The enormous economic and political ramifications of a potential Russia invasion of Ukraine seem to grow each day. Clearly, European natural gas prices could explode if Russia chose to interrupt supplies to “punish” the continent for supporting Ukraine. Russia’s exports account for around 40% of the natural gas consumed by European nations.

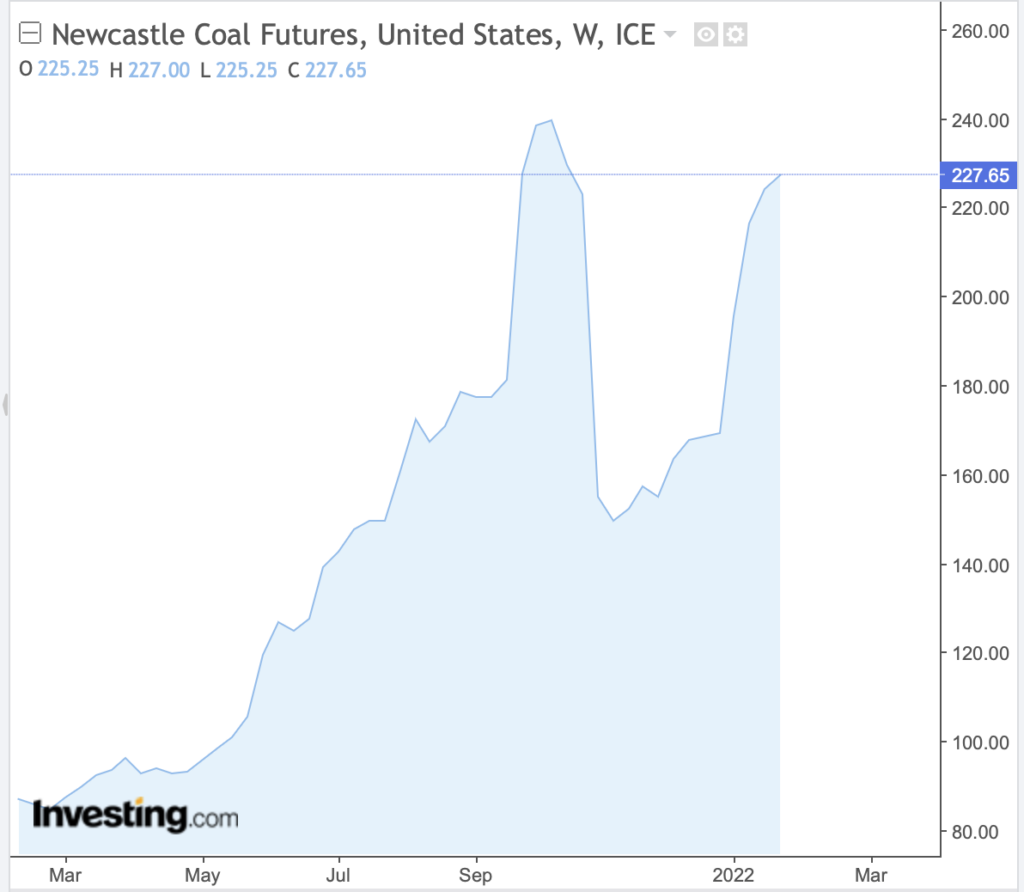

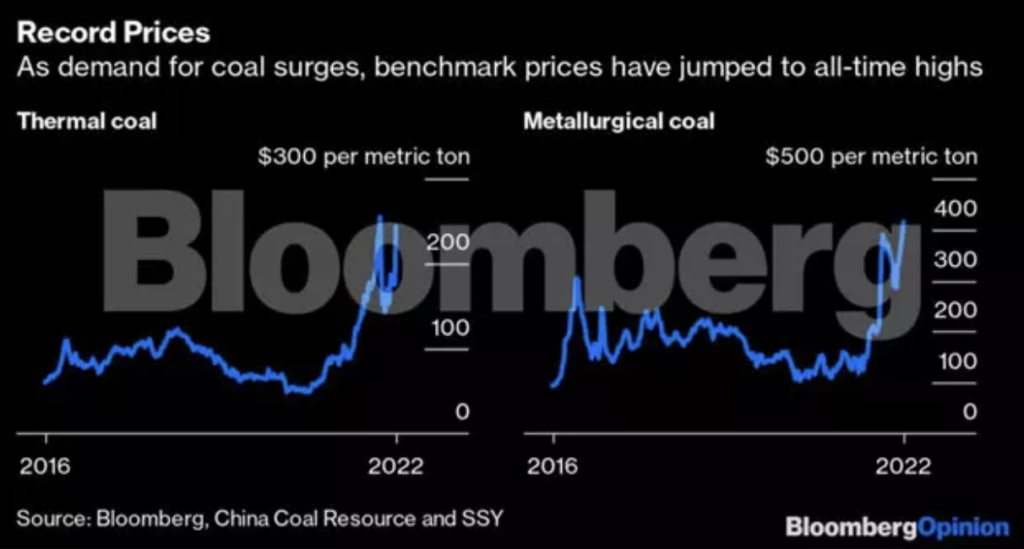

Now, coal prices are soaring as well, as European utility buyers are turning to this dirtier alternative fuel as a fallback strategy. Prices have rebounded to near the all-time high levels of the early fall of 2021. Indonesia’s decision to ban all coal exports in January 2022 during the peak winter demand season, after its state-owned power company reported critically low stocks at its power plants, has also contributed to the commodity’s upward price movement.

Indeed, according to Reuters, transactions on the coal marketplace Coalshastra indicate that most coal spot cargoes are headed toward Europe. There, coal exporters are receiving premium prices. Data from commodity analytics firm Kpler seems to confirm this trend: Europe is expected to import about 5.6 million tonnes of coal in January 2022, its highest total since November 2019, and more than one million tonnes above its 2021 monthly average.

Liquefied natural gas (LNG) prices on a global basis are also being lifted by fears of Russian natural gas supply disruptions to Europe. On January 28, 2022, March 2022 LNG prices for delivery to northeast Asia reached US$27 per million BTUs, up 17% in just a week (also according to Reuters).

In turn, Japanese utilities, which are major LNG consumers, have decided to import more than 17 million tons of coal in January 2022, the most they have purchased since December 2019 and 5% above the seasonal average. The reason: even at now-higher coal prices, coal is cheaper than spot LNG.

According to The Economic Times, benchmark thermal coal prices in Asia reached US$244 per tonne in late January 2022, the second highest level ever. Metallurgical, or steelmaking coal, is likewise trading at or near record levels, about US$400 per tonne.

One way that investors can participate in both the thermal and metallurgical export coal sectors is through CONSOL Energy Inc. (NYSE: CEIX). CONSOL produces both thermal and metallurgical coal in the U.S.’s Northern Appalachian Basin. Making use of an export terminal it owns in Baltimore, Maryland, CONSOL exports both types of coal to foreign markets.

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.