Aside from NVIDIA Corporation’s (NASDAQ: NVDA) graphics processing unit (GPU) chips used for generative AI applications, few global commodities seem to be experiencing strong levels of demand. Copper, which is widely used in many types of electrical equipment including EV’s and is considered a reliable predictor of overall economic health, is one of those commodities displaying weak pricing trends.

Copper has declined 13% over the last six weeks to US$3.65 per pound; bringing the price of the reddish-orange metal back to early 2021 levels. Notably weaker than expected demand in China, particularly during April 2023, has been the principal cause of the falling price trajectory. China’s economy simply has not recovered as rapidly as projected after it ended its zero-COVID policy around the start of 2023. Indeed, smelting plants in China have reportedly been exporting copper to other countries.

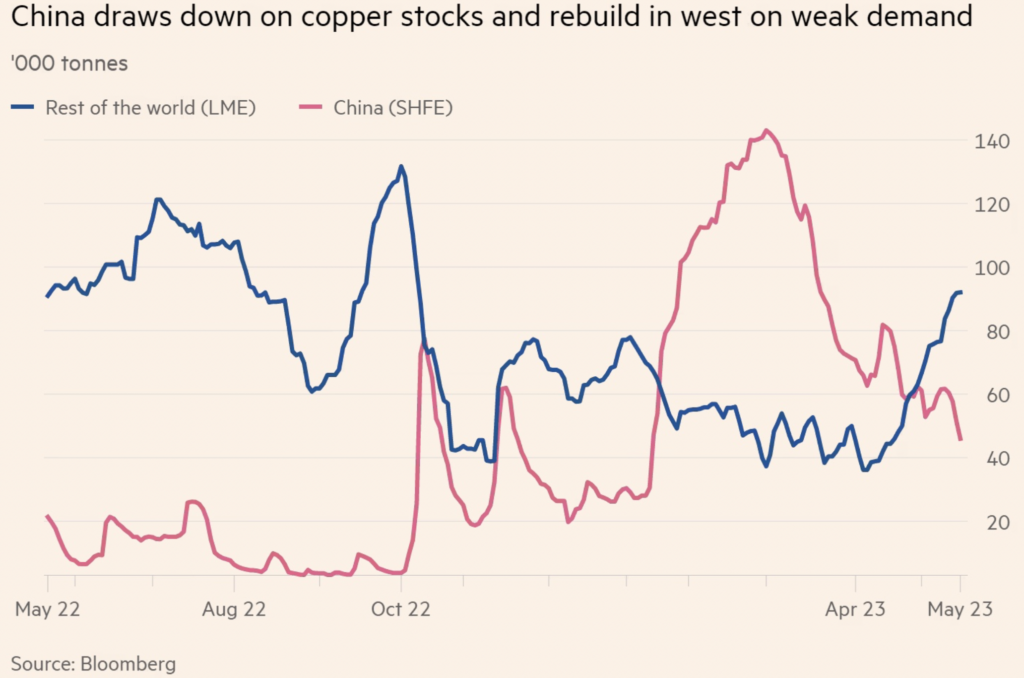

Phrased another way, China is drawing down its copper inventories, and China’s exports to the rest of the world are causing inventories to build in the West, most notably in London Metal Exchange (LME) warehouses.

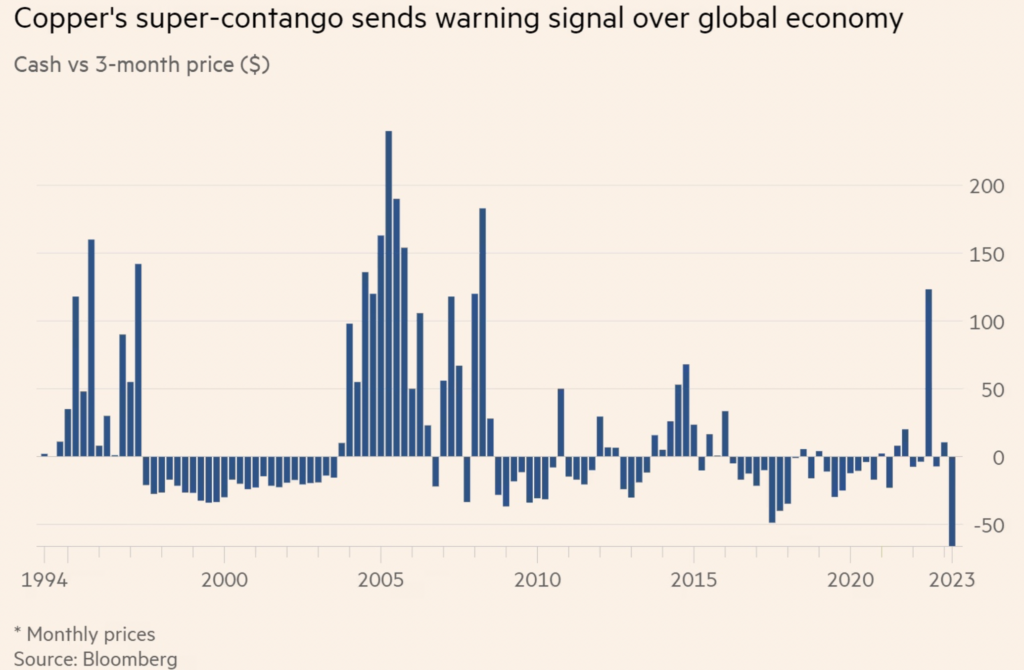

The enormous difference between the current price of copper versus its futures price three months from now may best illustrate the weakness in the copper market. This gap — US$66 per ton, equivalent to US$0.033 per pound — is the largest since 1994. Most traders believe the “super-contango” condition reflects concerns that China’s hoped-for industrial rebound is simply not occurring.

Much higher prevailing interest rates this year have also contributed to copper’s trading at such a large discount to future prices. Commodity traders are cautious about holding surplus copper given expensive financing costs, pushing current prices down.

Another proverbial thorn-in-the-side for copper prices is rising global supply. For example, First Quantum Minerals began shipping copper again from its Cobre Panama mine in Panama in March 2023 after resolving a dispute with that country’s government, and China’s CMOC Group is set to begin producing copper in the Democratic Republic of Congo.

Information for this briefing was found via Bloomberg, Trading Economics, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.