The coronavirus pandemic has caused the Canadian federal government to impose stay-at-home orders, strict social distancing guidelines, and non-essential business shut-downs. However, as a means of mitigating the severe financial hardships that some Canadians and businesses have had to endure as result, the federal government has also been generous with its monetary and fiscal policies. Now that the peak of the coronavirus is beginning to subside, Canadian opposition parties are calling on the release of an economic update so as to put into context federal spending thus far.

Since the onset of the coronavirus pandemic in March, the federal government has unveiled unprecedented spending measures as a means of mitigating the resulting economic damage. Thus far, the government has pledged in excess of $150 billion in COVID-19 related financial aid. But as that spending continues to mount, including CERB benefits that have gone at least $8 million over budget, the opposition wants some form of accountability.

Prior to the pandemic, Finance Minister Bill Morneau had anticipated to deliver the 2020 budget at the end of March. Simultaneously however, the World Health Organization declared the coronavirus a global pandemic, so Parliament was immediately suspended and resources were diverted elsewhere. Although there exists a significant difficulty in making accurate projections in terms of forthcoming spending during the pandemic, Conservative Party leader Andrew Scheer is calling on the Department of Finance to at least provide Canadians with a transparent economic update.

As a result, the Liberal government has agreed to plan for a release of an economic update. Although the exact date of the release is unknown, finance department officials are anticipating to have it ready sometime in the summer.

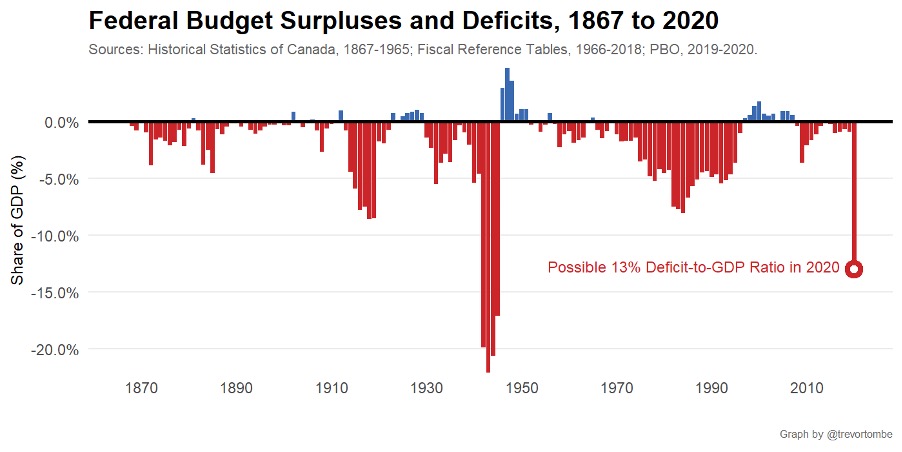

Yves Giroux, who is the Parliamentary Budget Officer, recently provided an estimate regarding the federal deficit. Thus far, the deficit is as high as $260 billion, and could very well continue increasing to $1 trillion in fiscal 2020. Given that there is not an infinite amount of money to spend, future taxpayers will most likely be on hook for this year’s stimulus spending for a long time.

Information for this briefing was found via Bloomberg, Maclean’s, and CTV News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.