Before the market opened on June 23, CarMax, Inc. (NYSE: KMX), the U.S.’s largest retailer of used cars, reported another quarter where the key metrics of revenue, EPS and used car unit sales declined versus the year ago period, yet these figures were better than analysts’ consensus estimates. In response, the stock jumped 10% on June 23 to close at US$86.21.

More specifically, 1Q FY24 (quarter ended May 31, 2023) revenue totaled US$7.7 billion, down 17.4% from US$9.3 billion in 1Q FY23, but ahead of the average revenue estimate of US$7.5 billion. Similarly, recurring EPS in the just-completed quarter was US$1.16, well ahead of the US$0.79 estimate, but lower than the US$1.56 per share earned in the year-ago period. Effective cost controls accounted for the sizable earnings beat versus consensus expectations.

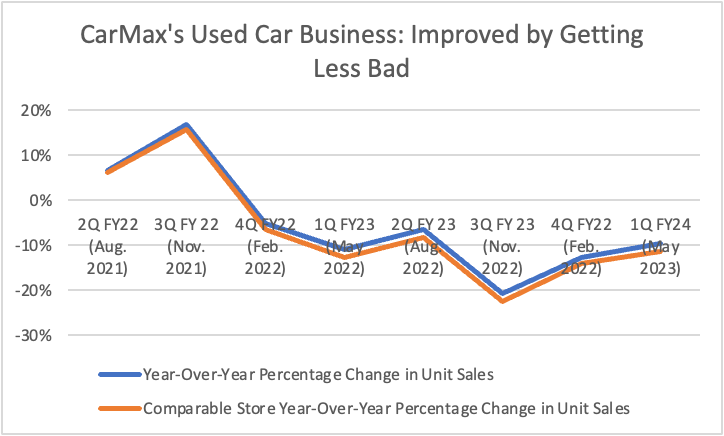

Retail used car unit sales declined 9.6% in 1Q FY24 versus 1Q FY 23. This represents the second successive quarter when the year-over-year unit decline was down substantially, but less severe than the giant 20.8% decline in the quarter ended November 30, 2022. Retail used car unit sales fell 12.6% year-over-year in the quarter ended February 28, 2023.

One unusual aspect of CarMax’s 1Q FY24 report was a significant decline in year-over-year operating cash flow: negative US$185 million versus positive US$531 million in 1Q FY23. The difference is attributable to a US$355 million inventory build in 1Q FY24 versus a US$434 million reduction in 1Q FY23. Hopefully, this proves to be just a timing difference, and inventories adjust in the next quarter.

CARMAX, INC. — Selected Financial Statistics

| (in thousands of U.S. dollars, except per share data) | 1Q FY24 | 4Q FY23 | 3Q FY23 | 2Q FY23 | 1Q FY23 |

| Revenue | $7,687,063 | $5,722,493 | $6,505,956 | $8,144,803 | $9,311,621 |

| Net Income | $228,298 | $69,012 | $37,580 | $125,905 | $252,265 |

| Recurring EPS – Fully Diluted | $1.16 | $0.44 | $0.24 | $0.79 | $1.56 |

| Operating Cash Flow | ($185,285) | ($378,745) | $1,182,488 | ($51,363) | $530,952 |

| Cash – Period End | $264,247 | $314,758 | $668,618 | $56,772 | $95,313 |

| Debt – Period End | $2,493,111 | $2,598,335 | $2,576,252 | $3,185,246 | $3,245,470 |

| Shares Outstanding (millions) – Period End | 158.2 | 158.1 | 158.0 | 158.0 | 159.6 |

| Unit Sales – Used Vehicles | 217,924 | 169,884 | 180,050 | 216,939 | 240,950 |

| Year-Over-Year Percentage Change | -9.6% | -12.6% | -20.8% | -6.4% | -11.0% |

| Comparable Store Percentage Change in Unit Sales of Used Vehicles | -11.4% | -14.1% | -22.4% | -8.3% | -12.7% |

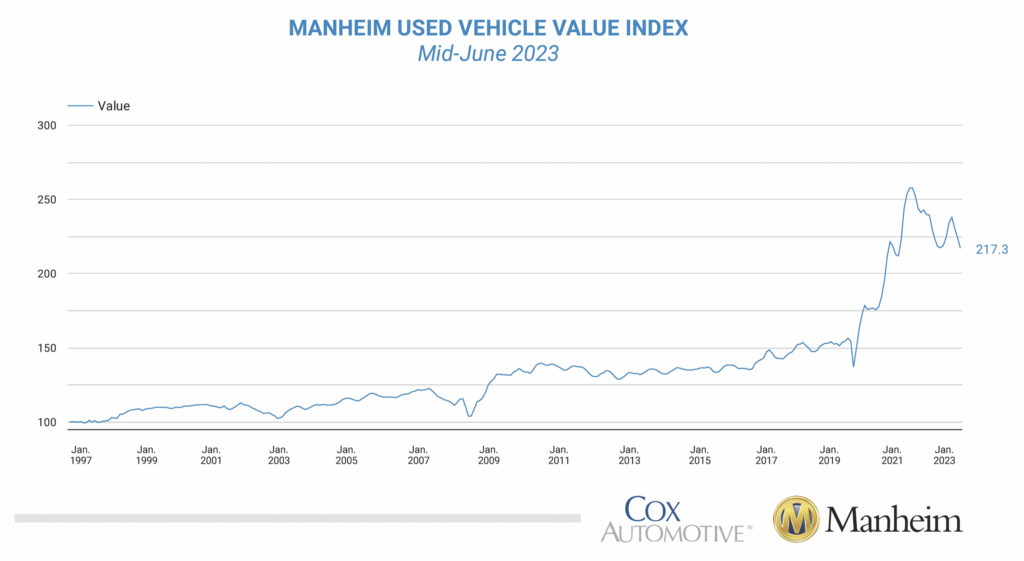

As has been the case for some time, vehicle affordability remains CarMax’s biggest challenge. Persistent inflation, higher interest rates, tougher lending standards by banks and other financial service entities, and low consumer confidence all affected CarMax’s ability to close transactions. These challenges could remain in place for some time, but used car prices have moved somewhat lower, translating into a US$1,600, or a 5.5%, year-over-year reduction in CarMax’s closed used car transaction prices in 1Q FY24.

CEO Bill Nash welcomed the lower prices: “I think the more prices move down, the better that is for the industry.”

Not surprisingly, CarMax’s used car prices have generally tracked those of the overall industry. The widely followed Manheim Used Vehicle Value Index has dropped in each of the last three months, a cumulative 9% decline. The index peaked in early 2022 and has oscillated quite noticeably since then. On a net basis, the index is little changed over the last eight months.

Investors are generally bullish on CarMax’s prospects. The stock has rallied about 55% over the last three months and trades at a 2024 P/E multiple of about 25x (based on estimated earnings for the year ending February 28, 2025). Given the significant uncertainties of both the health of the overall economy and the future direction of used car prices, this multiple looks quite full.

CarMax, Inc. last traded at US$86.21 on the NYSE.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.