Last week, Cantor Fitzgerald updated their estimates on a bundle of Canadian licensed producers. In every case, they slashed the 3 largest license producers’ price targets. Cantor Fitzgerald lowered their 12-month price target on Canopy Growth Corp (TSX: WEED) (NASDAQ: CGC) to C$21.00 from C$30.50 and reiterated their neutral rating.

Canopy Growth currently has 14 analysts covering the stock with an average 12-month price target of C$27.56, or a 60% upside. Out of the 14 analysts, 1 has a strong buy rating, 2 have buy ratings, 10 have hold ratings and 1 analyst has a strong sell rating on Canopy Growth. The street high sits at C$51 from MKM Partners while the lowest price target comes in at C$15.

Cantor Fitzgerald’s analyst, Pablo Zuanic, says that they have revised their full year 2022 estimates down after CEO David Klein walked down 2022 numbers at a broker conference. He additionally adds that they prefer Tilray since Canopy trades at 15x CY22 sales while Tilray trades at 11x.

During the broker conference, Klein reiterated that Canopy will see a “significant” sales ramp-up and margin expansion during their fiscal second half of 2022. Mainly driven by innovation and distribution, on top of booking a full quarter of Supreme Cannabis, but Pablo says that according to Hifyre, Canopy had a “low teens decline in the base domestic cannabis business.”

Klein believes that margins will slowly grow as the revenue mix gets more slanted toward the premium products, as well as more 2.0 products such as vapes. While Cantor says that, according to Hifyre, the results of Canopy focusing more on the premium products have been mixed.

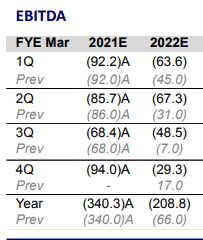

Canopy previously had guided that SG&A will be down $40-$50 million this quarter, and they’re targeting cost savings of $150-$200 million for 2022, but Cantor wonders if there will be any bottom-line accretion. They additionally don’t believe Canopy will meet their positive adjusted EBITDA target, which Klein guided for Canopy to have by the end of fiscal 2022. Zuanic believes that this won’t happen as Canada continues to face pricing pressures and that SG&A has to move down more than $50 million. They believe that it’s more likely that Canopy hits positive adjusted EBITDA by the fiscal first quarter of 2024.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.