FULL DISCLOSURE: This is sponsored content for Canadian Copper.

Canadian Copper (CSE: CCI) this morning released their exploration strategy for 2026 as they work towards advancing their flagship Murray Brook deposit towards production.

Exploration in 2026 is set to be multi-faceted, with Canadian Copper focused on expanding the resource at Murray Brook while also putting considerable effort into advancing regional targets along their 18 kilometres of contiguous Caribou Horizon Trend.

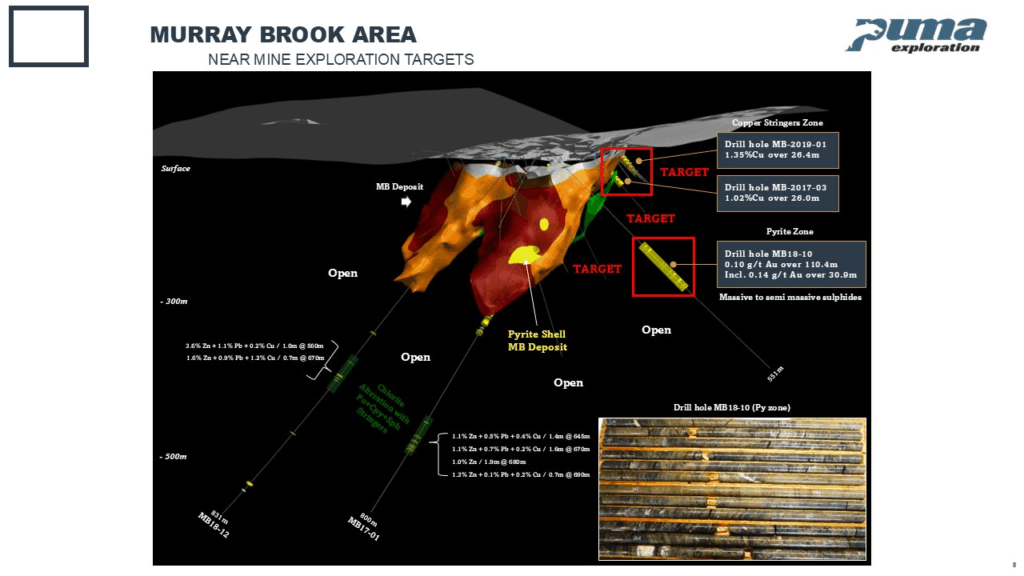

Key to that effort is a 2,500 metre drill program, which targets the open western copper mineralization extensions of the Murray Brook deposit. Of particular focus for Canadian Copper is the follow up of a 2019 drill hole that intersected 1.35% copper, 19 g/t silver and 0.75% zinc over 26.4 metres from just 26.0 metres below surface. The mineralization is currently viewed as being part of an untested stringer zone horizon found adjacent to the known deposit.

Downhole surveying is set to be undertaken as part of that effort, while Earth Ex Geophysical Solutions has been contracted to compile exploration data and assist in target generation. Geophysical interpretations and new surveys are set to take place after an initial phase of operations is completed.

WATCH: America Uses More Copper Than It Makes!? | Simon Quick – Canadian Copper

Drilling is set to begin in the second quarter of this year, while the first phase of the EarthEx arrangement is already underway, with new geophysical studies expected to begin next quarter. A separate five-month regional exploration program meanwhile is expected to begin in April, which is set to explore along the entire Caribou Horizon, with mapping, sampling, and trenching planned as part of that effort.

When speaking to The Deep Dive in the fall of 2025 about the larger strategy for Canadian Copper, CEO Simon Quick commented, “If we step back a 20,000 foot view, the goal is to get to a construction decision at some point in 2027. [..] I think we’re going to be the only producer in New Brunswick with an approved mill and a soon-to-be approved deposit that make an exciting story in this base metal environment.”

Canadian Copper last traded at $0.73 on the CSE.

FULL DISCLOSURE: Canadian Copper is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Canadian Copper. The author has been compensated to cover Canadian Copper on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.