Lithium’s tortured three-year slump may finally have reached its end. Commonwealth Bank of Australia says the battery metal has “passed the lowest point in the lithium price cycle,” helped by an aggressive Chinese crackdown on illegal mining and overcapacity.

Spodumene, Australia’s flagship lithium feedstock, has surged 48% from its June trough of US$575 per tonne to US$850 on July 25, S&P Global Platts data show.

“The recent surge… suggests that we are past the lowest point so long as China’s crackdown reduces lithium supply,” CBA commodities strategist Vivek Dhar told clients.

Chinese regulators are attacking the glut at its source. Yichun, which Benchmark Mineral Intelligence estimates will supply 10% of global mined lithium this year, ordered eight operators to resubmit reserve reports after an audit uncovered overstated deposits. Qinghai’s authorities told Zangge Mining to halt unlicensed extraction, with Dhar adding that “the potential for licensing-related supply cutbacks is meaningful.”

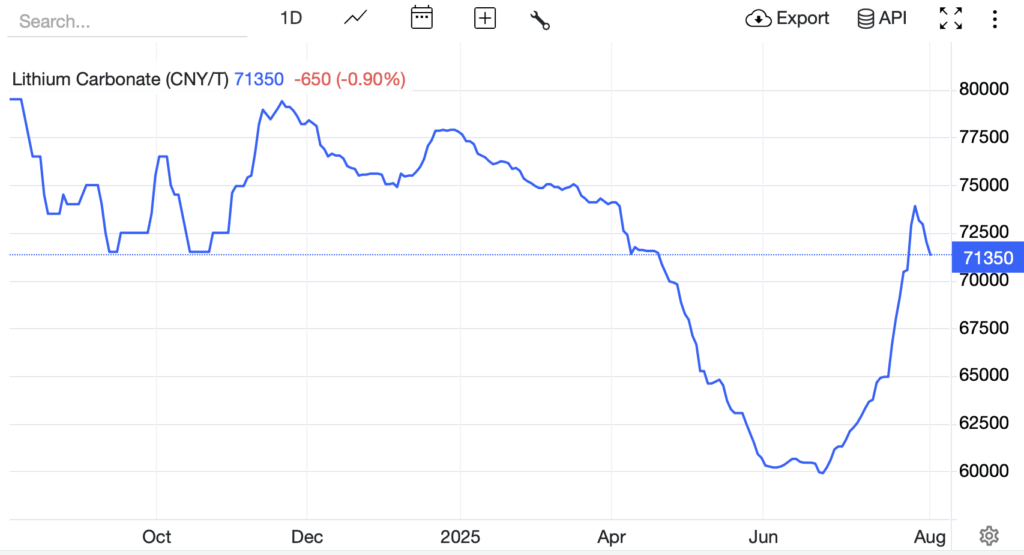

Prices remain a shadow of their 2022 peak, down about 90%. Yet Beijing’s broader bid to rein in deflationary overcapacity—highlighted by a fresh ¥1.2 trillion hydropower megaproject in Tibet—has lifted the entire commodity complex since early July.

Canaccord Genuity analyst Reg Spencer conceded the firm’s earlier call for a 2025 slowdown in electric vehicle sales was “too conservative.” Global EV deliveries are up 30% year-to-date, led by 32% growth in China and a 26% rebound in Europe, more than offsetting flat North American volumes.

Still, Chinese cathode manufacturers remain reluctant buyers of high-priced feedstock. Dhar cautioned that it seems “premature to attribute any lithium price rise to a material change in demand expectations.”

Spot lithium carbonate slipped 0.9% on Friday to ¥71,350 per tonne, trading 15.7% above last month’s level but 10.3% below a year ago.

Information for this briefing was found via Financial Review and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.