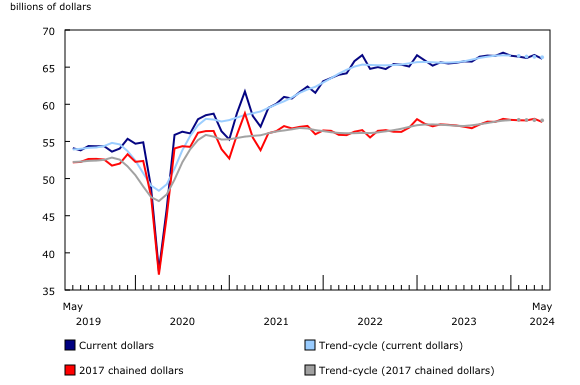

Canadian retail sales fell by 0.8% in May to C$66.1 billion, according to Statistics Canada, marking a significant decline led by decreased spending at food and beverage retailers. This drop exceeded economists’ expectations of a 0.6% decrease, indicating a more pronounced slowdown in consumer spending than anticipated.

The decline was broad-based, affecting eight out of nine retail subsectors. Core retail sales, which exclude gasoline stations, fuel vendors, and motor vehicle and parts dealers, experienced an even steeper decline of 1.4%. This follows a 1.2% increase in April, suggesting a notable shift in consumer behavior.

Food and beverage retailers were hit particularly hard, with sales dropping 1.9%. Supermarkets and grocery stores saw a 2.1% decrease, while beer, wine, and liquor retailers experienced a 3.3% decline. Other sectors feeling the pinch included building material and garden equipment suppliers (-2.7%) and general merchandise retailers (-1.0%).

The automotive sector provided the only bright spot, with motor vehicle and parts dealers reporting a 0.8% increase, driven primarily by new car dealers (+1.6%) and used car dealers (+1.8%)[4]. However, this was partially offset by declines in other motor vehicle dealers and automotive parts retailers.

Geographically, the downturn was widespread, with nine out of ten provinces reporting decreased sales. Alberta led the provincial declines with a 2.5% drop, while British Columbia saw a 1.3% decrease. Nova Scotia was the sole province to buck the trend, posting a 0.6% increase.

E-commerce also felt the impact, with seasonally adjusted online sales falling 3.6% to C$3.9 billion, accounting for 5.9% of total retail trade, down from 6.1% in April.

Looking ahead, Statistics Canada’s advance estimate suggests a further 0.3% decline in June, though this figure is subject to revision. This preliminary data, based on responses from just over half of surveyed companies, hints at a potentially prolonged period of retail weakness as Canadian consumers grapple with economic uncertainties.

These numbers are for May – the flash for June is -0.3%. So overall economic activity is grinding to a halt. Nine provinces saw a decline in retail sales. https://t.co/uuM6Xxiom9

— Frances Horodelski (@fhoro) July 19, 2024

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.