FULL DISCLOSURE: This is sponsored content for Temas Resources.

Amidst supply challenges in the aerospace industry, Ottawa has reportedly granted waivers to Airbus and Bombardier, allowing them to continue using titanium sourced from Russia despite Canadian sanctions targeting the country’s titanium exports.

The decision, revealed by two government sources, sparked criticism from Ukrainian Canadians and the opposition party. The sanctions, imposed in February, targeted Russia’s VSMPO-AVISMA Corporation, a major titanium producer.

The waiver for Airbus is temporary, with hopes that the company will transition away from Russian titanium. Other sources for titanium include China, Japan, and Kazakhstan. The move follows concerns about the impact of the sanctions on Canadian aerospace companies and potential job losses.

French government lobbying played a role in securing the waiver for Airbus, which has manufacturing facilities in Quebec and Ontario.

Meanwhile, Bombardier, along with its European partner Airbus, received a similar exemption. Bombardier, based in Montreal, clarified that it doesn’t directly purchase Russian titanium but relies on suppliers who do.

“Very disturbing”

Critics, including the Ukrainian Canadian Congress and the Conservative Party, condemned the waivers, arguing they contradict Prime Minister Trudeau’s stance on Ukraine and could finance Russia’s actions.

“The announcement of a sanctions waiver granted to Airbus on the use of Russian titanium allows Canadian companies to continue to do business with Russia – thereby financing and fuelling Russia’s war,” UCC president Alexandra Chyczij said. “This is untenable, particularly since Canada is a leading producer of titanium. We call on the Canadian government to immediately cancel this waiver, and enforce its own sanctions policy. We renew our call for a full trade embargo on Russia.”

The waiver has also elicited a strong emotional reaction from Ukrainian ambassador Yuliya Kovaliv. During an appearance on CBC’s Power & Politics, she displayed a photograph depicting the aftermath of a Russian Kalibr missile strike two years ago, illustrating the use of titanium in manufacturing various warplanes, including supersonic rockets.

Kovaliv expressed her concern, calling the move “very disturbing,” and adding that she had contacted Global Affairs Canada for clarification but had not yet received a response.

Responding to the backlash, Foreign Affairs Minister Mélanie Joly emphasized the importance of maintaining Canadian jobs while pressuring the Russian regime. Airbus and Bombardier collectively employ over 20,000 workers in Canada.

“We will always make sure to put maximum pressure on the Russian regime and meanwhile protect our jobs here at home. We can do that together,” Joly said.

The sanctions on VSMPO-AVISMA caught the aerospace sector off guard, with the full extent of the implications only now emerging.

Sanctions and supply crunch

Titanium is a crucial material known for its lightweight yet strong properties, resistance to corrosion, and suitability for high-temperature environments. It finds extensive use across industries like aerospace, chemical processing, power generation, and medicine.

In aerospace, titanium plays a vital role in advanced composite aircraft. It is particularly valued for its compatibility with carbon fiber reinforced plastic (CFRP) parts, ensuring structural integrity and mitigating galvanic corrosion risks.

Titanium production begins with ores like ilmenite and rutile, with major contributors including Russia, the U.S., Kazakhstan, Ukraine, Japan, and China. Forging is a critical step in processing titanium, but it presents challenges due to the metal’s properties.

Out of the estimated 8.6 million metric tons of ilmenite production globally last year, itself a drop of 200,000 metric tons from 2022, the U.S. produced approximately 200,000 metric tons while Canada produced 500,000 metric tons.

China continues to assert its dominance in the global titanium market, with significant contributions across various stages of the supply chain. As the leading producer of titanium minerals, China commands 34% of global production at 3,100,000 tonnes, almost double the second-largest producer Mozambique.

Despite its critical importance, the U.S. remains heavily reliant on imported titanium, with domestic production facing challenges from foreign competition and economic pressures. The closure of domestic titanium facilities in recent years has exacerbated this dependency, raising concerns about supply chain resilience, especially amidst geopolitical tensions.

In 2019, the U.S. imported 95% of the titanium it consumed. Recent data indicates that the value of titanium mineral and synthetic concentrates imported into the United States reached an estimated $690 million in 2021.

In 2023, U.S. titanium sponge metal production was limited to one operation in Utah, with production figures kept confidential for proprietary reasons. The facility in Salt Lake City had an estimated annual capacity of 500 tons, supplying titanium for electronics after further refining. Another sponge facility in Henderson, NV, with a capacity of 12,600 tons per year, remains idle since 2020 due to market conditions. A third facility in Rowley, UT, capable of producing 10,900 tons per year, has been inactive since 2016.

Although specific consumption data for 2023 was not disclosed, titanium metal was primarily utilized in aerospace applications, with other uses including armor, chemical processing, marine hardware, medical implants, power generation, and consumer goods. Importantly, the import value of sponge reached approximately $420 million in 2023, significantly higher than the $273 million recorded in 2022.

In the same year, titanium dioxide (TiO2) pigment production, carried out by four companies across five facilities in four states, was valued at around $3 billion.

On the other hand, the Canadian sanctions were earlier braced for by aerospace firm Boeing, which had its partnership with VSMPO heavily affected. As Boeing cautioned earlier this year, the ongoing crisis in Ukraine and Russia has the potential to disrupt titanium supply chains significantly.

In Canada, titanium is classified as a critical mineral, part of the government’s $4-billion Critical Minerals Strategy set out in 2022. The plan aimed to “increase the supply of responsibly sourced critical minerals and support the development of domestic and global value chains for the green and digital economy.”

Boosting local production

But with the waivers becoming necessary to weather the sanctions, it is clear that the country needs more titanium sources. As reliance on Russia and China for titanium supply grows, Western nations are intensifying efforts to bolster local critical mineral production. Concurrently, local producers are ramping up operations to meet domestic demand.

Case in point, Temas Resources (CSE: TMAS), which is advancing the La Blache titanium-iron-vanadium project in eastern Quebec. The project aims to produce high-quality ore suitable for processing into pigment-grade titanium dioxide.

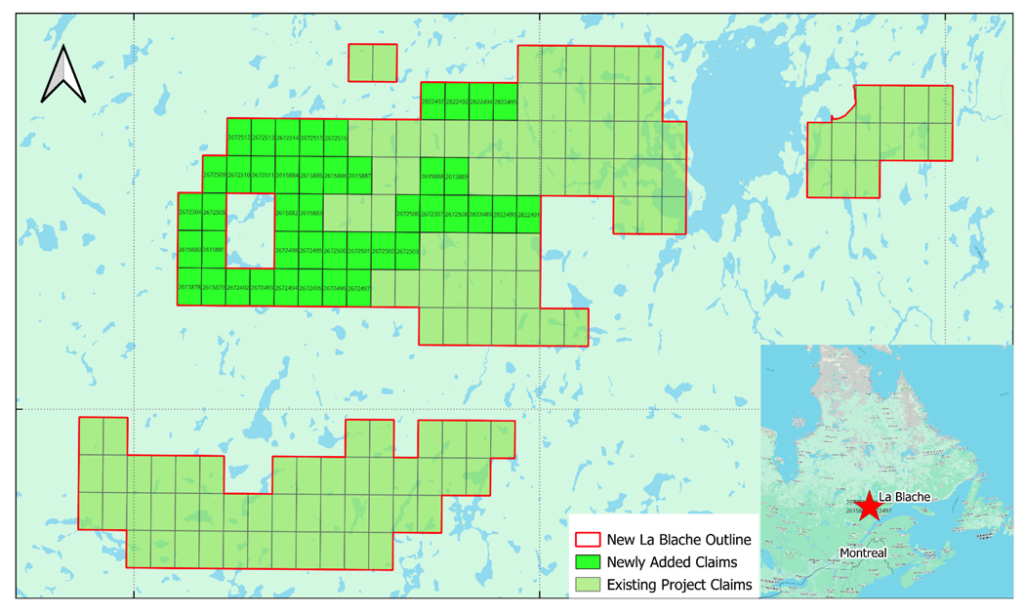

Spanning 117 claims over 6,203.12 hectares, the La Blache Project is located 100 km north of Baie-Comeau, Quebec. Temas recently expanded its holdings as part of a strategic growth plan. The project hosts the Farrell-Taylor magnetite-ilmenite deposit, encompassing the Hervieux-Est and Hervieux-Ouest mineralization zones.

Temas also possesses proprietary processing technology through ORF Technologies Acquisition, enabling the recovery of titanium dioxide (TiO2), vanadium pentoxide (V2O5), and ferric oxide (Fe2O3) from ore. Testing demonstrated full recoverability of TiO2 suitable for further processing.

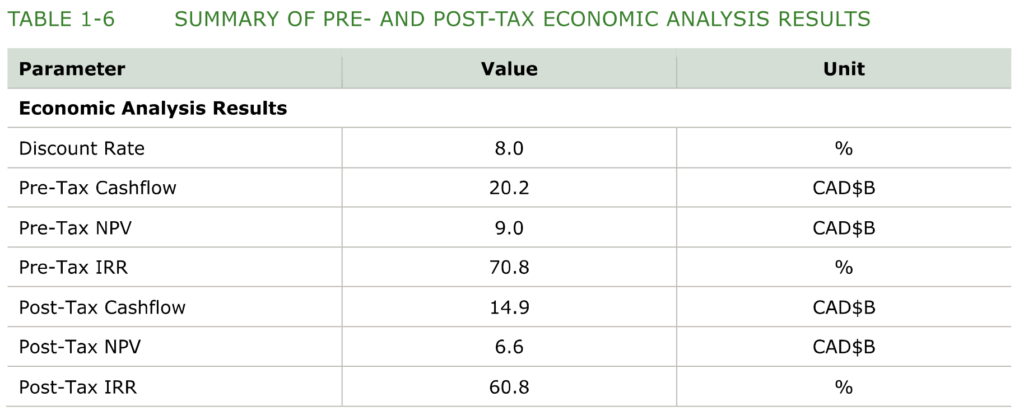

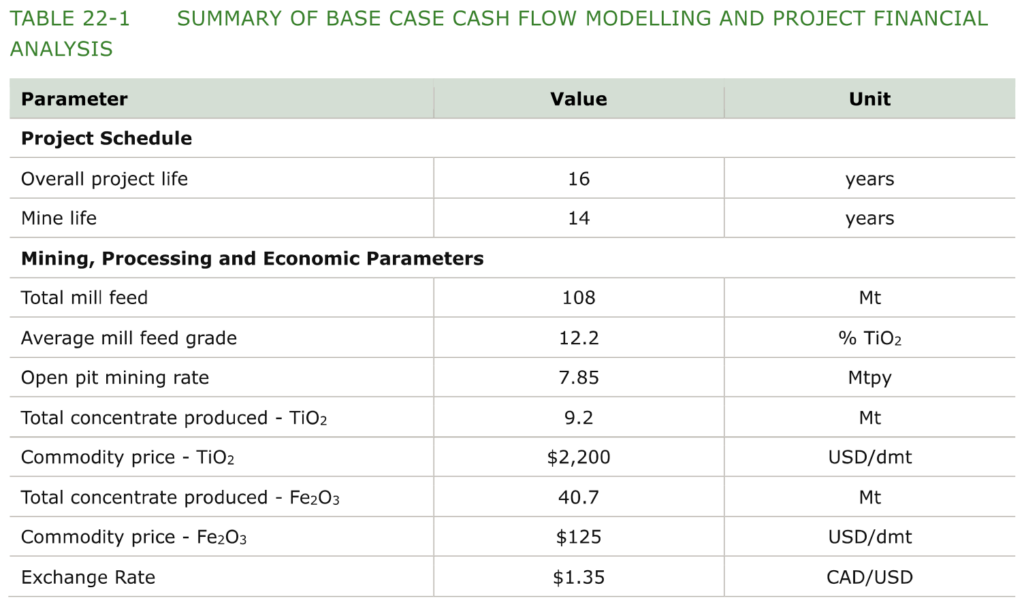

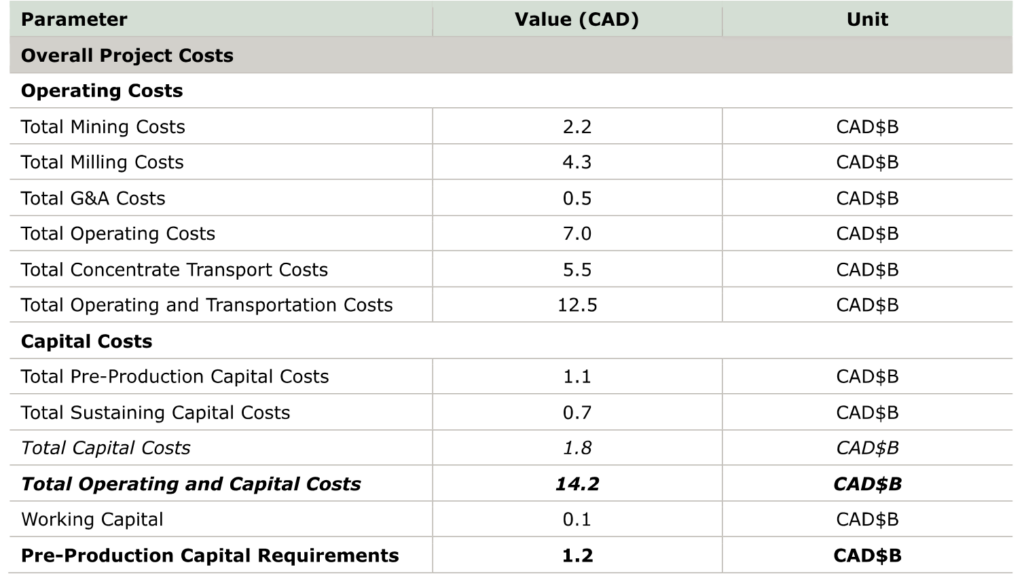

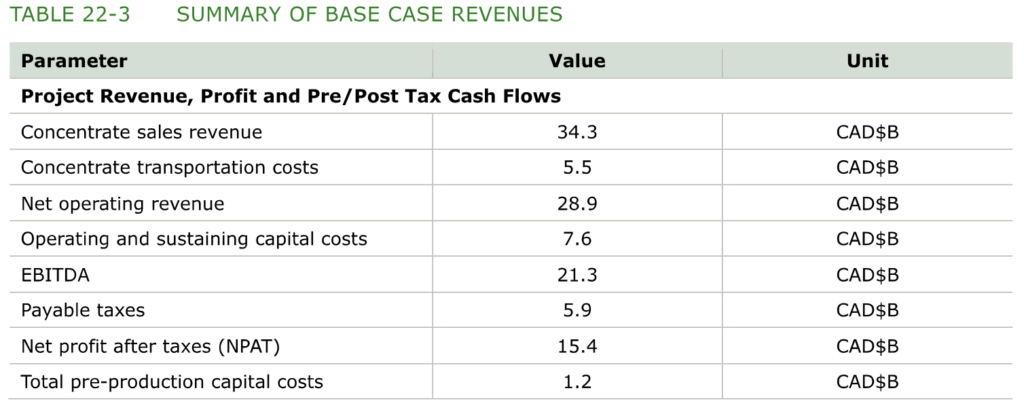

A recent preliminary economic assessment (PEA) outlined a post-tax net present value of $6.6 billion and a post-tax internal rate of return of 60.8%, with a mine life of 14 years. The payback period is under two years from production commencement.

Over its 14-year lifespan, the La Blache project is projected to yield 9.2 million tonnes of TiO2, 40.6 million tonnes of Fe2O3, and 152,000 tonnes of V2O5.

“Titanium has been trading well above our assumptions of USD $2,200 per tonne for over three years and at over USD $3,000 per tonne since August 2022. We believe this trend will continue due to the increasing demand for TiO2, major global supply coming to end of life, and lack of both brownfield expansion and new projects coming online in North America,” Temas President Tim Fernback said.

Fernback referenced the favorable outcomes of the PEA, stating that they inspire the company to delve deeper into determining the most effective course of action for advancing the integrated La Blache project.

“By adding the additional mineralization, optionality opens up on the best approach and overall path to development. There is still a lot of work to do on the Farrell-Taylor, but we are keen to apply what we have already learned to this part of the trend,” he added.

Information for this briefing was found via CBC, The Globe And Mail, and the sources mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: Temas Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Temas Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.