Copper prices plunged below the $10,000 per metric ton mark on Tuesday, as traders grappled with a sharp rise in global inventories and softer-than-expected US job openings data, fueling expectations of an imminent interest rate cut by the Federal Reserve.

The red metal’s decline comes amid a surge in stockpiles on the Shanghai Futures Exchange, which have climbed to their highest levels since 2020. Additionally, there has been a steady stream of smaller inflows into Asian depots tracked by the London Metal Exchange over the past few weeks.

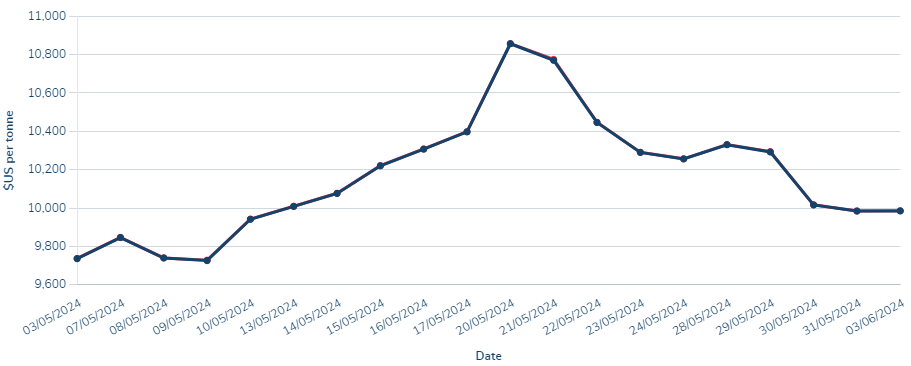

Typically, copper inventories tend to decline during this time of year, making the recent jump in stockpiles even more significant. This unexpected buildup has put significant pressure on prices, which had spiked to a record high above $11,100 per metric ton just last month.

The inventory surge coincides with the release of US job openings data, which came in softer than anticipated, reinforcing bets that the Federal Reserve will be able to cut interest rates this year. The prospect of lower borrowing costs has added to the bearish sentiment surrounding copper, as it could potentially dampen demand from the construction and manufacturing sectors, which are major consumers of the industrial metal.

Copper’s decline has been exacerbated by concerns over the global economic outlook, with fears of a potential recession weighing on industrial demand. However, some analysts remain optimistic about the long-term prospects for the metal, citing the ongoing transition towards renewable energy and electric vehicles, which are expected to drive demand for copper in the coming years.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.