Canadians continued to pay significantly more for goods and services last month, as inflationary pressure broadened with various metrics soaring to new record-highs.

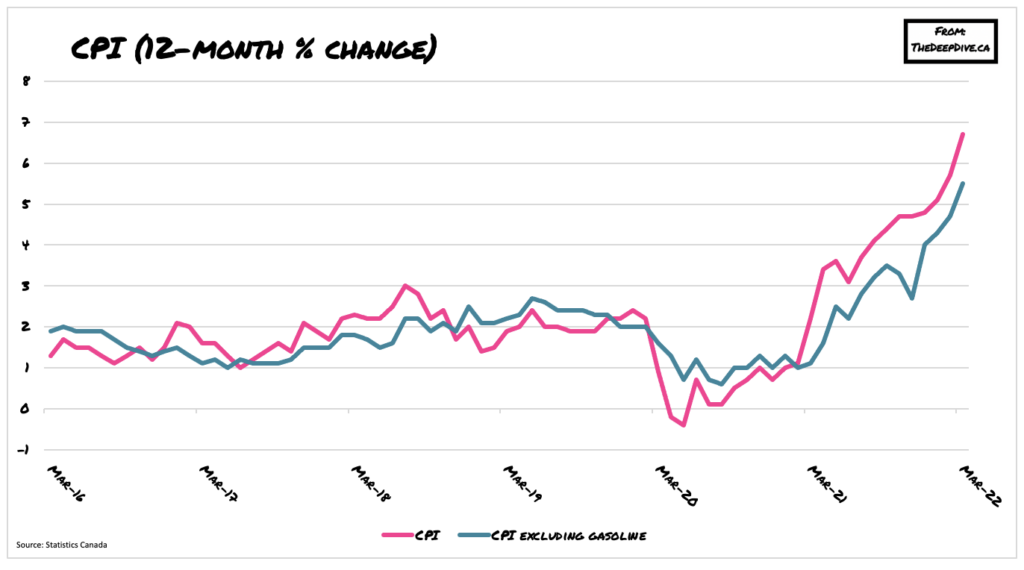

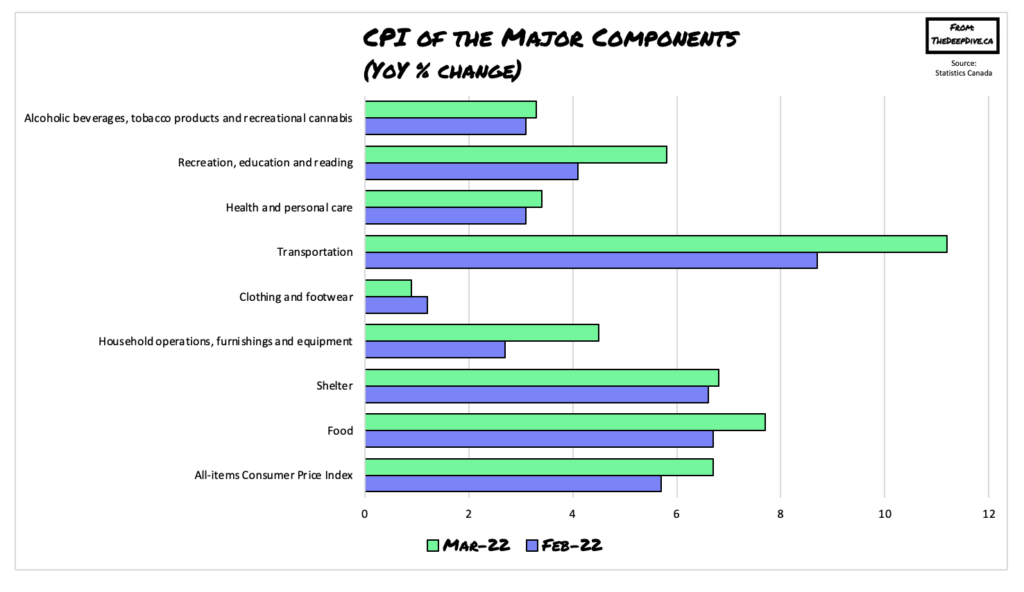

Following a gain of 5.7% in February, consumer prices jumped 6.7% last month, marking the biggest gain since January 1991. On a seasonally adjusted basis the monthly gain stood at 0.9%, which was the largest increase on record. Core CPI, which excludes gasoline, was up 5.5%, which too, set another record gain since Statistics Canada began tracking the aggregate in 1999. Inflation was broad-based across all major components, while average hourly wages rose 3.4% year-over-year— a paltry gain relative to the explosion in CPI.

Gasoline prices were the main driver behind March’s eye-watering print, rising 11.8% month-over-month following a 6.9% gain in February. Prices for fuel oil and other fuels jumped 19.9%, marking the second-biggest increase since February 2000. Compared to March 2021, fuel oil was up 61%.

Following an increase of 4.8%, durable goods prices rose 7.3% year-over-year— the biggest gain since February 1982. Canadians continue to pay more for vehicles, with Statistics Canada reporting a 7% increase in the price of passenger cars. If you were furnishing your home last month, then you too, felt the wrath of inflationary pressures, as furniture prices jumped 13.7% from last year amid ongoing supply chain disruptions and higher input prices.

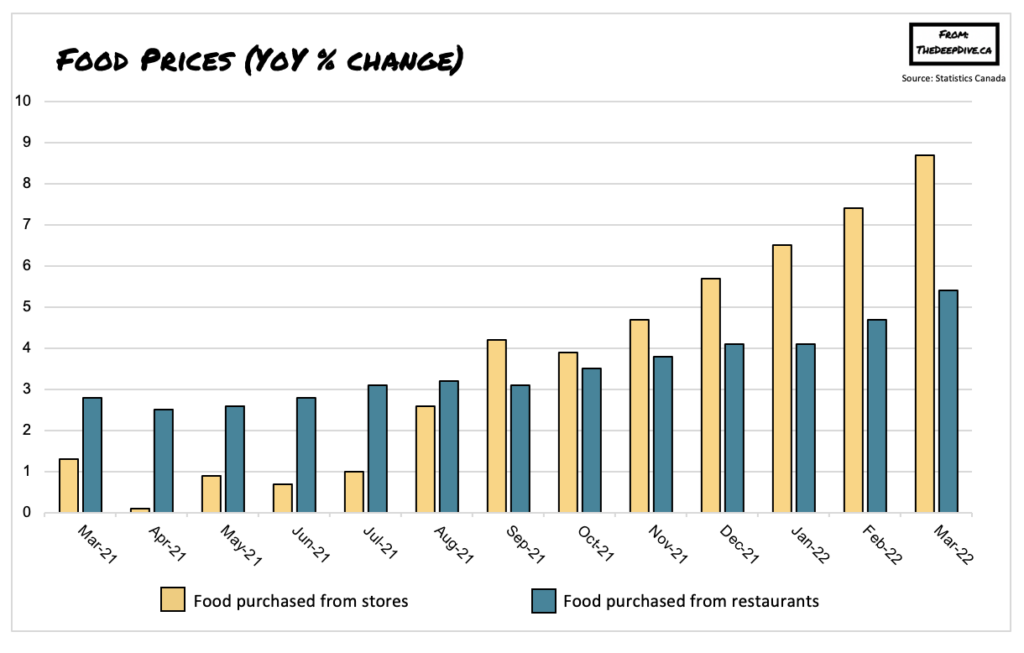

Groceries— the component affecting all Canadians— increased 8.7% compared to March 2021, following an annual increase of 7.4% in the month prior. This was the largest such gain since March 2009, as an increase in input costs and logistics mayhem put upward pressure on stores’ food prices. Dairy products and eggs rose 8.5% year-over-year last month, marking the biggest annual increase since February 1983. Consumers paid a staggering 17.8% more for pasta products, after wheat futures soared to a 14-year high amid the Russia-Ukraine crisis.

However, inflation didn’t stop there: Canadians paid substantially more for recreational activities, such as flights, hotel rooms, and dining out. Prices for food purchased at restaurants rose 5.4%, prices for traveller accommodation were up 24.4% year-over-year last month, while air transportation prices increased 8.3% from February amid strong demand for domestic and US travel.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.