Businesses across Canada are facing broad economic challenges related to supply chain disruptions, material and labour shortages. and surging demand, which in turn is igniting concerns over rapidly rising inflation and anticipation of an interest rate hike as soon as next week.

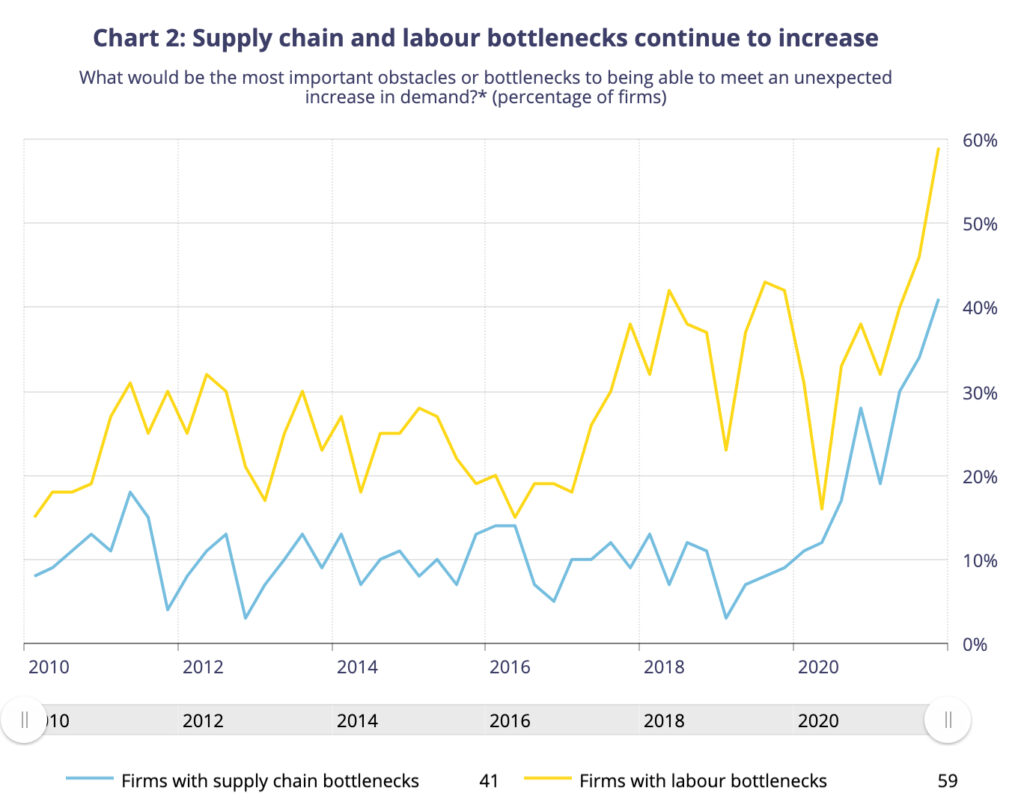

According to the Bank of Canada’s quarterly Business Outlook Survey, about 4 out of 10 Canadian businesses reported growing challenges with supply bottlenecks and labour shortages, some of which are stretching beyond pandemic-related circumstances. Among the issues broadly cited by employers, structural shifts in the labour market— such as aging demographics and technological advancements demanding updated skills— were among the main factors currently limiting the supply of available workers.

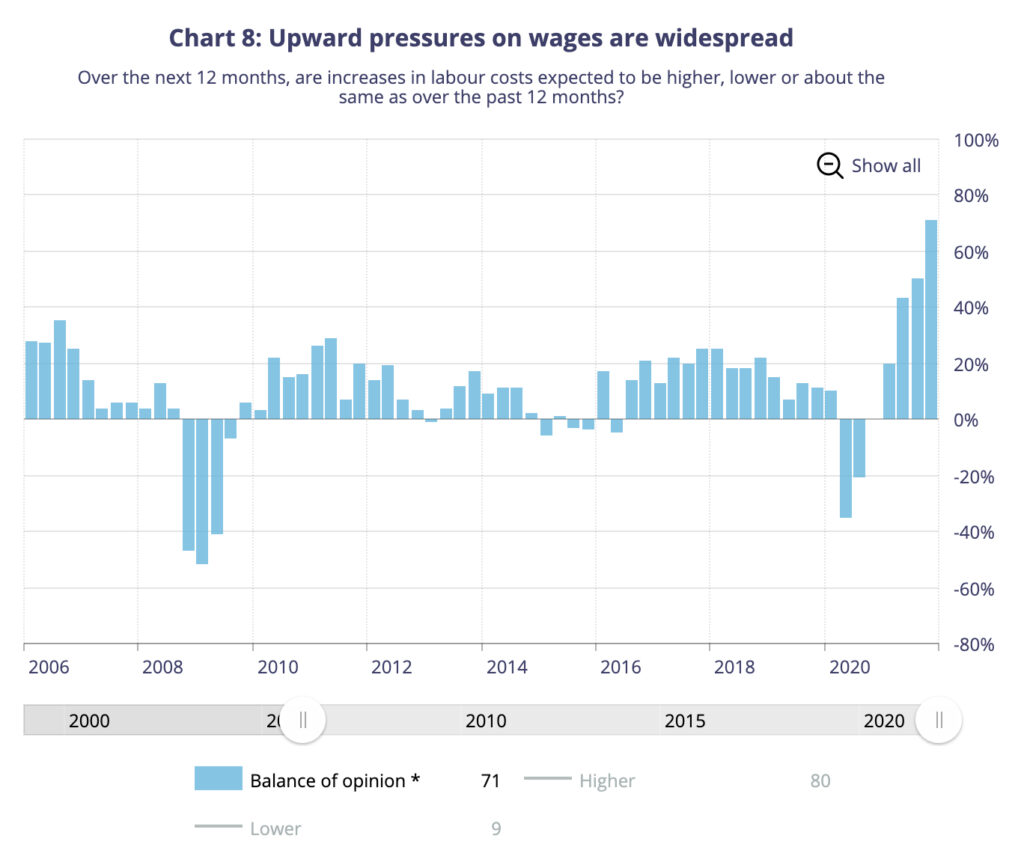

The majority of businesses revealed they have attained pre-pandemic employment levels, with intentions to exceed their worker count in an effort to accommodate for growing consumer demand. As such, a growing number of firms plan to raise wages in an effort to retain and attract employees, which in turn is expected to put upward pressure on output prices.

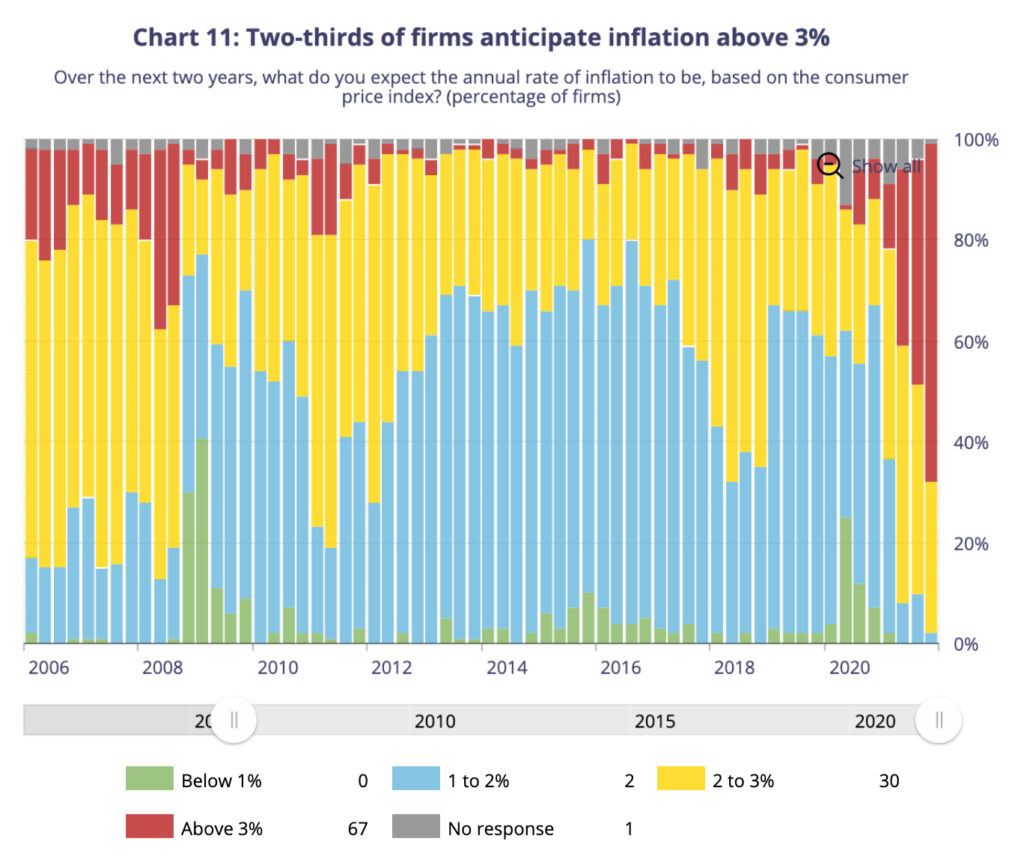

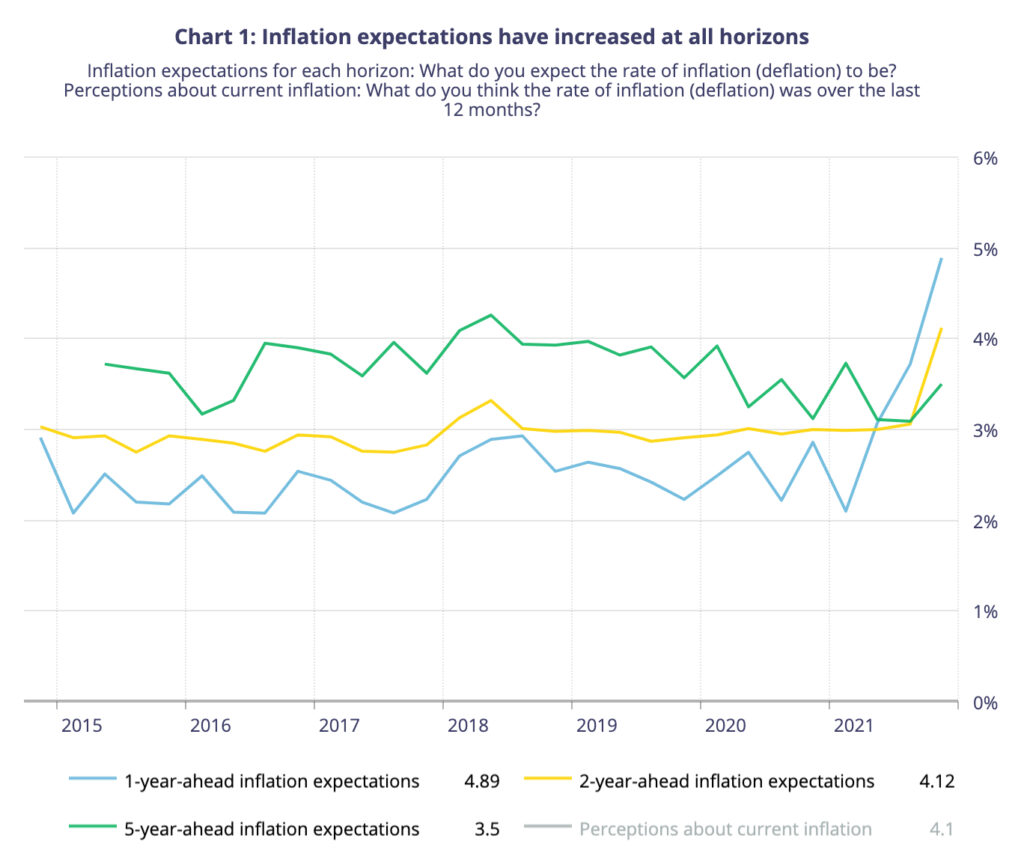

With that in mind, inflation expectations among companies has advanced even further. Now, two-thirds of Canadians businesses expect inflation to remain above 3% over the next two years. Among the factors perceived as affecting inflation, the survey’s respondents said higher prices are mainly being driven by worsening supply chain bottlenecks, surging energy and food prices, and of course expansionary fiscal and monetary policies.

A separate Bank of Canada survey found that the inflationary sentiment was also similar among consumers, with two-thirds of the respondents believing that price pressures have become increasingly more difficult to control. Canadians revealed that prices are rapidly increasing, particularly for essential items such as groceries.

The surveys’ results further cement the market’s expectations that the central bank will raise interest rates in the very near term. As cited by Bloomberg, investors are forecasting at least six rate hikes in 2022, with a 70% chance of an increase as early as January 26, when the bank’s policy makers are scheduled to meet for the first time since the beginning of the new year.

Information for this briefing was found via the Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.