On November 12th, Columbia Care (NEO: CCHW) reported its third quarter financial results. The company reported revenues of $132.32 million, a 21% increase sequentially and a 144% year over year. Gross profits came in at $63 million, while adjusted EBITDA was $31 million for the quarter, up 89% sequentially.

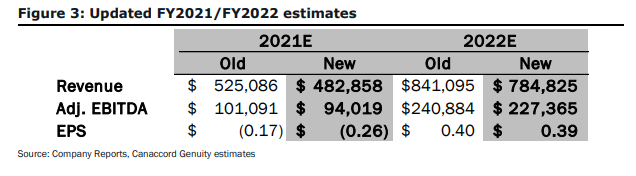

Additionally, the company has revised its 2021 guidance downwards. They now expect 2021 full-year revenues to be between $470 and $485 million, down from $500 to $530 million. Adjusted gross margins are expected to be 46%+, down from 47%+, and adjusted EBITDA is now expected to be between $85 and $95 million, down from $95 to $105 million.

Columbia Care currently has 12 analysts covering the stock with an average 12-month price target of C$14.06, or a 230% upside to the current stock price. Out of the 12 analysts, 5 have strong buy ratings, 6 have buy ratings and 1 analyst has a hold rating on the name. The street high sits at C$19 from PI Financial while the lowest comes in at C$11.50.

In Canaccord’s third quarter review they reiterate their buy rating, but lower their 12-month price target to C$13 from C$15 and say that sector headwinds continue to lead to a top-line miss.

For the results, Columbia Care came up short, missing all of Canaccord’s estimates. Canaccord estimated that revenue for the quarter would be $148.6 million and gross margins would be $71.33 million. They write, “overall revenue progression for the period was negatively impacted by moderate macro-level headwinds in some of the company’s higher contribution markets.”

They say that management noted that three out of five of their top states had “headwinds,” with California’s total revenue being down 10% sequentially. In Colorado, they had a lower average daily spend at its retail dispensaries, and in Pennsylvania they saw lower wholesale pricing.

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.