Chinese homebuyers are refusing to pay their mortgages for the increasing number of unfinished projects, stoking fears that it could lead to further decline of the already embattled biggest real estate market in the world.

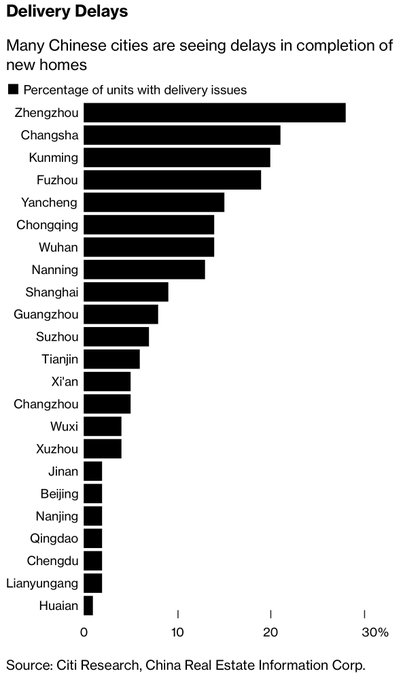

China Real Estate Information reported on Wednesday that around 100 projects in more than 50 cities aren’t receiving mortgage payments from homeowners, almost double its numbers the day prior and four times two days ago.

“The incident would dampen buyer sentiment, especially for presold products offered by private developers given the higher risk on delivery, and weigh on the gradual sales recovery,” wrote Jefferies Financial Group analysts, including Shujin Chen.

The homeowners are boycotting the increasing delays in completing the presold properties. Between 2013 and 2020, only around 60% of the presold homes were delivered while outstanding mortgage loans rose by 26.3 trillion yuan.

“Presales carry mounting risks for developers, homebuyers, the financial system and the macro economy,’ wrote Nomura analysts, including Ting Lu.

The payment snubs are part of the domino effect that has pervaded the Chinese real estate market, starting from Evergrande’s default on its debt payments.

The pillars of strength in China's property bond market are crumbling.

— Rebecca Choong Wilkins 钟碧琪 (@RChoongWilkins) July 14, 2022

The dollar bond selloff that began with Evergrande, and decimated nearly all weaker developers, is now threatening investment-grade giants like Vanke that until this week seemed insulated. 3/6 pic.twitter.com/uoK43tKio0

Home prices have also fallen for nine consecutive months in May, dropping on average 15% from its figures three years ago, according to Citigroup analysts. The decline in property values is also seen as a contributing factor to the payment boycotts.

“Investors are concerned about the spread of mortgage payment snubs to buyers, simply due to lower property prices, and the impact on property sales,” Chen added.

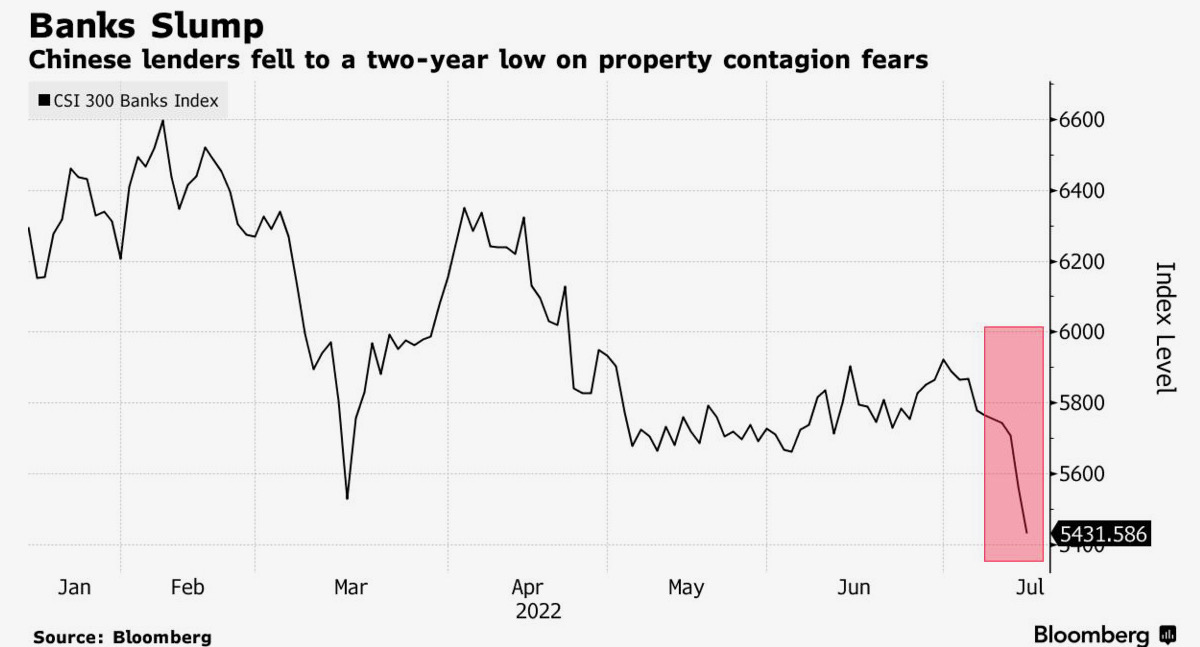

Fears from mortgage payment refusals are hitting the developers who are already facing liquidity issues due to economic factors.

Corollary, lenders are also feeling the effects of the real estate crisis as it sends the industry to its lowest index in two years. It is estimated that mortgages comprise close to 20% of the banks’ loan portfolio.

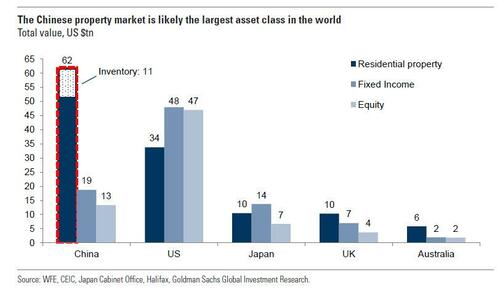

With the Chinese property market likely being the largest asset class in the world, the country’s real estate decline is feared to reverberate across the globe–if not already affecting the international market due to bond defaults.

“We are especially concerned about the financial impact of the homebuyers’ ‘stopping mortgage repayments’ movement,” Ting added. “China’s property downturn may finally adversely affect onshore financial institutions after hitting the offshore high-yield dollar bond market.”

The country’s strict COVID policy isn’t helping the situation; instead, it is magnifying the reverberating effects of Beijing’s economy on the global market.

“[China’s lockdown] is already having a dramatic effect on the markets… It’s killing the supply chain, it’s hurting the American business dramatically,” said market analyst Bubba Trading CEO Todd Horwitz in a Daily Dive interview. “If you ask me… the more reason they’re shutting down is to bring in more pain and more issues here in the United States.”

Information for this briefing was found via Bloomberg and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.