Capital One (NYSE: COF) has unveiled plans to acquire Discover Financial Services (NYSE: DFS), aiming to obfuscate the mounting delinquency and non-consumer finance issues by merging balance sheets and leveraging synergies.

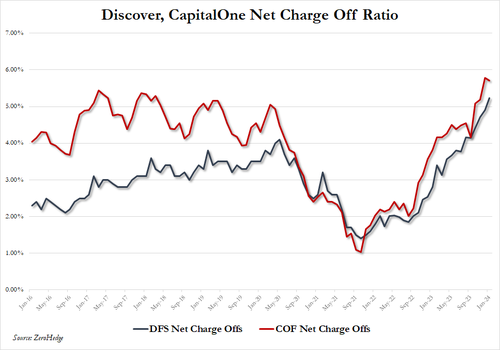

The announcement comes as delinquency and charge off ratios at major credit card companies in the US have spiked, suggesting potential financial strain on consumers. This alarming trend has sparked concerns among traders, exemplified by Goldman trader Rich Privorotsky’s remarks highlighting the escalating consumer issues, particularly regarding Discovery’s 242bps surge in net charge-offs.

The all-stock transaction offers Discover shareholders a lucrative deal, with Capital One valuing shares at approximately $140 per each. This represents a substantial premium compared to Discover’s recent closing price of $110.49, valuing the deal at around $35 billion.

If successful, the acquisition would significantly bolster Capital One’s position in the payments ecosystem, given Discover’s status as one of the few competitors to Visa and Mastercard in the US. This also puts the firms competitively against premium offerings from rivals such as American Express, Citigroup, and JPMorgan Chase.

“Our acquisition of Discover is a singular opportunity to bring together two very successful companies with complementary capabilities and franchises, and to build a payments network that can compete with the largest payments networks and payments companies,” said Capital One CEO Richard Fairbank.

However, Capital One’s intention to transition some cards to Discover’s network raises concerns about potential customer attrition due to Discover’s limited global acceptance compared to its larger counterparts.

Despite the potential benefits, regulatory approval remains uncertain, particularly amidst heightened scrutiny of major mergers by the Federal Trade Commission (FTC) under the Biden administration. Discover, amidst its own challenges, including regulatory scrutiny, misclassification of credit-card accounts, and recent leadership changes, finds itself at a pivotal juncture with this acquisition offer.

For Capital One, the deal represents an opportunity to expand its credit-card lending business and consumer deposit base, positioning itself as a dominant player in the financial services industry.

This acquisition, touted as one of the largest deals of 2024, signals a resurgence in merger and acquisition activity following a subdued period in 2023.

Information for this briefing was found via AP News and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.