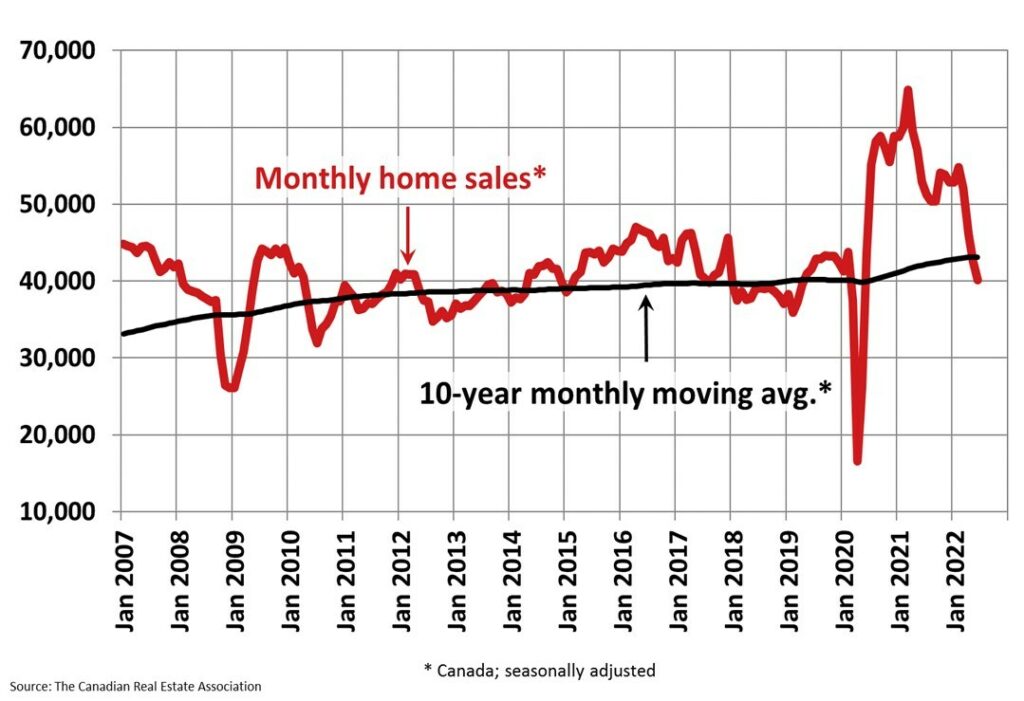

Home sales across Canada continued their downward slide in June, as rapidly rising interest rates left an increased number of potential homebuyers on the sidelines of the real estate market.

Latest data from the Canadian Real Estate Association (CREA) showed that national home sales fell 5.6% between May and June, and are down 23.9% compared to the same period one year ago. Sales levels slumped across 75% of all local markets, namely in the Greater Toronto Area, Greater Vancouver, Calgary, and Ottawa areas. “Sales activity continues to slow in the face of rising interest rates and uncertainty,” said CREA Chair Jill Oudil.

“The cost of borrowing has overtaken supply as the dominant factor affecting housing markets at the moment, but the supply issue has not gone away. While some people may choose to wait on the sidelines as the dust settles in the wake of recent rate hikes, others will still engage in the market in these challenging times,” she added.

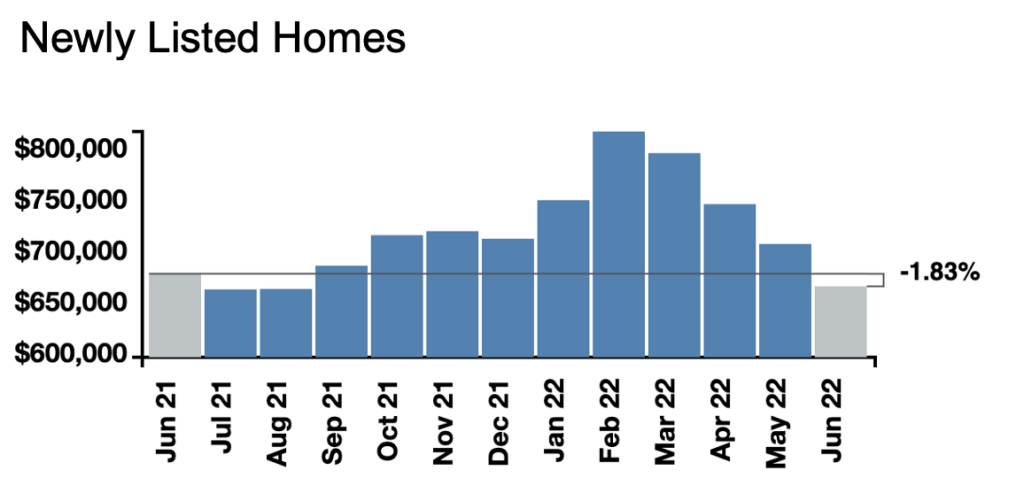

Indeed, with sales activity falling, new listings were able to rise. CREA reported that the number of homes to hit the market increased 4.1% month-over-month in June, mostly due to a sharp jump in supply in the Montreal real estate market. This caused the sales-to-new-listings ratio to fall back to 51.7%— the lowest since January 2015. There was about 3.1 months worth of inventory in June, which, even despite being historically low, is showing signs of increasing compared to real estate market conditions merely six months ago.

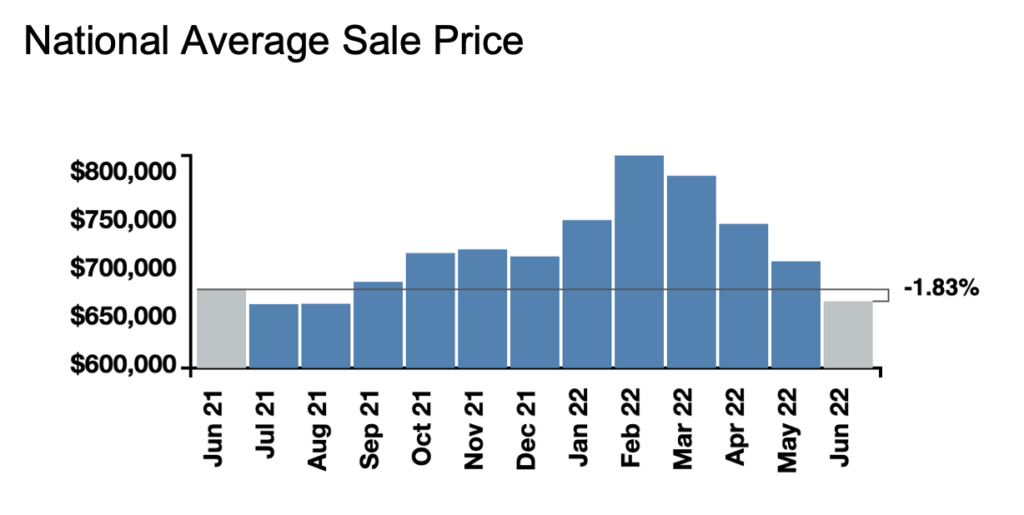

Prices were also on the decline last month, falling 1.8% from June 2021 to an average of $665,850. Home prices eased across certain regions in British Columbia, remained steady across the prairies, and slightly declined in Quebec.

Information for this briefing was found via the CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.