Yesterday, Canopy Growth Corp (TSX: WEED) (NYSE: CGC) announced that they would hold their second quarter fiscal 2021 results before the market open on November 9th. In connection with this, Bank of America Securities released a note reiterating their buy rating and C$30 price target on Canopy.

Bryan D. Spillane, Bank of America’s analyst, justifies the rating by highlighting “Canopy’s share position, robust balance sheet and ind. conditions,” and, “we see management changes, right-sizing of operations, and its enviable cash and share position as all reasons to believe that Canopy can be a long term leader in the cannabis sector.”

Spillane adds that they expect fiscal 2021 to be a transition year, “as it resets its strategic focus, rolls out a new organizational design and implements operational and supply chains productivity programs,” and hopes for management to give an update on COVID impacts, growth in the value segment and reviews of their 2.0 product lineup.

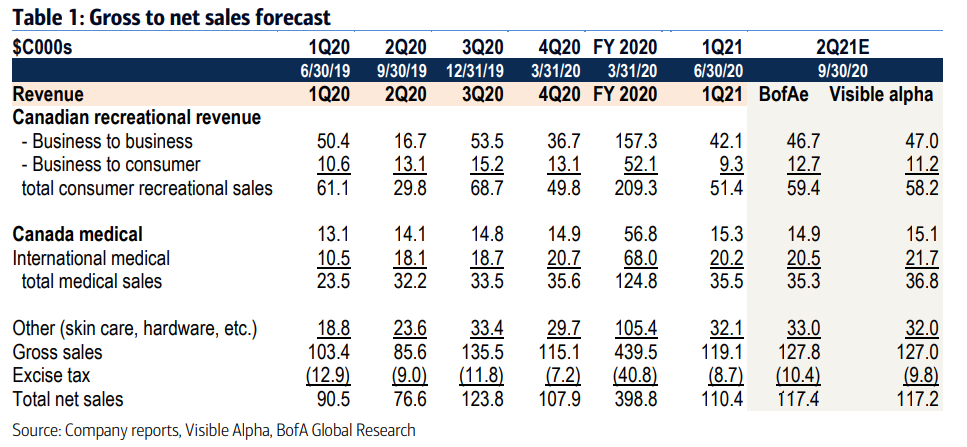

Bank of America currently forecasts Canopy to have net sales of C$117.4 million, while the street estimate is C$117.2 million. This is up from their first quarter sales of C$110.4 million, mainly on the increase in recreational sales. At the same time, they guide that Canadian and International medical, along with the “other” revenue which consists of skin care, and hardware, will be flat quarter over quarter.

They attribute that the sales growth will come from additional store openings, but add that the growth will be offset “by lower revenue/kg due to the category’s downtrading to the value segment, improved ordering by retailers as they became more business-oriented.” Spillane adds that licensed producers taking share away from the illicit market via the value segment is beneficial in the long run. Licensed producers need to have an “up trading strategy to drive profitability longer term, which we think will take time as brand loyalty is just in its infancy.”

Currently, they have the full-year fiscal 2021 revenue estimate at C$508.7 million, but qualify it by stating that if store openings rise above 1,300 locations in calendar 2020, then there is upside to that estimate.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.