FULL DISCLOSURE: This is sponsored content for Canadian Copper.

Development continues at Canadian Copper’s (CSE: CCI) Murray Brook project, with the company this morning providing a brief update on the status of the project following the recent close of a $15 million funding round.

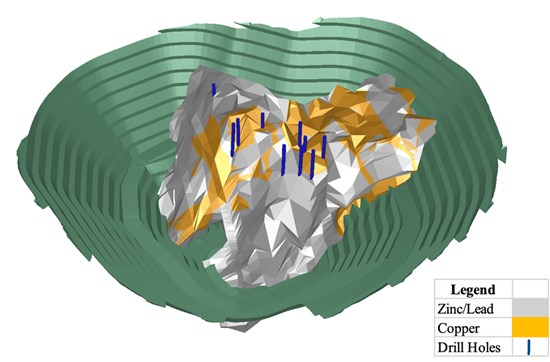

Metallurgical work is continuing on the project, with a testwork program recently awarded to SGS Canada. The program, which has seen 3,100 kilograms of material from recent drilling collected, aims to further refine process plant operating costs and recovery performance as outlined as part of the next steps in Canadian Copper’s recent preliminary economic assessment for the project.

Permitting is also proceeding, with Canadian Copper engaging the Technical Review Committee in July 2025 to discuss the combined strategy to move the Murray Brook project forward. The meeting was conducted in advance of Canadian Copper submitting their environmental impact statement in the first half of 2026, as part of an effort to better understand committee questions and to share project details in advance.

Baseline environmental data collection programs in support of that environmental impact statement have already been completed for the current field season, with data collected on a range of topics to support the filing. Desktop studies meanwhile are underway in relation to surface and groundwater, along with air quality and climate, which will be incorporated into the submittal of the environmental impact statement.

WATCH: Canadian Copper: The $172M Combined Strategy PEA

Lastly, Canadian Copper is said to be in the process of advancing discussions for funding of the Murray Brook project. The company aims to secure funding for both pre-development as well as project construction. A path and partners are currently expected to be selected in the first half of 2026, in addition to Canadian Copper seeking government sources of funding under Natural Resources Canada and the Critical Minerals Infrastructure Fund.

The latest developments follow a recent $15 million funding round conducted by Canadian Copper, which is expected to provide the capital required to purchase the Caribou mill, while allowing the company to fund the completion of necessary environmental baseline studies and further the development of Murray Brook.

“Subject to final conditions being satisfied, this financing will enable us to complete the acquisition of the existing Caribou mill and shift our immediate focus on executing the development strategy of Murray Brook and Caribou combined. It is clear from last week’s federal budget that national critical mineral supply is a key and increasing area of concern for Canada. Canadian Copper is well positioned as part of the near-term metal supply solution by combining the only permitted milling complex in New Brunswick with a large open pit base metal resource,” commented Simon Quick, CEO of Canadian Copper, in connection with the closing of that funding.

Canadian Copper last traded at $0.305 on the CSE.

FULL DISCLOSURE: Canadian Copper is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Canadian Copper. The author has been compensated to cover Canadian Copper on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.