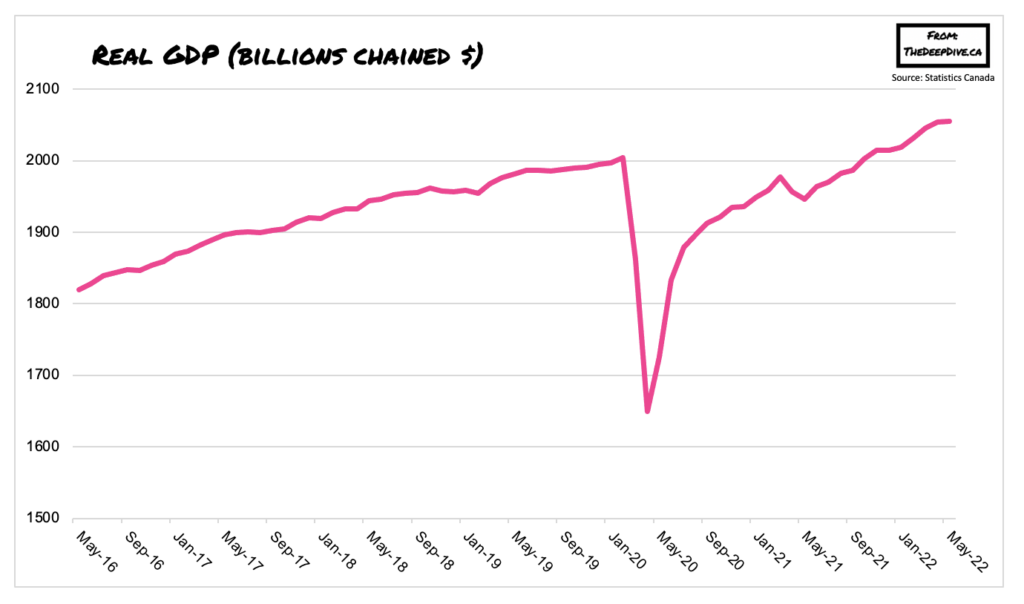

Canada’s economy showed signs of losing steam over the past two months, as persistently high inflation and subsequent rising interest rates weigh down on output.

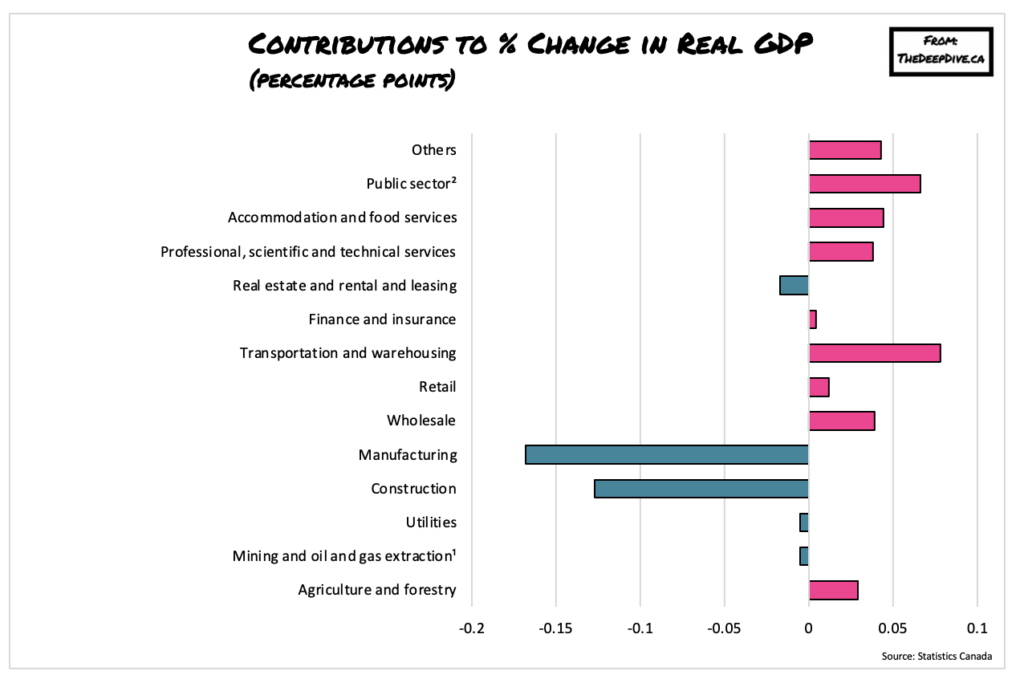

Latest data from Statistics Canada shows that GDP growth did not change in May, following a 0.3% increase in the prior month. Although the country’s services-producing industries expanded by 0.4%, the gain was largely offset by a decline of 1% across goods-producing industries. Meanwhile, preliminary estimates suggest that output rose only a paltry 0.1% in June, with increases being noted across construction, manufacturing, and accommodation and food services sectors.

Canada’s transportation sector experienced notable growth in May, rising 1.9% amid a boost in air transportation that was driven by increased movements of passengers and cargo. Likewise, the accommodation and food services sector expanded 1.9%, marking the fourth straight month of gains. Favourable weather conditions also helped the country’s agricultural and forestry sector grow by 1.6%, as high precipitation across the prairies aided during the seeding season.

On the other hand, though, the manufacturing sector slumped 1.7% in May for the first time following seven consecutive months of growth. The construction sector— which up until now benefited from a booming real estate market— contracted for the second straight month, falling 1.6% in May. Residential building construction declined for a second time, amid a drop in the construction of new single-family homes. Canada’s oil and gas sector also didn’t fare too well in May, declining for the first time in four months.

The latest results point to a GDP level that is weakening from robust gains following the lifting of Covid-19 restrictions and a rebound in the broader global economy. The Bank of Canada recently delivered a colossal interest rate increase of 100 basis points in July, in an effort to slow down the highest inflation in 40 years. “The Bank of Canada is still on course to deliver another non-standard rate hike at its next meeting,” warned CIBC economist Andrew Grantham as cited by Bloomberg.

Information for this briefing was found via Statistics Canada and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.