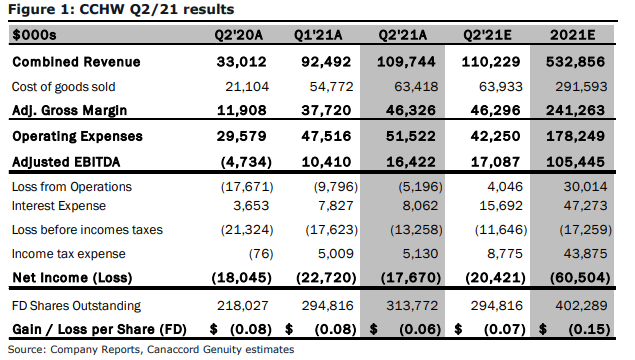

On August 12, Columbia Care Inc. (CSE: CCHW) reported its second-quarter financial results, wherein the company announced record revenues of $109.7 million, up 19% sequentially, with a gross margin of 43%. Gross profits rose 23.6% to $43.3 million, while Adjusted EBITDA came in at $16.4%, up 58% sequentially, and an EBITDA margin of 15%. The company reaffirmed its full year 2021 guidance of $500-$530 million in revenue and an Adjusted EBITDA of $95-$105 million.

Analysts made a few changes to their 12-month price target, raising the average consensus to $14.70 from $13.77 before the earnings. Columbia Care has 12 analysts covering the stock with 4 having strong buy ratings, 7 have buy ratings and a single analyst has a hold rating. The street high sits at $19 while the lowest comes in at $12.

Canaccord reiterated their buy rating and $15 price target on Columbia Care, saying that the company reported solid top-line growth and the company remains its top pick in their cannabis coverage.

Columbia Care generally came in line with Canaccord estimates, barely missing their revenue and Adjusted EBITDA expectations. Canaccord says that the revenue growth was boosted by a partial inclusion of Greem Leaf Medical. While Columbia Care reported California, Colorado, Massachusetts, Ohio, and Pennsylvania as its top 5 markets, Canaccord says its other operations in the states of Flordia, Arizona (+23), New Jersey (+20%), and Illinois (+15%) saw great growth.

Columbia Care saw its dispensary count increase to 77 retail locations with further locations in various stages of completion. The company also is adding to its Colorado exposure by acquiring Medicine Man for $42 million.

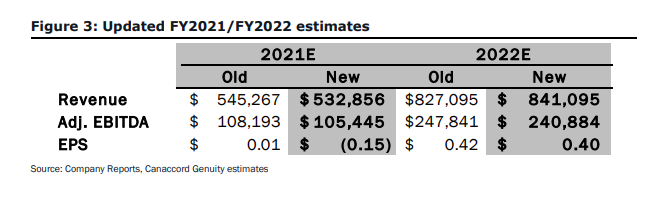

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.