given valuations. As a result, it is likely that banks will choose to shed [risk-weighted assets] RWA in order to meet capital requirements,” wrote Perrault.

Cutting dividends can also bolster reserves but that would affect the shareholders’ income, making it a politically and economically difficult option. This highlights the catch-22 banks face: needing to increase capital reserves to comply with Basel IV, while available methods are either politically sensitive or economically unfavorable.

The timing of these changes raises significant concerns. The federal government has pledged to build three million new homes to address the housing crisis, but reduced mortgage lending could hinder these efforts. According to Scotiabank’s chief economist, the implementation of Basel IV could, “force banks to cut back lending to the very sectors of the economy governments are trying to mobilize financing for. Moreover, a potential reduction in mortgage financing at a time of dramatically rising demographic requirements risks making housing even less accessible to some Canadians despite government efforts to the contrary.”

One of the primary goals of Basel IV is to enhance the resilience of banks by requiring them to hold more capital against their risk-weighted assets. By adopting these standards swiftly, Canada aims to strengthen its banking sector against potential economic shocks and financial crises. This is particularly important given the global economic uncertainties and the lessons learned from the 2008 financial crisis.

However, critics argue that the rapid implementation of Basel IV represents a coordination failure between regulatory bodies and government housing policies. The discrepancy between Canada’s timeline and those of other major economies could place the country at a competitive disadvantage. As OSFI pushes for a safer banking system, the economic costs of such reforms are becoming increasingly apparent.

Some stakeholders have questioned whether Canada could avoid the stringent requirements of Basel IV. While opting out entirely isn’t feasible for a country that relies heavily on its international banking reputation, there are potential ways to mitigate the impact. One approach could involve negotiating for a more extended implementation timeline, aligning more closely with the schedules of the UK and Europe.

Another possibility is lobbying for specific adjustments or exemptions that consider the unique aspects of the Canadian financial system. However, such strategies would require significant diplomatic effort and coordination among Canadian financial authorities, regulators, and international banking partners.

Information for this briefing was found via Scotiabank and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.