Century Lithium (TSXV: LCE) is reporting an after-tax net present value (8%) of $3.0 billion for its Clayton Valley Lithium Project in Nevada, along with an IRR of 17.1%. The figure is based on a feasibility study conducted by the company.

The estimate is based on a 40 year mine life for the project, which would see the production of 34,000 tonnes per annum of lithium carbonate intended for the automotive industry. Processing of the mineral would come from a combination of direct lithium extraction and a chloride leaching process, which the company has been developing and testing for over two years.

As part of the study, proven and probable resources of 287.65 million tonnes have been established, at an average grade of 1,149 ppm lithium, resulting in 0.330 Mt of lithium. Measured and indicated resources meanwhile total 1,207.3 Mt, at an average grade of 957 ppm lithium, resulting in 1.155 Mt of lithium.

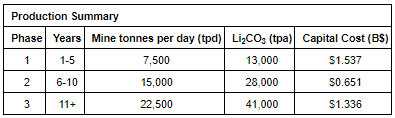

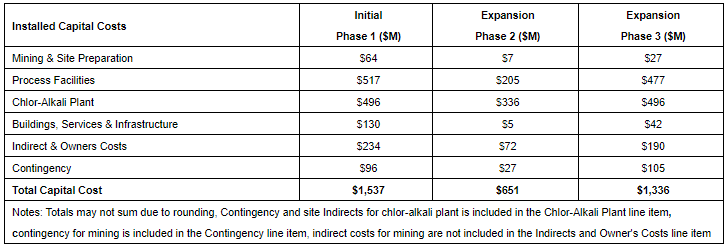

Phase one of the proposed project would see the production of 13,000 tpa of lithium carbonate, at an initial capital cost of $1.54 billion. Phase two would expand production to 28,000 tpa at a cost of $0.65 billion, while phase three would finally push production to 41,000 tpa at a cost of $1.34 billion.

The project is said to have an operating cost of $8,223 per tonne of lithium carbonate produced, which falls to $2,766 per tonne after sales of surplus sodium hydroxide. The first phase of the project however is estimating operating costs of $10,390 per tonne LCE, which falls to $4,364 per tonne after sodium hydroxide sales.

It should also be noted however that the after-tax net present value of $3.0 billion, is based on a price of $24,000 per tonne lithium carbonate. For context, lithium carbonate is currently trading at CNY$110,5000 per tonne, which roughly translates to US$15,256 per tonne. The figure used by Century Lithium is said to be based on a “conservative mid-point” between current prices and forecast prices published by Benchmark Mineral Intelligence.

Going forward, Century has said it will now focus its efforts on engineering and permitting, with discussions with government agencies said to be in the process of being advanced. At the same time, the company is holding discussions with strategic partners and interested parties for project funding to advance the project.

Century Lithium last traded at $0.64 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.