After a multi-day trading halt, Cielo Waste Solutions (TSXV: CMC) has announced an asset purchase agreement to acquire certain assets and liabilities of Expander Energy, referred to as the EBTL and BGTL technologies. The purchase is said to accelerate the timeline of commercialization of Cielo’s proprietary thermal catalytic depolymerization tech.

Total consideration is said to be $45.3 million, which will be satisfied via the issuance of 906.5 million common shares of Cielo at $0.05 per share, resulting in Expander owning a 49.9% stake in the company. 25% of the shares will be subject to a lock-up arrangement, while 15% of the shares will be held back for indemnification purposes for 15 months.

As part of the transaction, Cielo will also see the addition of three Expander executives to its board of directors, including James Ross, the executive chairman and CFO of Expander.

The arrangement will see the granting of an exclusive license within Canada to use the EBTL and BGTL technologies, as well as in the US, for creosote and treated wood waste. The tech is planned to be used to build facilities that process biomass into fuels to create bio-syndiesel.

Under the transaction, Expander will remain a separate entity, but will provide services for engineering, procurement and construction phases of six projects in Alberta and two in the US, while also providing certain services for the operation and project management phases.

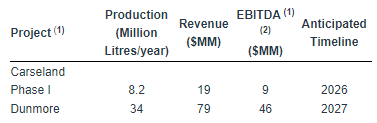

The six projects in Alberta include three proposed by Cielo and three proposed or underway already by Expander. The first proposed projects are found in Carseland and Dunmore, with Carseland anticipated to be in operation by 2026. Dunmore is anticipated to open the following year. Estimates currently call for a combined production of 42.2 million litres a year, generation revenue of $98 million.

The remaining two projects in Alberta are to be located in Carseland and Slave Lake, with the US locations currently undecided. Six locations will be required to have hit the final investment decision stage within a five year period, or Cielo risks losing exclusivity to the tech.

Terms of the transaction require that Cielo is to have $45.0 million in cash available at closing, with the company indicating that it is in discussions with third parties for financings to support this.

The appointment of the Expander execs remains subject to shareholder approval, with the shareholder meeting scheduled for October 26. The company is also unsurprisingly proposing a share consolidation of up to a one for fifteen basis, which remains subject to shareholder approval as well.

Cielo Waste Solutions last traded at $0.05 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.