On Monday CloudMD Software & Services Inc. (TSXV: DOC) reported its fourth quarter results for the period ended December 31, 2021. The company reported revenues of $38.7 million, down sequentially. The company attributes this decline to the completion of its COVID testing contracts. Gross margins also contracted, dropping to 30% from 34% last quarter and 40.4% last year.

The company reported adjusted EBITDA of $0.6 million, slightly below the $0.8 million figure posted last year, and earnings per share of $0.06, or net income of $15.1 million. The firm ended the year with $45.1 million in cash on hand.

CloudMD currently has 7 analysts covering the stock with an average 12-month price target of C$2.41, or an upside of 375%. Out of the 7 analysts, 2 have strong buy ratings and the other 5 analysts have buy ratings. The street high sits at C$5, which represents an upside of 880% to the current price.

In Canaccord Genuity’s note on the results, the firm reiterates its speculative buy rating but slashed its 12-month price target from C$3.00 to C$1.50. Canaccord comments that they continue to look ahead for profitability, which will help the company de-risk from being a growth company as Canaccord believes the market is currently favoring profitability over growth.

On the results, Canaccord says that the company beat slightly on revenues as their estimate was $37.3 million, while the company missed on their $1.2 million adjusted EBITDA estimate. They also note that the company’s free cash flow was impacted by a one-time M&A deal and accounts receivable issues. The company saw a $3.4 million charge related to these issues.

Additionally, Canaccord says that going forward they expect the MindBeacon acquisition growth will overshadow any organic growth. While they believe that the latest management musical chairs adds another element of risk to the company.

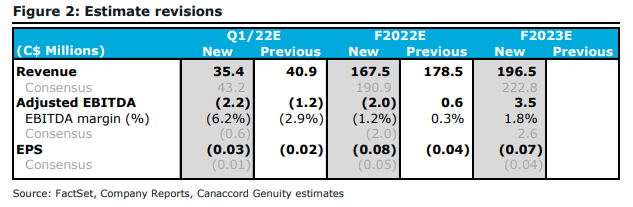

Lastly, Canaccord has cut their estimates going forward as they factor in lost US revenue from the VisionPros business and higher employee costs.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.