On May 13, Cineplex Inc. (TSX: CGX) reported its first quarter financial results. The company announced revenues of $228.7 million, up 452% from its 2021 pandemic results. The company saw its net loss get cut in half year over year, going from $89.7 million in 2021 to $42.2 million in 2022. Additionally, the company reported a positive adjusted EBITDA of $36.5 million.

Cineplex reported box office revenues of $79.95 million, while foodservice revenues grew to $68.34 million. Amusement revenues grew to $50.4 million for the quarter and all other revenues came in at $14.4 million for the quarter.

The company reported 6.7 million people attended their theatres this quarter, compared to the 0.4 million last year. This means that the box office revenue per patron grew from $9.20 last year to $12.00 this year. This was similar to its concession revenues per patron, which grew 44% year over year to $8.82.

Cineplex currently has 6 analysts covering the stock with an average 12-month price target of C$17.75, or an upside of 43%. Out of the 6 analysts, 1 has a strong buy rating, 3 analysts have buy ratings and the last 2 analysts have hold ratings.

In Canaccord Genuity’s note on the results, they reiterate their speculative buy rating and increase their 12-month price target from C$17 to C$18, saying that the box office outlook continues to improve.

Canaccord says that Cineplex box office results came in slightly below their estimates while total revenues beat their estimates. Cineplex’s revenue of $228.7 million beat their estimate of $194.9 million, the beat was primarily driven by “a robust performance in LBE and P1AG.” Though the company’s adjusted EBITDA was ($5.7) million compared to the ($1) million estimate, which was impacted by additional COVID lockdowns around the world.

On box office revenues, which came in below their $85.9 million estimates, about 51% of pre-pandemic revenues, they say that the ongoing recovery “was impacted by the lockdowns imposed in the latter half of December.” While Canaccord says that attendance and BPP came in roughly in line with their estimates while BPP was a first-quarter record.

Lastly, on the results Canaccord says that there were a few notable things. First was that P1AG continued to show strong growth as it was at 73% of 2019 levels while the company benefitted from reopening locations and prudent cost management. While the company’s media revenues came in below their $18.1 million estimates.

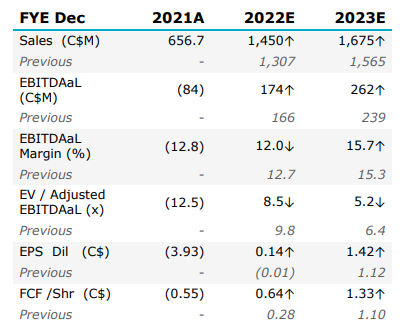

Below you can see Canaccord’s updated estimates on Cineplex.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.