Canada’s economy fared worse than expected in August and remained little changed in September, as ongoing supply chain disruptions continue to impede a strengthening in economic growth.

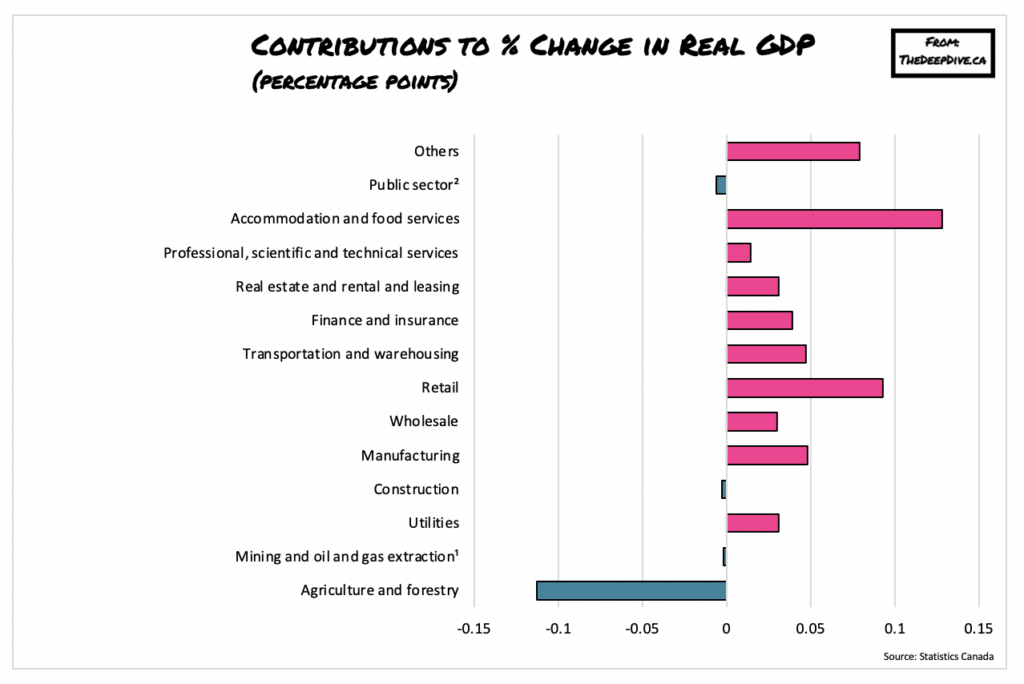

According to data published by Statistics Canada on Friday, GDP expanded by only 0.4% in August, largely as a result of increases across services-producing industries which grew 0.6%, offsetting a 0.1% decline in the goods-producing industries. Although 15 of the 20 industrial sectors reported growth in August, the overall GDP gain was still less than the 0.7% growth forecast by economists polled by Bloomberg.

To make matters worse, preliminary estimates for September suggest that economic activity did not improve from August’s dismal reading, and remained essentially unchanged at 0.5%. Although there was a significant increase in the mining, quarrying, and oil and gas extraction sector led by a surge in global energy prices last month, it was not enough to outweigh the substantial drop in manufacturing and retail trade.

Looking closer at the figures, the accommodation and food services sector was up 7% in August, marking a continued increase since plummeting at the beginning of the pandemic. Similarly, the retail trade sector also rose 1.8% in August, following a decline of 0.6% in the month prior. Canada’s manufacturing sector increased 0.5%, while transportation and warehousing also continued to make gains for the third straight month, rising 1.2%.

On the contrary, though, the dry heat wave that persisted throughout much of the summer across western Canada caused the agriculture, forestry, fishing and hunting sector to fall 5.7%, after declining 5.5% in July. All subsectors in this industry were down, with crop production falling by a staggering 10.9% in August, bringing activity to the lowest since 2003.

The latest figures paint a troubling picture for the Bank of Canada, which on Wednesday announced it will be pulling back its government bond purchases while preparing to hike interest rates ahead of its previous timeline. The sudden pivot towards a more hawkish stance from the central bank comes as supply chain disruptions continue to impede economic growth while stoking skyrocketing inflation. Following Statistics Canada’s report, the Canadian dollar slumped to $1.239 per US dollar at the time of writing.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.