Hexo Corp (TSX: HEXO) (NYSE: HEXO) on August 20 announced a $140 million public offering consisting of 47,457,628 units at a price of US$2.95 per nit. Each unit comes with 1 share and one half of a warrant which can be exercised for 5 years at an exercise price of US$3.45. This subsequently dropped HEXO’s stock price down 28%, closing that day at $2.96.

Some analysts changed their 12-month price target, bringing the consensus between all 11 analysts down to C$6.97 from $8.05 last month. Alliance Global Partners has the street high sitting at C$12 while the lowest comes in at C$2.80. Out of all 11 analysts, 3 have buy ratings, 5 have hold ratings, 2 have sell ratings and a single analyst has a strong sell on the name.

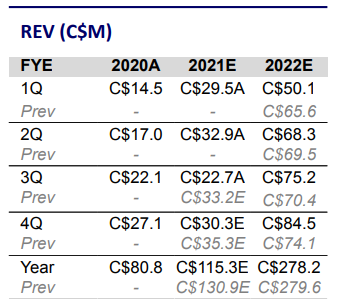

Cantor Fitzgerald was one of the firms cutting their price target on HEXO after the bought deal was announced. They cut from C$9.00 to C$3.40, but reiterated their neutral rating saying that the proforma numbers look good as the stock is trading at 3.3x their C$278.2 million 2022 revenue estimate.

Pablo Zuanic, Cantor’s analyst says that there are multiple potential reasons for HEXO to rerate higher such as:

- Once investors get a better sense of the scale and prowess of the combined company.

- As it begins to report positive EBITDA in FY22.

- As we all get more visibility about the company’s US strategy.

- If management clearly states that further stock dilution is unlikely in the year ahead.

Cantor says that with these new 47.5 million units, which is diluting the shareholders roughly 21%, the proforma shares outstanding for HEXO sits at 270 million. This includes the 17.6 million shares issued to Zenabis shareholders, 5.6 million to 48 North shareholders, and 69.7 million to Redecan shareholders.

Cantor also talks about HEXO’s CEO interview wherein it was stated that the company is in the process of acquiring California assets and that the deal is structured similar to their peers, where Hexo will own an option to acquire 80% of the companies assets upon federal legalization.

Below you can see Cantor’s 2020 to 20-23 Revenue estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.