In a recently released Rental Market Report (RMR), the Canada Mortgage and Housing Corporation (CMHC) sheds light on the challenges faced by the country’s rental market, revealing a persistent imbalance between demand and supply for the second consecutive year.

According to the report, strong rental demand has outpaced the available supply in most major markets across Canada, leading to a shortage of purpose-built rental apartments and a subsequent decline in affordability. The national vacancy rate for Canada’s primary rental market reached an unprecedented low of 1.5% in 2023, marking the lowest recorded rate since 1988 when CMHC began tracking national vacancy rates.

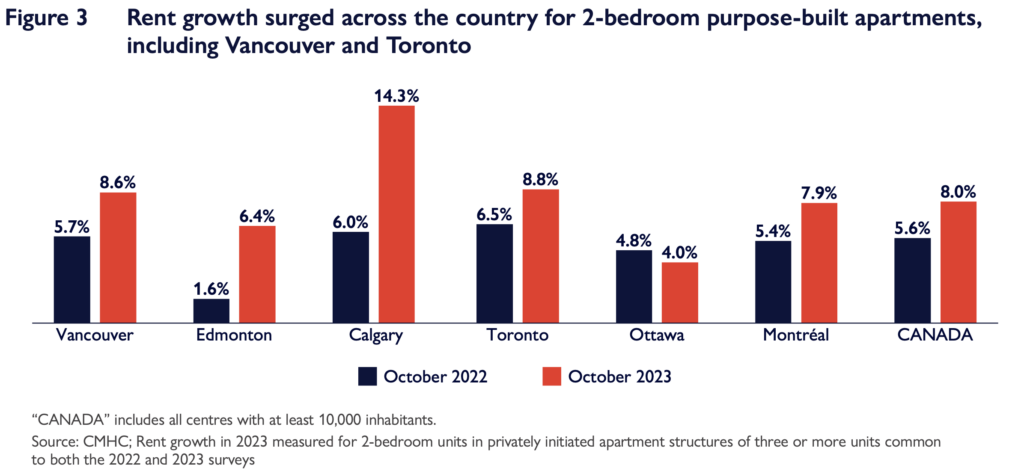

The report highlights a significant increase in average rent growth for 2-bedroom purpose-built rental units, reaching 8% in 2023. This “same-sample” rent growth is well above historical averages, signaling challenges for renters. The change in average rents for 2-bedroom “turnover” units also exceeded non-turnover units, indicating the impact of new tenants entering the market.

Kevin Hughes, CMHC’s Deputy Chief Economist, expressed concern about the growing disparity between rental supply and demand, stating, “The vacancy rates and rent increases we are observing are further evidence the current level of rental supply in Canada is vastly insufficient, and the need to increase this supply is urgent.”

Factors contributing to the imbalance include high population and employment growth, elevated mortgage rates, and persistently high home prices. These elements collectively make the transition from renting to homeownership less attractive for many Canadians. Additionally, the construction of new rental homes faces challenges due to higher costs for financing, construction materials, and labor shortages experienced by homebuilders.

The secondary rental market, specifically the rented condominium market, also experienced tightening in 2023. The average vacancy rate for rented condominiums in the 17 census metropolitan areas surveyed by CMHC fell to 0.9% in 2023, down from 1.6% in the previous year.

Looking at specific cities, Calgary and Toronto tied for the second-lowest vacancy rate among the six largest Canadian cities in 2023. Calgary, affected by high levels of interprovincial migration and significant international migration, faced challenges in meeting the demand for rental housing. Montréal experienced its lowest vacancy rate since before the pandemic, while both Calgary and Edmonton recorded their lowest vacancy rates in a decade.

In terms of rental rate increases, Calgary and Edmonton saw the sharpest rises, while Toronto, Montréal, and Vancouver also experienced significant upward trends. Vancouver, in particular, remains Canada’s tightest major rental market with the highest monthly average rents.

Information for this briefing was found via Canada Mortgage and Housing Corporation. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.