Few companies are fighting wars, particularly existential wars, on as many fronts as Coinbase Global, Inc. (NASDAQ: COIN). The most recent relates to the startup of a new crypto exchange, called EDX Markets, backed by the giant investment firms Citadel Securities, Fidelity Investments and The Charles Schwab Corporation (NYSE: SCHW).

EDX Markets is a noncustodial exchange; it does not require customers to store digital assets in wallets run by the exchange, as Coinbase does and FTX did. Instead, EDX Markets is simply a platform (or marketplace) on which investment firms and individuals execute trades involving digital currencies and dollars at mutually agreed-upon prices.

READ: BlackRock Files For First Spot Bitcoin ETF With Coinbase As Custodian

Later in 2023, EDX plans to launch a clearinghouse that would settle trades, but even in this case, third-party banks and a crypto custodian will hold all customer assets, not the clearinghouse.

Separating the roles of the crypto exchange and crypto custodian is one of the key goals and safeguards of SEC Chairman Gary Gensler. Simply put, such a clear demarcation removes the potential conflicts of interest (and the chances for mischief in FTX’s case) entailed when the same entity serves as an exchange and as a custodian of funds.

No aspect of a firm with EDX Markets’ pedigree or operating plan entering the crypto exchange space can be considered good news for Coinbase. Current and prospective Coinbase customers will doubtless consider whether EDX Markets might be a better, less risky place to transact digital currencies.

Separately, but clearly related, the SEC charged Coinbase on June 6 with operating its crypto trading platform as an unregistered national securities exchange. For good measure, the SEC also alleges that since 2019 the company has engaged in unregistered securities offerings through its crypto assets staking-as-a-service program.

Somewhat surprisingly, Coinbase stock is nearly flat since the SEC filed formal charges against the company, although its underperformance is more pronounced when compared against the NASDAQ’s 3% rise over the same period.

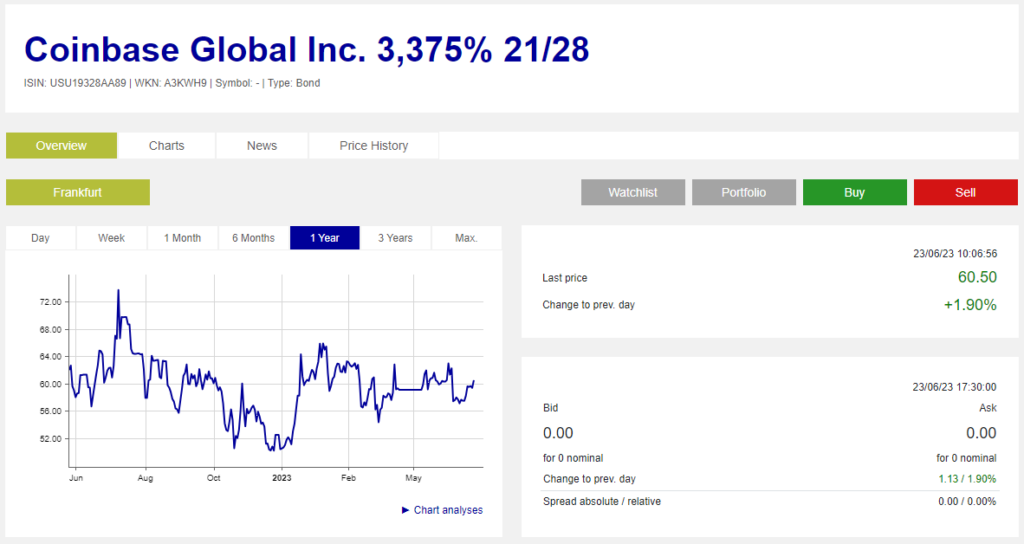

Coinbase’s 3.375% bond which matures in 2028 is probably pricing in more risk than Coinbase’s stock. The bond last traded well below par at 60.50, equivalent to a 14.81% yield, more than an 1,100-basis point premium to the comparable U.S. Treasury yield.

Coinbase Global, Inc. last traded at US$61.47 on the NASDAQ.

Information for this briefing was found via the Financial Times and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.