The recent surge in e-commerce retail sales amid the pandemic has sparked an increase in demand for warehouse space, which will likely continue even beyond the pandemic.

According to a recent report by brokerage firm CBRE Ltd, Canada will require approximately 40 million square feet of additional warehouse space over the next five years, after a surge in online sales amid the pandemic prompted numerous companies to embrace an e-commerce-based business model. However, the estimated square footage requirement would exceed all of the leasable warehouse space currently available across the country’s main industrial real estate markets, suggesting that additional facilities will need to be constructed.

Despite initially lagging in embracing the growing popularity of e-commerce, Canadian firms and consumers are now posting some of the fastest growth in online shopping. “Last year not everyone would have been an e-commerce consumer. Now everyone is. Every retailer knows they have to have a digital presence to survive, and so now they’re building out their supply chain,” said CBRE Canada Vice Chairman Paul Morassutti in a telephone interview with Bloomberg.

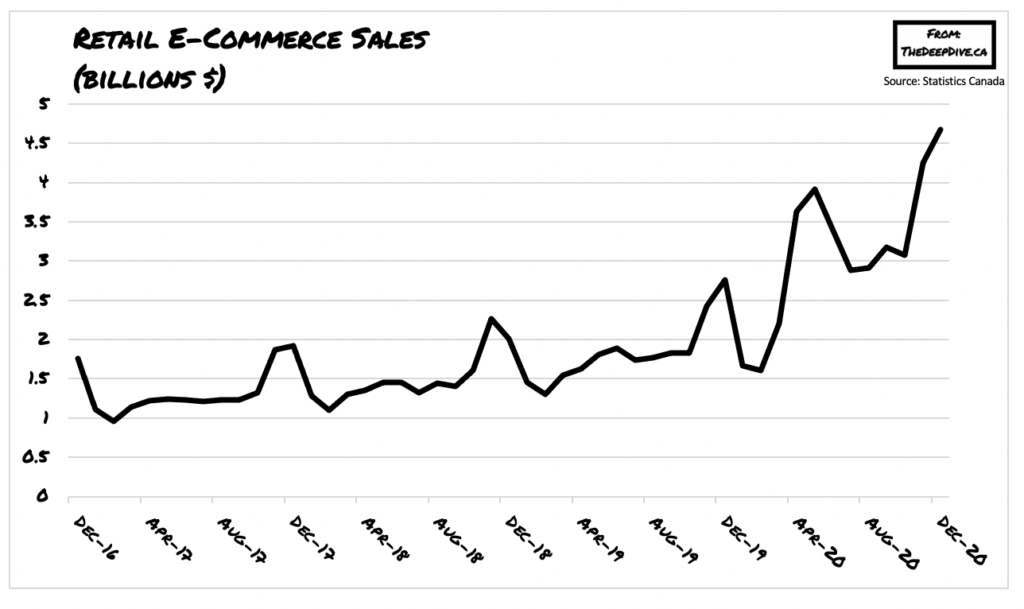

As a result, retailers have been scrambling to build logistics hubs in order to fulfill sales, making Toronto, Vancouver, and Montreal— the three largest cities in Canada— some of the tightest markets for warehouse space in North America. According to Statistics Canada data, e-commerce retail sales soared by 70.5%, to a record $3.6 billion in 2020. The boom in online shopping was largely the result of social distancing measures and stay-at-home orders, which prompted consumers to refrain from brick-and-mortar stores and instead conduct the majority of their shopping online.

Information for this briefing was found via CBRE Ltd, Bloomberg, and Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.