As a result of Canada’s housing market continuing to make strong gains despite less than ideal economic conditions, as well as an increased demand for new vehicles among Canadians, consumer debt spiked by 3.8% in the third quarter relative to last year’s levels.

According to the latest quarterly consumer credit conditions report published by Equifax Canada, consumer debt among Canadians rose to $2.041 trillion in the third quarter, which amounts to a 3.8% increase compared to third quarter 2019. In the meantime, overall average consumer debt is up by 3.3%, to $74,897 in the same period. The sudden rise in consumer debt is largely the result of homebuyers, with mortgage balances rising by 6.6% year-over-year in the third quarter, while the average new mortgage loan amount increased by 8.6% to exceed the $300,000 threshold for the first time.

In addition, Canadian car sales increased amid the pandemic, as an increasing number of consumers are opting out of public transportation over growing virus infection fears. In fact, with some regions of the country even experienced shortages due to pent-up demand stemming from manufacturer and auction house shutdowns during the spring. As a result, new auto loans rose by 11.7% relative to last year’s levels.

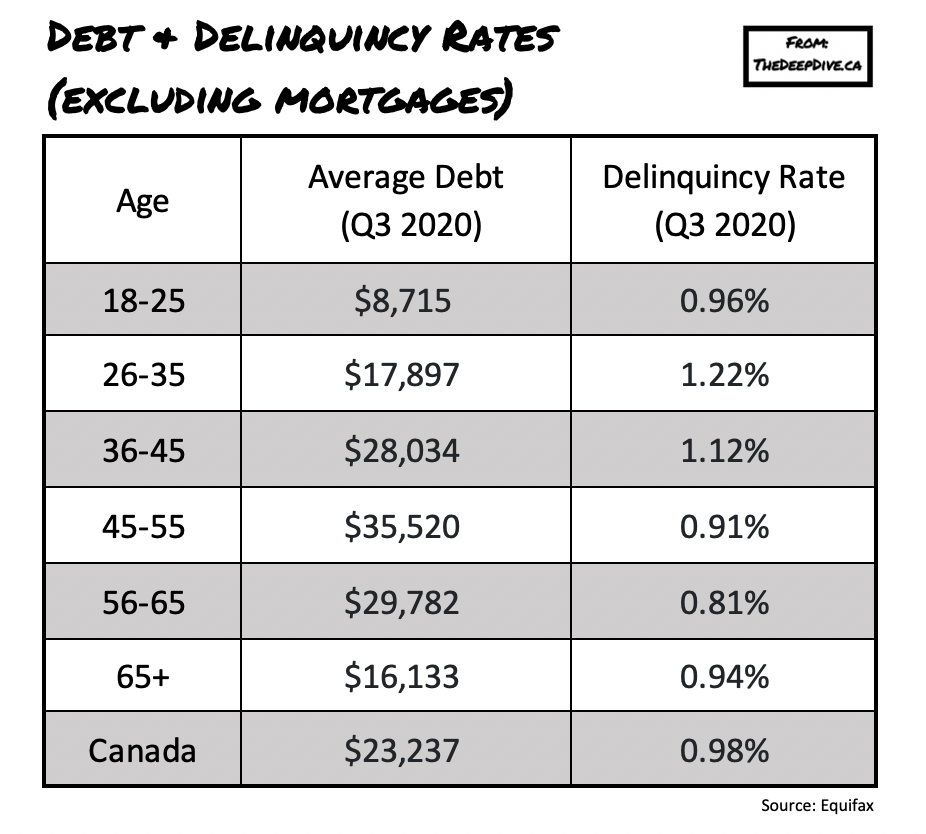

In the meantime, the 90-day delinquency rate for all non-mortgage debt dropped to 0.98% – the lowest level recorded since 2014. Although certainly an optimistic number, Equifax noted there are some underlying worries. The current lower-than average delinquency rates are likely being masked over by a variety of deferral programs, that were made available to Canadians amid a deteriorated labour market.

According to Equifax data, more than 3 million Canadians have taken advantage of payment deferrals since the onset of the pandemic; however, it has not stopped many from taking on additional credit, with nearly 12% of new credit products in Q3 being opened by consumers that already had a deferral on their credit line.

Information for this briefing was found via Equifax. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.