The US made its most aggressive move to crack down on cryptocurrency exchange Binance Holdings and its CEO Changpeng Zhao. The Commodity Futures Trading Commission (CFTC) filed a complaint in federal court in Chicago against Binance and its CEO, known as CZ, claiming they routinely flouted American derivatives rules as the company grew into the world’s largest trading platform.

According to regulators, Binance had to register with the agency years ago and continues to violate CFTC rules.

“The defendants’ own emails and chats reflect that Binance’s compliance efforts have been a sham and Binance deliberately chose – over and over – to place profits over following the law,” Gretchen Lowe, chief counsel in the CFTC’s enforcement division, said in a statement.

CFTC V Binancehttps://t.co/0tIVypBwoG

— db (@tier10k) March 27, 2023

Because the CFTC is a civil government agency, it cannot criminally prosecute companies or seek jail time for individuals. However, regulatory lawsuits can impose large fines and other penalties on companies and individuals.

CFTC not only sued Zhao and several Binance entities, but also claimed that Binance’s former chief compliance officer, Samuel Lim, violated its rules.

The agency said Zhao, Lim, and other senior management were unable to adequately monitor Binance’s activities, including instructing American customers to use virtual private networks (VPNs) to obscure their location and directing “VIP customers” with US ties — often institutional market participants — to open Binance accounts under the name of shell companies.

Zhao responded to the complaint, calling it “unexpected and disappointing.”

“Upon an initial review, the complaint appears to contain an incomplete recitation of facts, and we do not agree with the characterization of many of the issues alleged in the complaint,” the chief executive said in a statement.

Signal

The complaint highlighted how the crypto firm uses Signal, a messaging application known for its auto-delete functionality, alleging this was used to “cover their tracks after communicating about inculpatory matters.”

“Zhao and others acting on behalf of Binance have used Signal—with its auto-delete functionality enabled—to engage in business communications, even after Binance received document requests from the CFTC and after Binance purportedly distributed document preservation notices to its personnel,” the complaint read.

The agency laid out examples of “Signal text chains or group chats collected from Zhao’s telephone” that were set to auto-delete.

The feds have CZ's phone, things are getting SPICY pic.twitter.com/WRpKgDr5Oa

— @BennettTomlin@mstdn.social (@BennettTomlin) March 27, 2023

Zhao also allegedly has instructed Binance staff to use Signal to communicate with US customers.

Banking giants had to settle with the US Securities and Exchange Commission and the CFTC last year related to the agencies’ investigation into the use of banned private messaging apps like Whatsapp by the banks’ traders.

Binance trading on Binance

The CFTC also noted that “Binance has traded on its own platform through approximately 300 ‘house accounts’ that are all directly or indirectly owned by Zhao,” also noting that the chief executive himself has also traded on the Binance platform through two individual accounts.

“Binance does not disclose to its customers that Binance is trading in its own markets in its Terms of Use or elsewhere,” said the compliant. “Consistent with its apparent attempt to keep its proprietary trading activity on its own markets top secret, Binance has refused to respond to Commission-issued investigative subpoenas seeking information concerning its proprietary trading activity on Binance.”

You have to ask yourself why would a single trader need over three hundred trading accounts, to trade on Binance?

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) March 27, 2023

Because they're wash trading and painting the tape between their accounts.

They can make the prices do whatever they want. pic.twitter.com/YIF8XYSrlh

In response, Zhao clarified that he personally owns two accounts on Binance: “one for Binance Card, one for [his] crypto holdings.”

“Binance.com has a 90 day no-day-trading rule for employees, meaning you are not allowed to sell a coin within 90 days of your most recent buy, or vice versa. This is to prevent any employees from actively trading. We also prohibit our employees from trading in Futures,” Zhao said.

Compliance “fo’ sho'”

The CFTC added that even after Binance allegedly restricted access to its platform from certain jurisdictions in mid-2019, it left open a loophole for customers to sign up, deposit assets, trade, and withdraw without submitting to any know-your-customer (KYC) procedures as long as the customer withdrew less than the value of two bitcoin in a single day. The agency also said that the two BTC withdrawal restriction was effectively worthless because the notional value of two BTC in July 2019 was more than $22,000 and more than $100,000 in March 2021.

“In keeping with Binance and Zhao’s ethos of prioritizing profits over legal compliance, they knowingly allowed the two BTC-no KYC loophole to persist,” the complaint said.

It highlighted one October 2020 chat between Lim and a Binance colleague, with the chief compliance officer saying, “I think CZ understands that there is risk in doing [two BTC-no KYC loophole], but I believe this is something which concerns our firm and its survivability. If Binance forces mandatory KYC, then [competing digital asset exchanges] will be VERY VERY happy.”

Binance also did not, as previously said, prohibit the ability of unverified consumers to deposit funds and trade on the platform by October 19, 2021. Binance testified in February 2022 that just 30-40% of its customers’ identities have been verified with KYC documents.

“As Lim—at the time Binance’s CCO—recognized in an October 2020 chat with other Binance compliance personnel, Binance’s compliance environment has amounted to ’email sending and no action… for media pickup… I guess you can say it’s ‘fo sho’,'” the complaint read.

In response, Zhao defended the firm by saying Binance.com is “the first global (non-US) exchange to implement a mandatory KYC program, and remains today to have one of the highest standards in KYC and [anti-money laundering].”

“We block US users by nationality (KYC), IP (including commonly used VPN endpoints outside of the US), mobile carrier, device fingerprints, bank deposit and withdrawals, blockchain deposits and withdrawals, credit card bin numbers, and more,” Zhao added. “We are aware of no other company using systems more comprehensive or more effective than Binance.”

However, the complaint cited a June 2019 meeting where the Binance’s Chief Financial Officer stated during a meeting with senior management including Zhao: “We will never admit that we openly serve US clients. That’s why the PR messaging piece is very, very critical.”

Zhao agreed that Binance’s “PR messaging” was critical, explaining in a meeting the next day that “we need to, we need to finesse the message a little bit… And the message is never about Binance blocking US users, because our public stance is we never had any US users. So, we never targeted the US. We never had US users.”

At that meeting, Zhao himself allegedly said that “20% to 30% of our traffic comes from the US,” and Binance’s “July [2019 Financial] Reporting Package,” which was emailed directly to Zhao, attributes approximately 22% of Binance’s revenue for June 2019 to US customers.

“Haz no confidence”

Binance is also accused of failing to create an effective anti-money laundering program, according to the CFTC. It also failed to put in place the required protections for determining consumers’ genuine identities, according to the government. According to the complaint, the business had not filed a single suspicious activity report in the United States as of at least May 2022.

The CFTC further stated that according to Binance’s own documents for the month of August 2020, the platform made $63 million in fees from futures trades, and that around 16% of its accounts were held by US clients.

“Defendants have disregarded applicable federal laws while fostering Binance’s U.S. customer base because it has been profitable for them to do so,” the CFTC said in its complaint.

To illustrate, the CFTC said Binance underwent a compliance audit to satisfy a request from Paxos in October 2020. But according to Lim, Binance purposely engaged a compliance auditor that would “just do a half assed individual sub audit on geo[fencing]” to “buy [them] more time.”

“As part of this audit, the Binance employee who held the title of Money Laundering Reporting Officer (“MLRO”) lamented that she ‘need[ed] to write a fake annual MLRO report to Binance board of directors wtf,’” the complaint read.

Lim, who was aware that Binance did not have a board of directors, nevertheless assured her, “yea its fine I can get mgmt. to sign” off on the fake report.

“Around the same time as the referenced ‘half assed’ compliance audit, in November 2020 the MLRO exclaimed to Lim in a chat, ‘I HAZ NO CONFIDENCE IN OUR GEOFENCING,’” the complaint added.

I HAZ NO CONFIDENCE IN BINANCE SURVIVING https://t.co/4HzD969FfU

— DIRTY BUBBLE MEDIA: 4 FUD'S SAKE (@MikeBurgersburg) March 27, 2023

“We see the bad, but we close 2 eyes”

The CFTC also alleged that Binance officers, employees, and agents have admitted that the Binance platform has enabled possibly unlawful activity.

For example, after getting information “regarding HAMAS transactions” on Binance in February 2019, Lim explained to a colleague that terrorists normally send “small sums” since “large sums constitute money laundering.” Lim’s colleague responded: “can barely buy an AK47 with 600 bucks.”

The complaint wrote: “And with regard to certain Binance customers, including customers from Russia, Lim acknowledged in a February 2020 chat: ‘Like come on. They are here for crime.’ Binance’s MLRO agreed that ‘we see the bad, but we close 2 eyes.’”

CFTC alleges Binance funded terrorism.

— unusual_whales (@unusual_whales) March 27, 2023

Reportedly, employees said: "We see the bad, we close 2 eyes." pic.twitter.com/dxR4k6MfT2

A Binance employee also wrote to Lim and another colleague in July 2020, asking if a customer whose recent transactions “were very closely associated with illicit activity” and “over $5 million worth of his transactions were indirectly sourced from questionable services” should be off-boarded or if it fell into the category of cases “where we would want to advise the user that they can make a new account.”

“Can let him know to be careful with his flow of funds, especially from darknet like hydra. He can come back with a new account. But this current one has to go, it’s tainted,” Lim allegedly replied.

In another September 2020 chat, Lim reportedly explained to Binance employees that they “don’t need to be so strict” and that “Offboarding = bad in CZ’s eyes.”

“Don’t leave anything in writing”

In addition to instructing retail customers in the United States to use VPNs to avoid IP address-based compliance controls, Binance has developed special policies and procedures to assist its VIP customers in evading Binance’s compliance controls, allowing Binance to continue to access and profit from U.S. customers.

On June 13, 2019, Binance released a press release that “announced its partnership with BAM Trading Services Inc. (which would be Binance.US) to begin preparation to launch trading services for

users in the United States.”

“While outwardly preparing for the launch of Binance.US, internally, Zhao, Lim, and other key Binance personnel remained focused on retaining US VIP customers, and the liquidity and revenue they supplied, on Binance,” the complaint alleged.

One suggestion was to tell US VIP clients they must provide “new” KYC documentation when opening a “new” account. This strategy would allow VIP customers to continue trading on Binance while maintaining their preferred VIP status and rewards earned as a consequence of their previous Binance trading activity.

“During one meeting that Binance recorded, a senior employee proposed that Binance instruct U.S. customers to submit ‘new’ KYC documentation over social media—but Lim corrected the employee and mandated that such instructions should only occur in secret,” the CFTC said.

Zhao even stated in a June 2019 meeting: “We do need to let users know that they can change their KYC on Binance.com and continue to use it. But the message, the message needs to be finessed very carefully because whatever we send will be public. We cannot be held accountable for it.”

In keeping with the intention of retaining any “new account creations” by U.S. clients in order to keep VIPs a secret, Zhao requested at his October 13, 2020 “daily call” that all communications about the “US ban” be done over the Signal messaging app. Lim then sent Zhao’s directive to a top compliance staff member through chat, noting that “we do all US comms via Signal as mandated by CZ.”

Binance’s VIP Handling policy additionally provided means for Binance workers to troubleshoot for US customers identified by their IP address (as opposed to KYC documentation).

“[I]nform the user that the reason why he/she cant use our www.binance.com is because his/her IP is detected as US IP. If user doesn’t get the hint, indicate that IP is the sole reason why he/she can’t use

[Binance.com],” Binance was allegedly instructing its personnel.

When one of Binance employees handling VIP clients brought to Zhao a list of “affected API clients”–“including [a Chicago-headquartered trading firm] who is currently is a top 5 client and 12% of our volume,” the CEO replied: “Give them a heads up to ensure they don’t connect from a US IP. Don’t

leave anything in writing.”

Holy shit!

— Charlie Cai (@Charlie84437644) March 27, 2023

The account that's responsible for 12% of all Binance trading isn't even the top trading account. It's "top 5", meaning 4 other accounts are trading at 12+%

That means top 5 accounts are responsible for at least 65%+ of trade volume on that scam exchange.

Wow! pic.twitter.com/QJbJhP5yEm

US to UNKWN

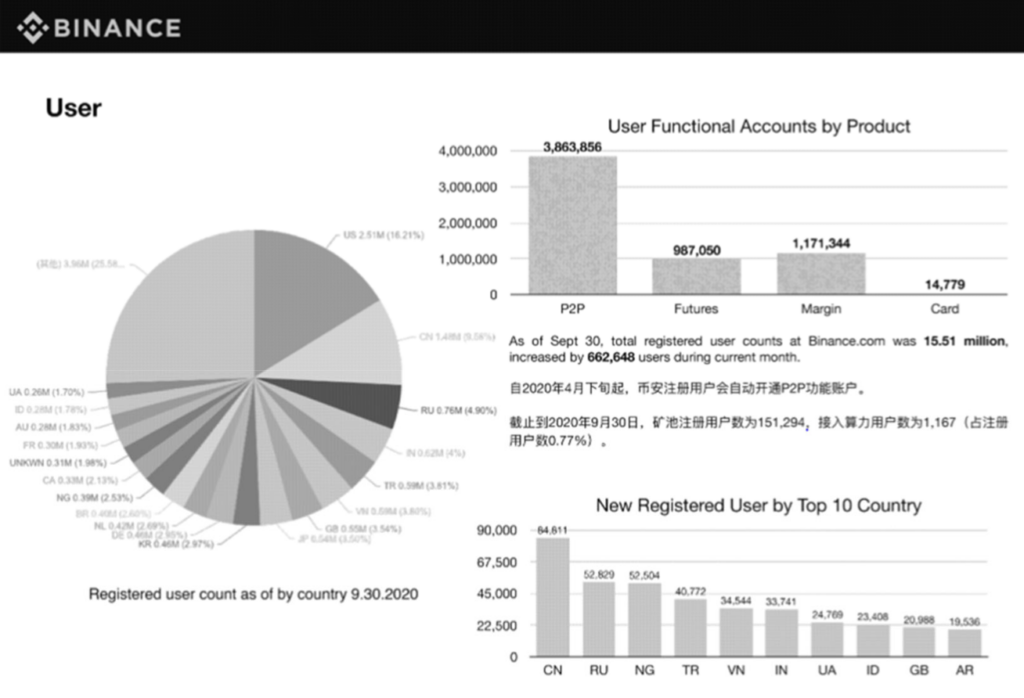

The monthly income data for September 2020 shows that 2.51 million customers were located in “US.” That same month, 0.31 million Binance users’ locales were “UNKWN.”

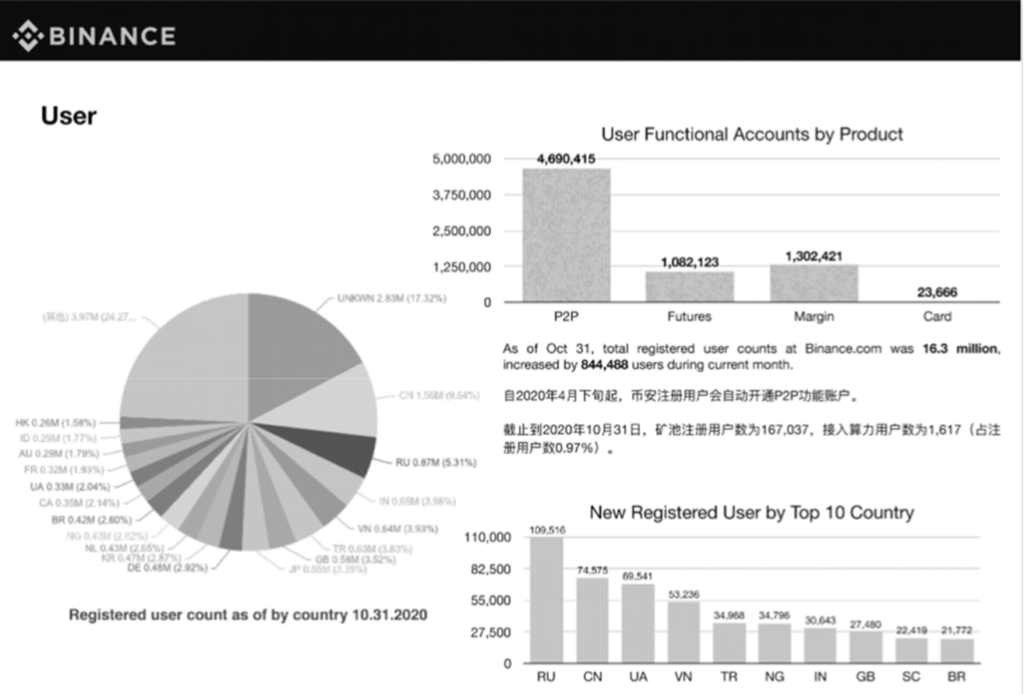

Later, in October 2020, the same month that the CFTC sued a competitor digital asset exchange and its owners, Zhao authorized Binance workers to replace the US value for various data fields in Binance’s internal database with the value UNKWN. As a result, Binance’s October 2020 monthly income report listed about 2.83 million customers’ locations as UNKWN, while making no mention of the United States.

In a November 17, 2020 internal chat, the Director of Operations explained: “At present, the keyword US for internal information is also a sensitive word, so you have to use Unknow [sic] to mark the country.”

The CFTC suit charged Binance with seven counts of violating the Commodity Exchange Act, including transactions of unregistered trade, failure to diligently supervise, failure to implement customer information program, KYC, and anti-money laundering practices, and anti-evasion.

The agency seeks to ban Binance from all trading, disgorge all profits and benefits, and restitute each and every customer or investor whole.

🚨Ω🚨

— ⚯ M Cryptadamus ⚯ | @cryptadamist@universeodon.com (@Cryptadamist) March 27, 2023

It's interesting to look at what #CFTC is asking the court for in the #Binance complaint:

1. Stop all trading immediately

2. Give us all the money

3. Actually give us more than all the money

4. Including salaries of all executives (lol @PRhillman)

5. Jury trial pic.twitter.com/v93KuWeJFq

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.