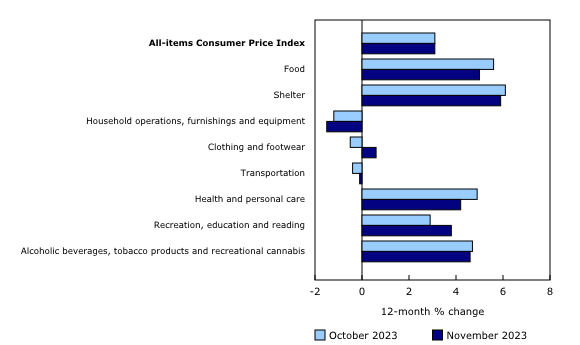

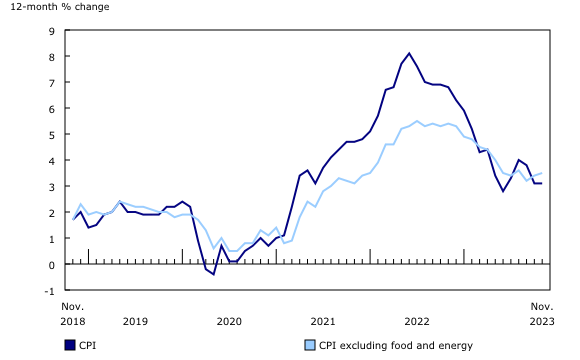

Canada’s Consumer Price Index (CPI) remained consistent in its year-over-year growth, registering a 3.1% increase in November, mirroring the rise in October. Notably, November’s inflation was influenced by a diverse range of factors, including heightened travel tour costs and moderated food and energy prices. The CPI, excluding food and energy, saw a slight uptick, rising by 3.5% in November compared to 3.4% in October. This increase reflects ongoing economic pressures beyond the volatile food and energy sectors.

On a monthly basis, the CPI exhibited minimal growth, rising just 0.1% in November, consistent with the growth observed in October. Gasoline prices, though falling, exerted upward pressure on the CPI as their decline slowed to -3.5% in November from -6.4% in October. The seasonally adjusted monthly CPI also witnessed a 0.3% increase.

Canadians continue to bear the brunt of escalating costs in several key areas. Mortgage interest costs soared by 29.8%, while food purchased from stores and rent increased by 4.7% and 7.4%, respectively. Grocery prices continued their upward trajectory but at a decelerating pace, rising 4.7% in November compared to 5.4% in October. This slowdown was evident across various food components, marking the fifth consecutive month of diminishing grocery price growth. Conversely, certain food items like meat, preserved vegetables, and sugar products saw faster price increases compared to October.

Service prices remained high, rising 4.6% year over year in November, a rate unchanged from October. The significant surge in travel tour prices, a striking 26.1% year-over-year increase, was primarily driven by events in U.S. destination cities.

Energy prices presented a mixed picture. While overall energy prices fell more significantly year over year in November (-5.7%) than in October (-5.4%), led by a sharp decline in fuel oil prices, electricity prices rose by 8.2%, with Ontario seeing a notable increase due to higher time-of-use rates.

Regionally, inflation rates increased across all provinces, though six provinces experienced a slower pace compared to October.

Information for this story was found via Statistics Canada. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.