Last week, Newmont Corporation (TSX: NGT) announced that it is acquiring GT Gold Corp. (TSXV: GTT) for $3.25 per share in an all-cash transaction. The deal values GT Gold at an enterprise value (EV) of around $414 million and represents a 38% share price premium to GT Gold’s 20-day volume-weighted average price. The Newmont-GT Gold transaction is expected to close in 2Q 2021.

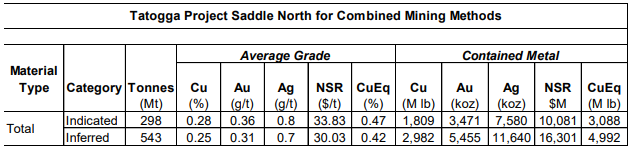

GT Gold’s principal asset is the Saddle North zone located within its 100%-owned, 475 square-kilometer Tatogga Property. Tatogga is located in the northern part of British Columbia’s famous Golden Triangle region. According to an August 2020 study, Saddle North contains 8.08 billion equivalent pounds of copper (3.088 billion pounds and 4.992 billion pounds on indicated and inferred bases, respectively). As a result, GT Gold’s takeover price equates to about $0.052 per equivalent pound of copper resource.

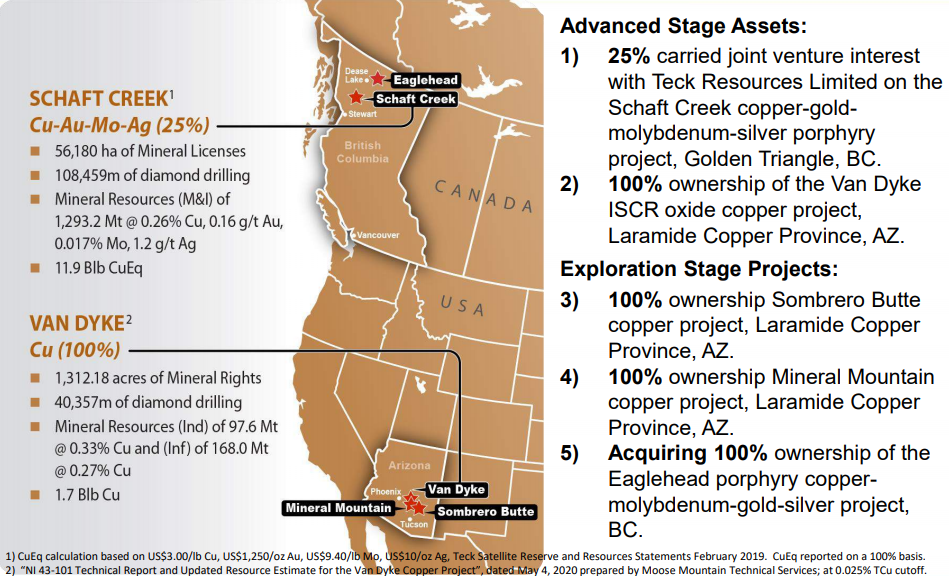

A comparable junior miner to GT Gold is Copper Fox Metals Inc. (TSXV: CUU), another pre-revenue copper developer. Copper Fox owns a 25% stake in the Shaft Creek Project (Teck Resources owns the balance), also located in the northern portion of the Golden Triangle. Shaft Creek has estimated equivalent copper resources of 11.9 billion pounds, making Copper Fox’s resource share around 3.0 billion pounds.

Furthermore, Copper Fox owns 100% of the Van Dyke copper project in the U.S. state of Arizona. Van Dyke’s copper resources are estimated to be 1.7 billion pounds, bringing Copper Fox’s combined total to around 4.7 billion pounds. Copper Fox’s EV is about $182 million, so its EV per pound of copper resource is around $0.039, or approximately a 25% discount to GT Gold’s takeover price. This differential could imply that Copper Fox is trading at a substantial discount to its potential takeover value.

Good Cost Controls

Copper Fox has controlled its costs reasonably well over the last five reported quarters; its operating cash flow deficit averaged about $230,000 per quarter over that period. Copper Fox’s balance sheet is debt free, but it has only around $0.5 million of cash, a fairly low figure for a company with its stock market capitalization.

| (in thousands of Canadian $, except for shares outstanding) | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 | 4Q FY19 |

| Operating Income | ($299) | ($249) | ($376) | ($206) | ($296) |

| Operating Cash Flow | ($108) | ($397) | ($414) | ($96) | ($141) |

| Cash | $492 | $869 | $1,358 | $190 | $375 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Weighted Average Shares Outstanding (Millions) | 498.3 | 490.0 | 462.2 | 461.3 | 461.3 |

Copper prices have increased nearly 90% over the past twelve months, reaching US$4.13 per pound this week. Infrastructure spending has been a priority in China and other countries, as many governments have funded such projects to stimulate their economies after COVID-19-induced slowdowns. If copper prices were to reverse lower, the share prices of Copper Fox and other copper miners could come under pressure.

The takeover price per pound of equivalent copper resource to which GT Gold agreed implies that Copper Fox, a similarly positioned junior copper mine developer, trades at a noticeable discount to that figure. We do emphasize, however, that this calculation is not the only way to value a junior miner; other factors like the quality of its resource or its cost structure are also important. To be clear, Copper Fox management has made no mention of its interest, or lack thereof, in merging with another company.

Copper Fox Metals and GT Gold shares are trading at $0.38 and $3.21, respectively, on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.