Cineplex Inc. (TSX: CGX) reported its second quarter financial results last week. The company announced revenues of $349.9 million, up from $228.72 million last quarter or up 53% sequentially. The move theatre’s gross profits increased 86% sequentially to $182.54 million, while reporting the first positive net income since the pandemic started.

Adjusted EBITDA meanwhile came in at $77.9 million, while its adjusted cash flow was $21.8 million this quarter, and its operating cash flow was $47.2 million for the quarter.

The company announced that theatre attendance grew to 11.1 million while box office revenues per person grew to $12.29 and concessions revenues per person grew to $8.84.

Cineplex currently has six analysts covering the stock with an average 12-month price target of C$16, or an upside of 43%. Out of the six analysts, one has a strong buy rating, three have buy ratings, and the last two analysts have hold ratings on the stock. The street high price target comes at C$18.50, representing an upside of 65%.

In BMO Capital Market’s note on the results, they reiterate their market perform rating and C$15 12-month price target, saying that the second quarter results came in line with expectations.

On the results, box office revenues, which came in at $136 million, were slightly below the consensus estimate of $141 million. BMO says that though the company did not beat estimates, Cineplex saw a more “normalized operation environment” while benefitting from the release of some very popular titles. This also helped to boost attendance.

Theatre food, Media, and Amusement revenues are all generally aligned with the consensus estimates. The company saw its food revenues go to $98 million, media revenues at $26 million, and amusement at $66 million.

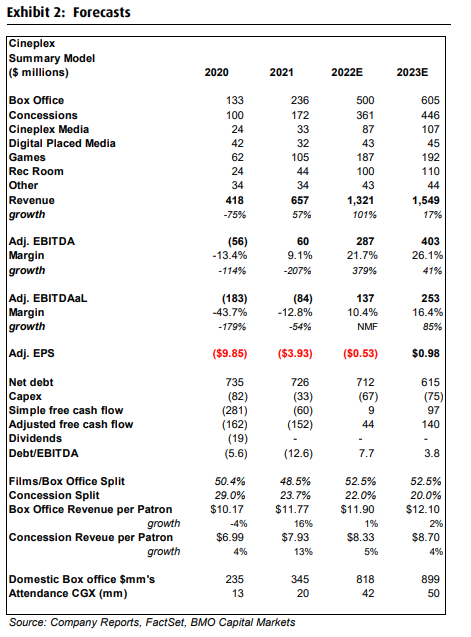

As a result of the company’s earnings, BMO has changed its estimates to reflect “a softer box office in Q3” due to some film delays. While they expect that the fourth quarter and 2023 will see a strong recovery, growing revenues to “roughly 85% of performance in 2019.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.