The ongoing Russia-Ukraine war incensed the much larger global conflict on trade. With the mounting sanctions from the international community, the Kremlin is looking to its Asian neighbor to sustain its economy.

Apparently, China is open for business. But is it worth the cost?

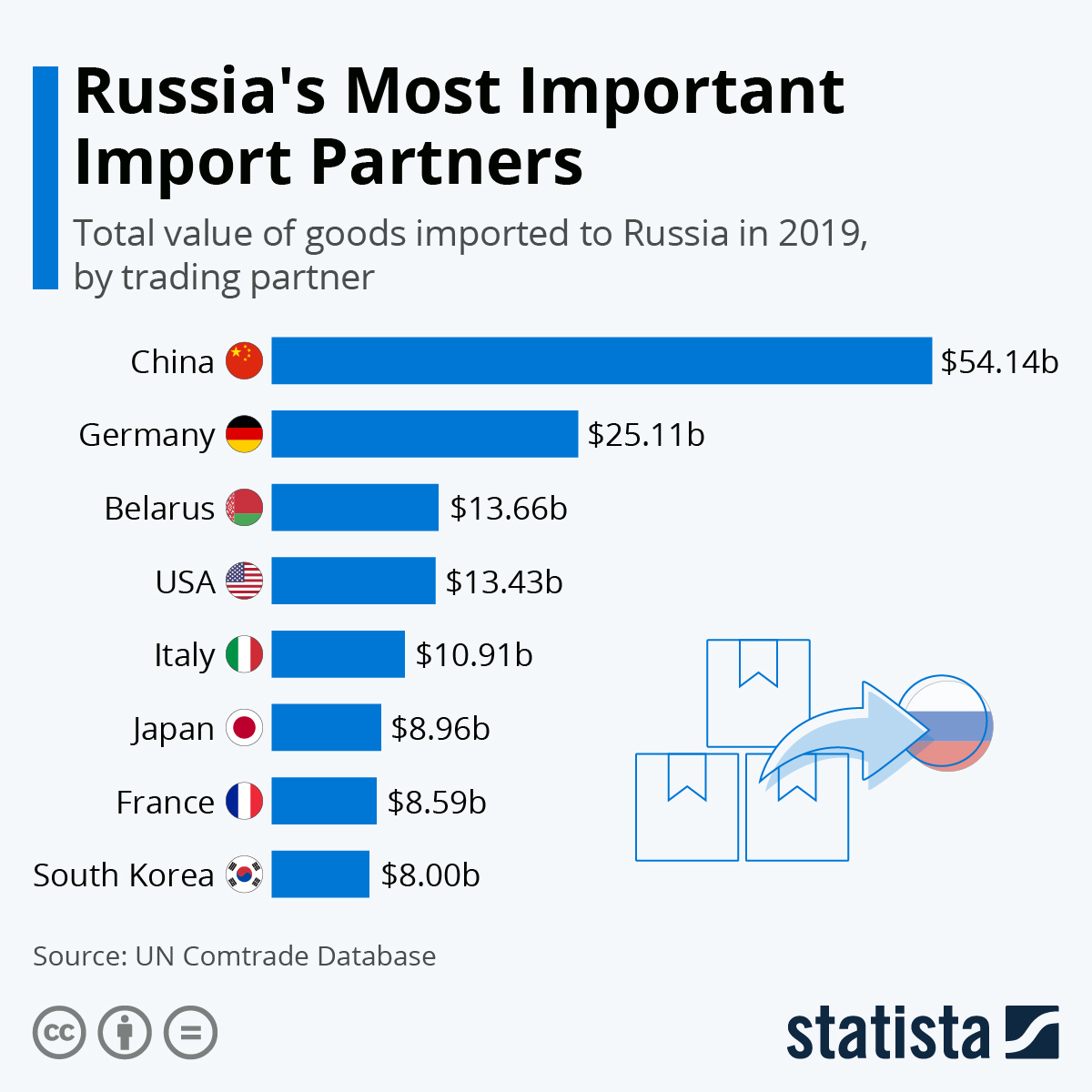

In a Bloomberg article, Beijing seems to be considering buying more stakes in Russian energy firms. According to sources familiar with the matter, there have been talks with state-owned companies, including China National Petroleum Corp., China Petrochemical Corp., Aluminum Corp. of China, and China Minmetals Corp., on the possibility of investing “in Russian companies or assets”.

The move is said to intensify the focus on energy and food security and not a show of support for Russia on its invasion of Ukraine.

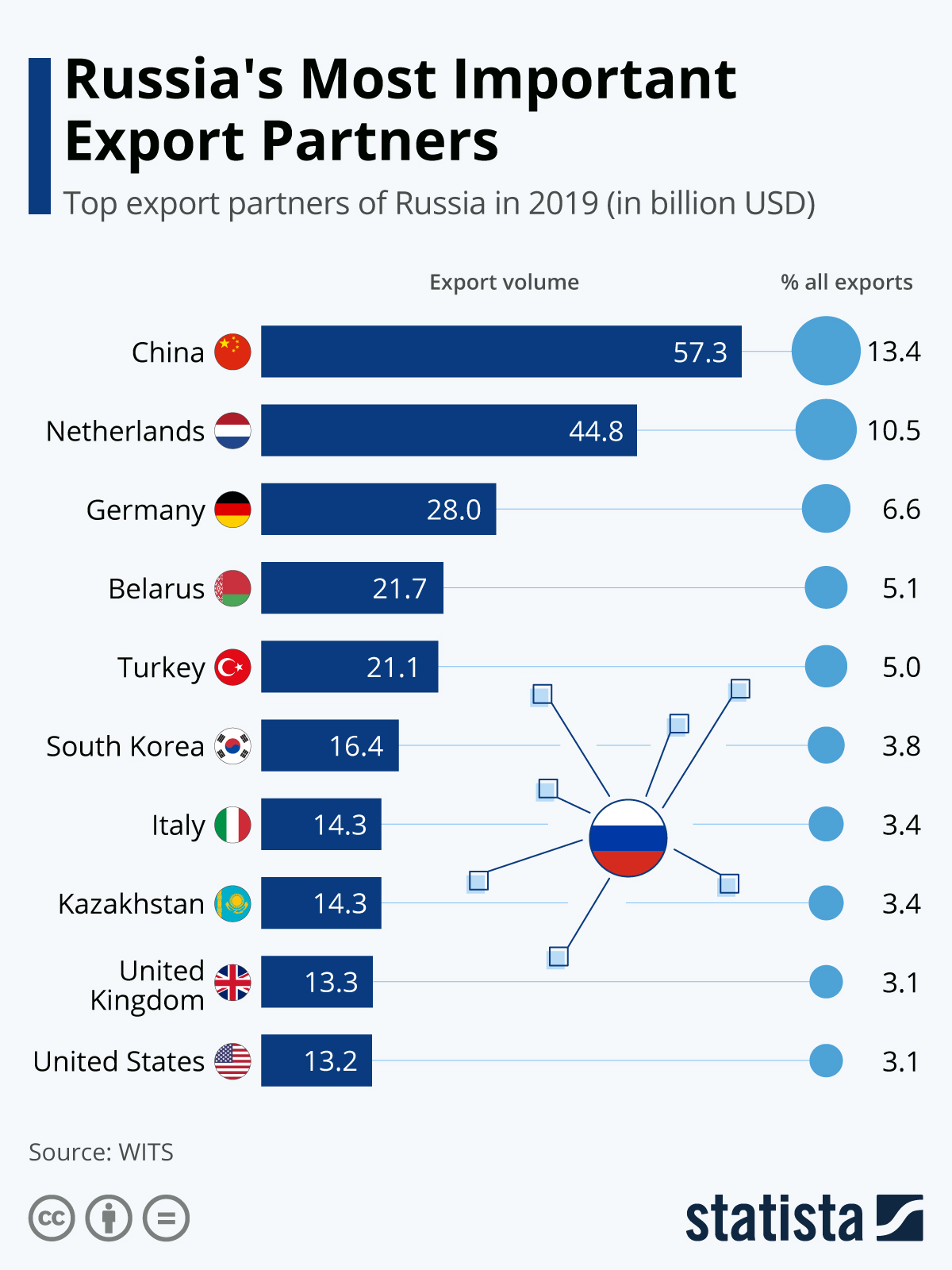

This follows the announcement by Russian President Vladimir Putin in February 2021 of around US$117.5 billion of oil and gas deals with China, in a move to lessen the country’s dependence on European customers.

“Our oilmen have prepared very good new solutions on hydrocarbon supplies to the People’s Republic of China,” Putin said at a meeting with Chinese President Xi Jinping.

In particular, Russia’s Rosneft scored an US$80-billion deal with China’s CNPC to supply 100 million tonnes of oil over 10 years.

While Xi tries to project a neutral stance on the ongoing war, calling for “maximum restraint”, there are telltale signs of China’s relationship with Russia. Beijing’s state-owned networks are calling the conflict a “special military operation” rather than war and have been repeating Russia’s own media’s propaganda from its officials.

A number of Russian banks are also opening accounts in China’s yuan after the ruble was frozen out by the global economies.

But it doesn’t mean Xi doesn’t care about the effects of the war; it’s just concentrated on one thing: sanctions.

“Sanctions will affect global finance, energy, transportation and stability of supply chains, and dampen the global economy that is already ravaged by the pandemic,’ Xi said in a conference meeting with French President Emmanuel Macron and German Chancellor Olaf Scholz. “This is in the interest of no one.”

But sanctions are so far the weapon waged by the global community that has proven to take effect. Many multinational firms have ceased their operations in Russia, ruble has been devalued by up to 40% of its value, and local firms are looking at the possible severing of international ties given the ban on foreign exchange transfers.

The sanctions even extend to Belarus, who’s been viewed as a sympathizer of Russia’s attack on Ukraine.

With respect to its trade with Russia, China has a tough balancing act to tread as the world watches every move of support for Putin’s invasion–and the latest discussions on considering buying stakes in Russian energy and commodity firms might be viewed as such.

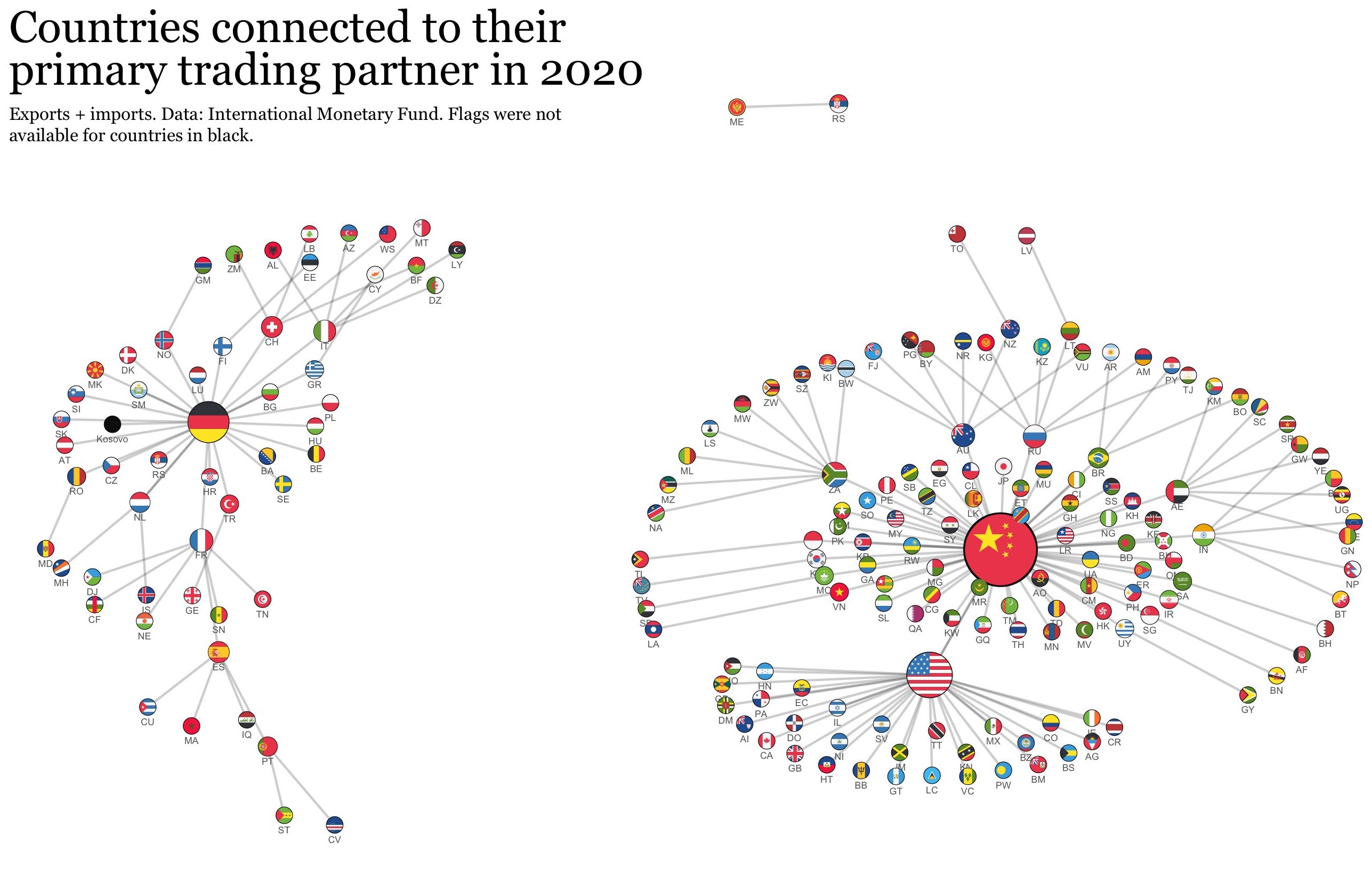

China has risen to become the world’s top trade partner, overtaking the United States in 2020. The tariffs imposed by either country on each other’s exports spurred the mounting trade war, with China leading the pack as it projects itself to be a global influence once more.

With how the global community acted on Russia–and more importantly, its perceived co-belligerent Belarus–once the war broke, China stands to lose its rise of geopolitical power and economic influence.

While China is Russia’s top trade partner, the latter only accounted for 2.0% and 3.1% of Beijing’s exports and imports, respectively.

Chinese exports and imports by trade partner

When push comes to shove, it would have really been a relationship that’s “stronger than an alliance”–as Xi put it–if China sides with Russia.

Information for this briefing was found via Bloomberg, Financial Times, AlJazeera, CNN, The Telegraph. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.