Noram Ventures Inc. (TSXV: NRM) is a Vancouver B.C. based exploration company actively developing its Zeus Lithium property in Nevada’s Clayton Valley. Advancements in lithium ion battery technologies for use in electric vehicles has spurred a sharp increase in demand for lithium.

Clayton Valley hosts the only producing lithium brine basin in North America. Near to Noram’s Zeus property is Albemarle Corporation (NYSE: ALB), the largest provider of lithium for electric vehicle batteries, who’s Silver Peak lithium operation has been in production in this basin since 1967. Tesla Motors is also in the process of building its lithium ion battery Gigafactory 225 km from Clayton Valley.

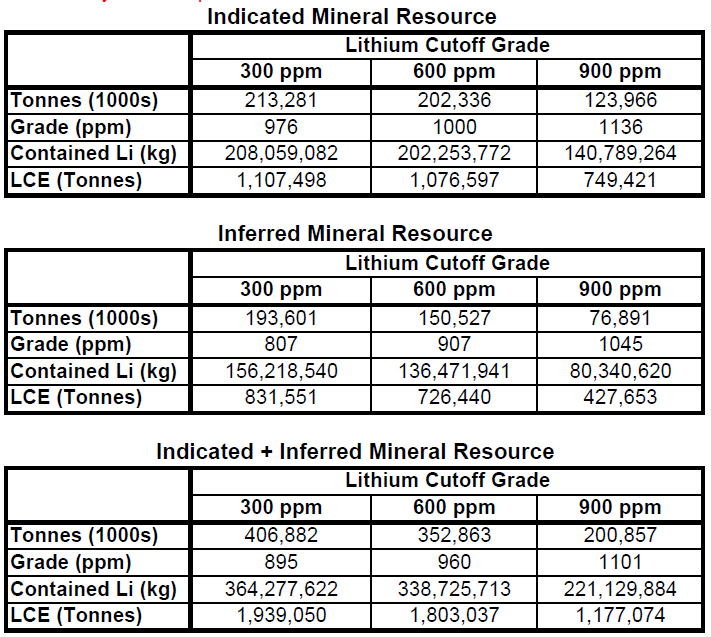

What makes Noram interesting is that its flagship Zeus lithium project is located within 1.6 km of Albemarle’s Silver Peak operations. Drilling has revealed claystone intersections hosting green-blue claystones that can often contain high lithium grades. After completing the first four phases of its drilling programs, the company’s current resource estimate shows an indicated resource of 124 million tonnes at 1136 ppm lithium and an inferred resource of 77 million tonnes at 1045 ppm lithium, using a cut-off grade of 900 ppm lithium.

The Investment Thesis

We base our investment thesis on the following factors:

- Noram’s flagship Zeus lithium project is located within 1.6 km of Albemarle’s Silver Peak operations, North America’s only producing lithium brine basin. The Silver Peak Mine has operated continually since 1967.

- Current resource estimate shows an indicated resource of 124 million tonnes at 1136 ppm lithium and an inferred resource of 77 million tonnes at 1045 ppm lithium.

- The demand for lithium is expected to rise as a result of the growing interest in electric vehicles.

- Nevada is a very mining friendly jurisdiction.

- The company has an excellent, experienced management team with extensive mining and public company experience.

- The area has very well established infrastructure to support all aspects of large-scale operations.

The current global macro environment provides a bullish catalyst for the demand for lithium for use in lithium Iin batteries for the electric vehicle (EV) industry. According to Bloomberg’s 2020 New Energy Finance study, it is expected that electric vehicles will account for 10% of global passenger vehicle sales by 2025 and 58% by 2040.

China has the largest share of the global electric vehicle market and the Chinese government is aggressively promoting the shift to EVs to reduce its dependence on energy imports and to reduce its air pollution. European countries are also actively promoting a move away from gasoline-powered vehicles as the continent continues its shift to renewable energy technologies to meet carbon emission standards and achieve carbon neutrality by 2050.

We expect the lithium market to grow significantly due to continuing growth of the electric vehicle market caused by a global shift to renewable energy sources, and continued improvement in battery technologies.

The Zeus Lithium Claystone Project

The Zeus property is located in the Clayton Valley of Nevada, approximately halfway between Las Vegas and Reno; and within 1.6 kms of Albemarle Corporation’s Silver Peak Mine lithium brine producing operations. The 1214 hectare property consists of 150 placer claims and 140 lode claims.

To date, the company has completed four phases of drilling on the property, while the fifth phase is currently well underway. After completing the first four phases of its drilling programs, the Company’s current resource estimate shows an indicated resource of 124 million tonnes at 1136 ppm lithium and an inferred resource of 77 million tonnes at 1045 ppm lithium, using a cut-off grade of 900 ppm lithium. Overall, this equates to a total of 1.18 million tonnes of lithium carbonate equivalent.

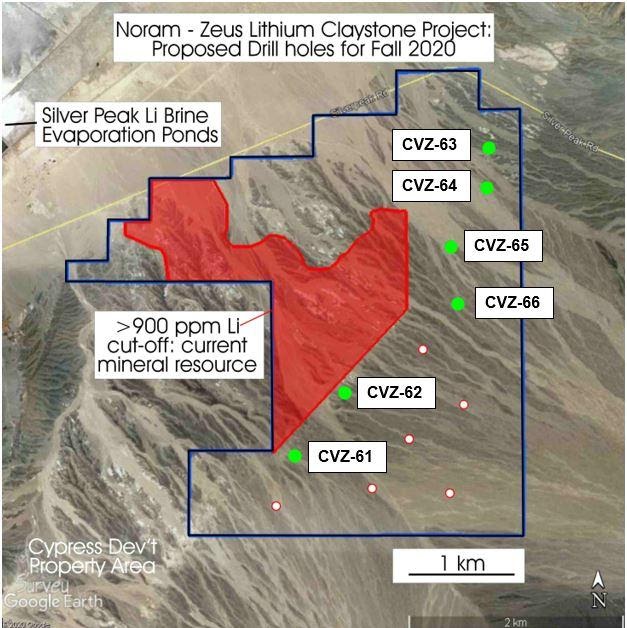

The 2020/2021 Phase V drill program meanwhile has been focused on the east and south portions of the property, with a plan to drill a total of 12 holes at a depth of 120 metres for a total of 1440 metres, with a goal of expanding the resource estimate. Drilling has revealed claystone intersections hosting green-blue claystones that can often contain high lithium grades. The company plans to complete a preliminary economic assessment (PEA) of the project later in 2021. This will increase the credibility of the project and could catch the attention of other industry participants who are looking to acquire an asset with significant potential.

Recent intersections reported from the program include:

- CVZ-61: 79 metres of 1130 ppm lithium

- CVZ-62: 27 metres of 1059 ppm lithium from the upper half of assays, while the lower half remains pending

- CVZ-63: 116 metres of claystones, assays pending

- CVZ-64: 73 metres of claystones, assays pending

- CVZ-65: 55 metres of claystones, assays pending

- CVZ-66: 91 metres of claystones, assays pending

The Geology

Clayton Valley and other major lithium sources are often found in brines, which are simply hyper-salty groundwater collected in aquifers within closed basins formed by non-marine sediments. The brines are mined by drilling holes into the aquifers and pumping out the brine to the surface and then extracting the lithium. Clayton Valley is a closed basin that is tectonically active and covers approximately 100 square kilometres and a drainage catchment area of roughly 1400 square kilometres. The region was subject to intense past volcanic activity which over time created structures that trapped the brines.

Brines are pumped up from deep aquifers within the basement and processed through a combination of evaporation and chemical leaching, a process that was developed by Albemarle in the 1960’s. The mining process pumps lithium rich brines to the surface where they are evaporated and concentrated in ponds, and then the concentrated material is processed in a chemical plant that produces the lithium carbonate and other lithium byproducts.

Lithium production is essentially an industrial chemical operation. Commercial lithium production is subject to advanced chemistry to separate the minerals. Exploration companies typically test the brines as they are extracted to determine the lithium content of the brines as measured in parts per million. The chemical composition and volume of brine will ultimately help determine the future economic potential of any given deposit. Companies will conduct a variety of tests to determine which methods will produce the greatest recoveries.

The Management

C. Tucker Barrie Ph.D., Ph.D, Geo – President and CEO

Mr. Barrie has over 25 years of experience as an Economic Geologist on five continents, including detailed studies of lithium brines and clays in North America. He holds a Ph.D. in Economic Geology and Geochemistry from the University of Toronto and a M.Sc. in Economic Geology from the University of Texas. Mr. Barrie has authored numerous publications and worked with a wide variety of companies including Barrick Gold, BHP Billiton, Cameco, Kinross Gold, Noranda, Placer Dome, Rio Tinto, Teck Resources and The World Bank, to name but a few.

Anita Algie – CFO and Director

Ms. Algie holds an Honours B.Sc. in Human Physiology from the University of British Columbia and has subsequently accumulated over 17 years of experience in management of resource-based public companies, having formerly served as President & CEO of American Lithium Corp. (LI-TSXV) and a number of other exploration companies. She has served on numerous boards during her career in the public markets and specializes in sourcing, acquiring and developing non-grass roots properties. listings, compliance, corporate structure and

Cyrus Driver – Director

Mr. Driver is a chartered accountant and a founding partner of Driver Anderson since its inception in 1981. He provides his services to TSX Venture Exchange-listed companies and members of the brokerage community, as well as serving on the boards of several listed companies. His knowledge of the securities industry with respect to rules and regulations on finance, taxation and other accounting related matters is invaluable to Starr Peak..

Mark Ireton – Director

Mr. Ireton, a former banker, has over 30 years of experience in all areas of commercial mid-market lending and is well-versed in both public and private transactions, reorganizations, acquisitions—both management buyouts and leveraged buyouts—and divestitures in a variety of sectors that include wholesale distribution, manufacturing, aviation, transportation, construction, excavation, post production and oil service.

Arthur Brown – Director

Mr.Brown has served on the boards of eight other companies in sectors ranging from technology to oil and gas and mineral exploration. Mr. Brown has substantial knowledge and experience in corporate structure and development, financings and venture capital, bringing 36 years of business experience to Noram’s board.

Brad Peek, CPG – Senior Consultant Geologist

Mr. Peek, a Certified Professional Geologist, has more than 40 years’ experience in project management, mineral exploration and in computer applications used in mineral exploration and mining. He brings eleven years’of experience with a water engineering consultancy firm, and is a member of the Society of Economic Geologists, the Society of Mining, Metallurgy and Exploration, and of the AIME American Institute of Professional Geologists.

The Comparables

While there is only one producing lithium operation currently in North America, there are a handful of other junior explorers in the region that are currently focused on developing similar projects. Here’s a quick summary of the comparables to Noram, and where they stand with their projects.

Cypress Development Corp. (TSXV:CYP) is actively developing it’s Clayton Valley Lithium Project which is located adjacent to the west of Albemarle’s Silver Peak Mine between and Noram’s Zeus property. The 100% owned property consists of 5,430 acres, and Cypress discovered a large lithium-bearing claystone next to the brine field and lithium mineralization within the clays occurs to a depth of at least 150 metres. A May 2020 prefeasibility study established a mineral resource estimate of measured and indicated mineral resources of 929.6 million tonnes averaging 1,062 ppm Lithium based on a cut-off grade of 900 ppm Lithium. The company has been conducting metallurgical studies using leaching with low acid consumption and have seen recoveries of over 85% lithium.

Pure Energy Minerals Limited (TSX-V: PE) is developing its Clayton Valley Project, a 9,450 hectare acre property consisting of 958 claims, which is the largest land position in the area. It borders on three sides of the Silver Peak Mine. The company released a PEA in 2017 and is working with it’s strategic partner, Schlumberger Technologies Corporation, to develop a pilot processing plant.

Sienna Resources (TSX-V:SIE) has had the Clayton Valley Deep Basin Lithium Brine Project since 2016 but has not done much with it to date. The project is located inside of and surrounded by Pure Energy Minerals’ property. On January 19, 2021, the Company announced that they are re-visiting its Nevada project due to the progress of other companies in the area and a stronger market for lithium and lithium prices.

The Risks

As with any investment, a number of risks are present that investors should be aware of. These include:

- Lithium Production Is Still Years Away. While lithium resource estimates have been improving through further proving out the resource, the company is notably some distance away from the achieving production, and thereby revenue generation.

- Lithium markets could decline. One important aspect behind the Noram thesis is that there is to be a rising demand for lithium with the advent of electric vehicles. However, if this is delayed or new battery tech developed, the lithium markets could in theory drop to lower levels.

- Noram will likely require further cash. If the current and potentially future drilling programs are successful, Noram could have to raise equity to fund further exploration activities.

For a full list of risks, we encourage readers to look at the company’s risk section of their most recent MD&A on Sedar.

Potential Catalysts

Some potential catalysts that could have a significant impact on Spruce Ridge’s share price include:

- Drilling results from the ongoing program. Noram Ventures has had an ongoing drill program for the last couple months. Further results could potentially lead to further confidence in the development of the property, thereby impacting share price.

- Junior miner consolidation activity. Consolidation is a large aspect of the junior mining space. Upon further proving out the Zeus property, the company could become an ideal acquisition target for its neighbors, or another firm looking to acquire lithium assets.

- Upgraded mineral resource. Noram currently expects to upgrade its mineral resource estimate for the Zeus property following the conclusion of the current drill program. A potentially expanded resource estimate could have a positive impact on the firms valuation.

In Conclusion

At the Deep Dive, we like the macro prospects for lithium and the underlying fundamentals that would suggest we are in the midst of a rapidly growing bull market for lithium. We especially like projects in safe jurisdictions that are located close to existing producing mines or significant discoveries.

The electric vehicle market is growing rapidly and is the key driver for the surge in demand for lithium as advances in lithium ion battery technologies are making EVs more economical for buyers, and countries around the world are establishing policies for curbing air pollution and carbon emissions that promote a macro shift to renewable energy sources and a move away from gasoline-powered vehicles. Many auto manufacturers have shifted to EVs and have announced plans to eliminate gasoline powered vehicles over the next few decades.

Traditional commodities such as gold, silver and copper are often dependent on the economic cycle, and in the past decade there was strong demand from China, which imports much of their copper to fuel their economy and is a major buyer of gold and silver for consumer jewelry as well as for use in technology components.

Noram Ventures is an early-stage exploration company with an exciting project in the prolific Clayton Valley lithium brine basin in mining-friendly Nevada. The Company is currently drilling and conducting work programs on their Zeus Project to further delineate the size and scope of the lithium zones and further build upon their progressive drilling data. Noram has compiled an impressive, increasingly larger resource estimate, and is planning to complete a Preliminary Economic Assessment (PEA) of the project in 2021.

With 58.05 million shares outstanding and a modest market capitalization of $52.24 million, NRM appears to offer a reasonably low-to-moderate risk play on a potentially dynamic property. NRM has a very experienced management team and advisors, and therefore can focus on efficiently developing the Zeus project to a level where it could be a potentially attractive acquisition target for Albemarle or another established lithium producer looking to establish a solid footing in Clayton Valley.

FULL DISCLOSURE: Noram Ventures is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Noram Ventures on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.