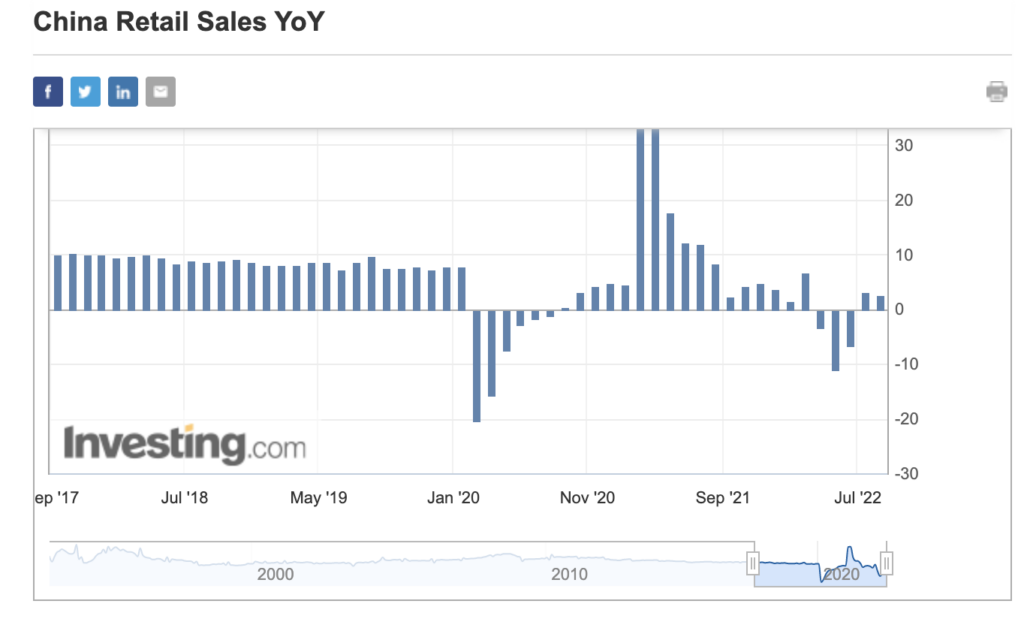

China, which plays an important role in upholding the global economy, appears to be suffering from a demand slump. Latest data shows the country’s retail and factory activity unexpectedly slowed last month, prompting the central bank to abruptly cut its two key lending rates in an effort to revive the economy.

The world’s second largest economy reported weaker-than-expected data for July, as Covid-19 restrictions and the concurrent real estate slump hindered growth. The National Bureau of Statistics reported that retail sales increased 2.7% year-over-year in July, substantially below the 5% expected by economists polled by Reuters and lower than the 3.1% reported in the month prior. Likewise, industrial production rose 3.8% from July 2021, down from June’s 3.9%, and also missing forecasts calling for an expansion of 4.6%.

At the same time, investment in China’s property market declined at a faster pace in July compared to June, as fixed asset investment in the first seven months of 2022 increased only 5.7% from the same period one year ago. “The July data suggest that the post-lockdown recovery lost steam as the one-off boost from reopening fizzled out and mortgage boycotts triggered a renewed deterioration in the property sector,” said Capital Economists senior China economist Julian Evans-Pritchard.

In an effort to help the economy overcome the recent slump, the People’s Bank of China slashed both its seven-day and one-year interest rates by 10 basis points. But, despite the updated monetary policy move, households and businesses are hesitant to borrow following Covid-19 restrictions. “The rate cut shows the entire economy is in trouble,” said Iris Pang from ING Groep NV. The central bank also withdrew some cash from the banking system, selling US$59.3 billion worth of yuan.

#China lowered interest rates after dismal Macro numbers, including retail sales and home prices.

— jeroen blokland (@jsblokland) August 15, 2022

This is a clear sign the Chinese economy is heading into the wrong direction as authorities refrained from cutting rates to prevent downward pressure on the #Yuan. #CNH #CNY pic.twitter.com/reRqHc3Ea1

“Usually the Chinese economy has been an important pillar in supporting the global economy. This time, the US and Europe are showing signs of slowing and possibly moving into a recession but the backdrop— China— isn’t there to support the global economy,” explained WisdomTree macroeconomic research director Aneeka Gupta as cited by the Financial Times.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.