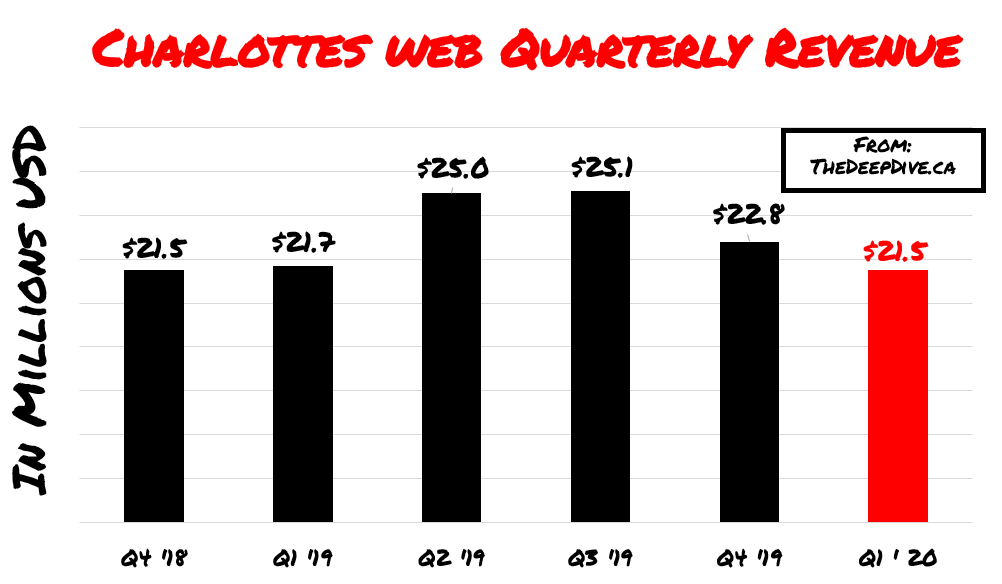

This morning Charlotte’s Web (TSX: CWEB) released their Q1 earnings and investors will be surprised to see revenue declined for the quarter vs. Q1 of 2019. The once shining object of the cannabis world has now failed to demonstrate the kind of growth required to justify their former $1B+ valuation.

The topline revenue number came in at $21.5 million vs. $21.7 million in Q1-2019 also down QoQ. Gross profit was $15.0 million working out to 69.8% of consolidated revenue. The company saw an adjusted EBITDA loss of $5.7 million while burning $14.9M in operating cash flow and $1.6M in investing cash flow.

The company tell us their Direct-to-Consumer eCommerce sales grew 29.4% year-over-year and contributed to 65.6% of the quarter’s revenue. The company also highlighted their recent acquisition of Abacus Health which is expected to close in late Q2 or early Q3 of this year. The new addition is a leading over-the-counter producer of topical products reaching more than 12,000 “doors” including the three largest U.S. pharmacy chains in America. The acquisition will be an all stock transaction for approximately $99M CAD, representing 19.2M shares of Charlotte Web’s common stock at a price of $5.17 per share.

The company’s balance sheet is sitting pretty with $53.0 million cash and $114.9 million. Representing enough a cash balance to get the company through the remainder of the year if they continue to burn at the current rate.

Charlotte’s Web’s stock price is down 71% year to date, and closed yesterday at $5.73 CAD.

All numbers in USD unless otherwise stated.

Information for this briefing was found via Sedar and Charlotte’s Web Holdings Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.