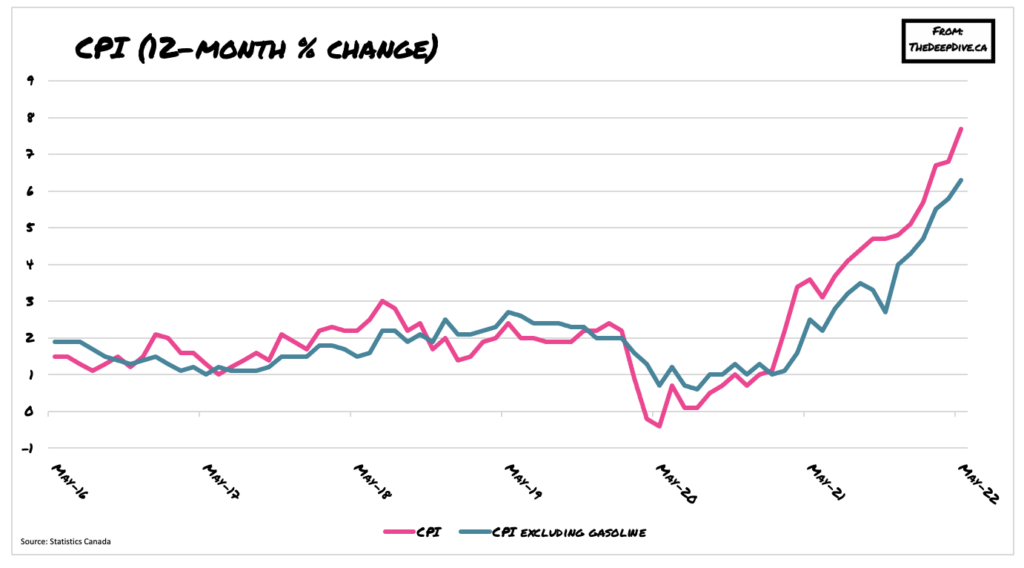

Canadians continue to feel the pain of the eye-watering surge in consumer prices, as May’s CPI reading hit a staggering 7.7%— the sharpest annual gain since January 1983.

Latest data from Statistics Canada showed that prices continued to rise across the country despite the central bank’s hawkish efforts to tighten ultra-accommodative monetary policies. Following a gain of 6.8% in April, annual inflation hit 7.7%, while core CPI— which does not account for gasoline prices, rose 6.3% year-over-year.

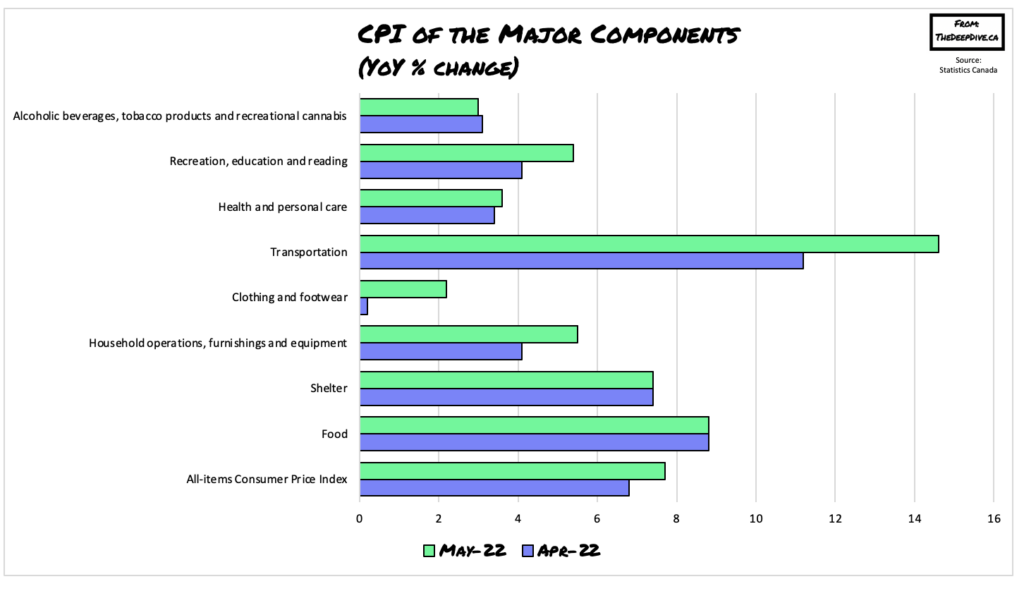

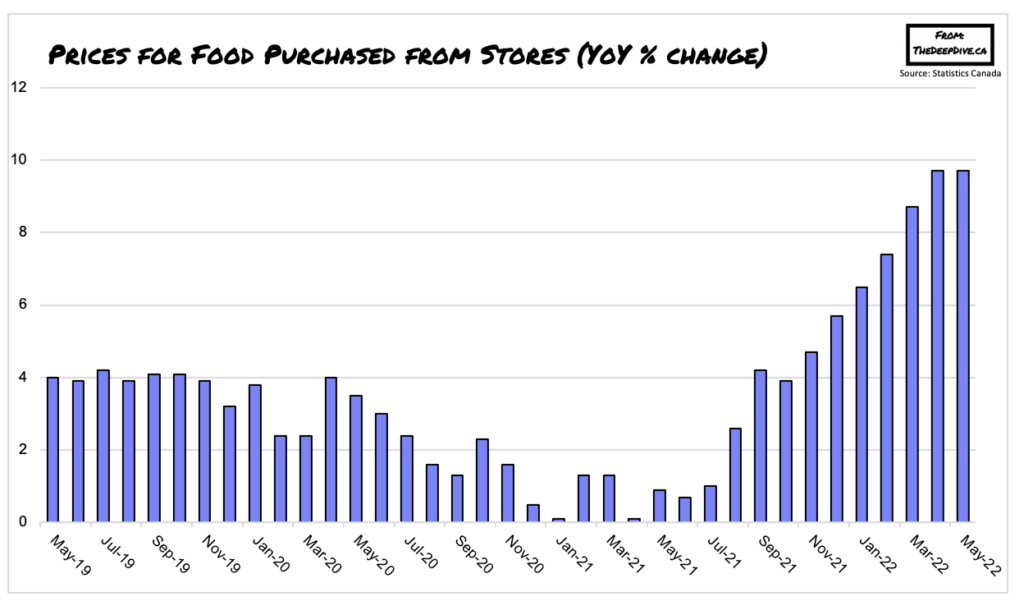

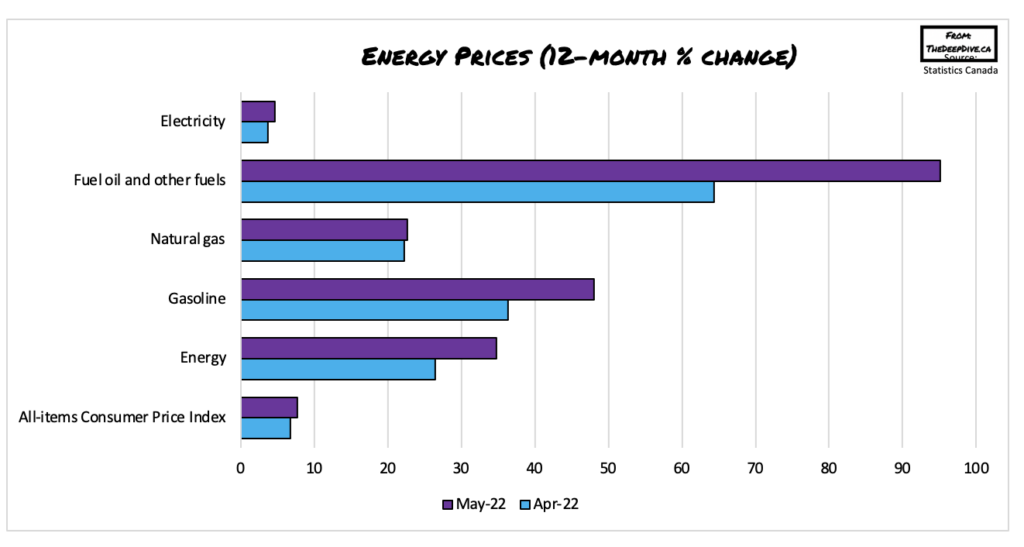

Last month’s painful increase in consumer prices was broad-based across nearly all categories, particularly for food, shelter, and of course gasoline. Indeed, grocery prices across Canada remained substantially elevated, soaring 9.7%, as surging transportation and input costs continue to expel upward pressure. Shelter costs jumped 7.4% in May, while energy prices exploded 34.8% year-over-year.

Between April and May, gasoline prices rose 12%, forcing Canadian consumers to pay a staggering 48% more to fill up their vehicles compared to the same month a year prior. The increase largely stems from global supply uncertainty and the ongoing conflict in Ukraine, which sent the price of fuel oil and other fuels up 95.1% since May 2021.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.