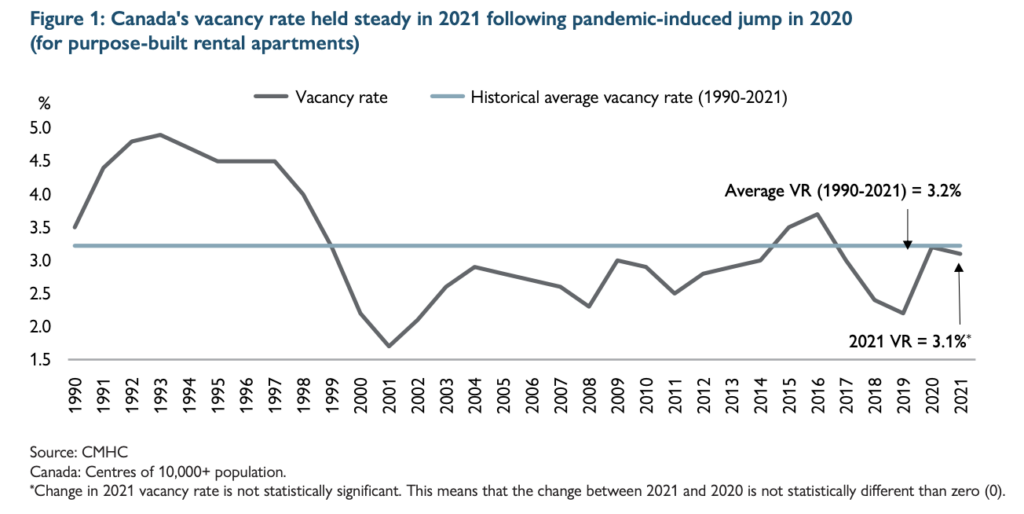

Canada’s rental market continued to recover throughout 2021, as economic conditions improved and strong vaccination rates bolstered a partial rebound in net migration in the latter half of the year. With that, however, rental affordability is becoming a growing concern, as an increasing number of households are forced to work more hours to maintain monthly rent payments at 30% of their income.

According to latest data from the Canada Mortgage and Housing Corporation (CMHC), the average national vacancy rate fell slightly from 3.2% in 2020 to 3.1% last year, to stand above the pre-pandemic level of 2.2% and closer in line with the long-run average. Vacancy rates slumped across 21 of the 37 centers across Canada, including Halifax, Vancouver, Victoria, and Calgary, and increased across 3 markets, most notably Toronto.

The lifting of Covid-19 related pandemic restrictions, coupled with strong vaccination rates, helped revive demand across Canada’s rental housing market throughout 2021. As such, the national average rent for a two-bedroom unit rose to $1,167, with Vancouver and Toronto markets registering the highest rental rates in the country, at $1,824 and $1,679, respectively.

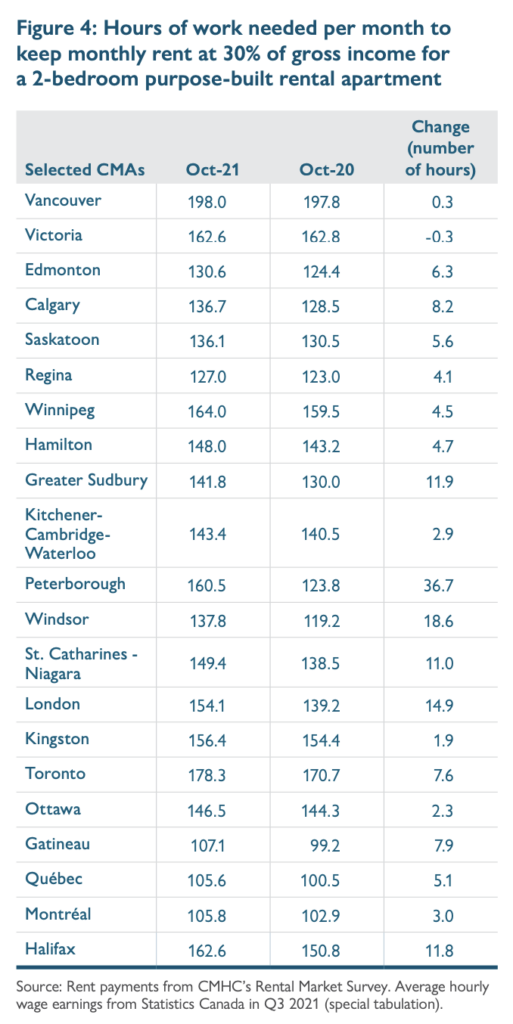

The CMHC noted that although there was a modest increase in housing supply last year, coupled with a stable vacancy rate, rental affordability continues to be a significant issue across Canada. Most CMAs across the country reported a shortage of affordable housing for Canadians in the bottom income quintiles, as households were forced to spend more than 30% of their gross monthly income on rent.

With full-time employment being defined as 150 hours per month, single average wage earners in 8 of the 21 CMAs across Canada were not able to afford rent without the help of an additional source of income, with Vancouver and Toronto reporting some of the highest level of unaffordable units for Canadians.

Information for this briefing was found via the CMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.