Consumers are seemingly substituting their beef with cheaper options like pork and poultry, even to canned products, leading Costco Wholesale Corporation (NASDAQ: COST) to draw parallels from past recession periods where the phenomenon last took place.

“Historically, like within fresh protein, we’ve always seen when there’s a recession, whether it was ’99 or ’00 or ’08, ’09, ’10, we would see some sales penetration shift from beef to poultry and pork. We have seen some of that now,” said CFO Richard Galanti in the Q3 2023 earnings call.

"Historically…we've always seen, when there's a recession, whether it was '99 or '00 or '09 — '08, '09, '10, we would see — some sales penetration shift from beef to poultry and pork. We have seen some of that now." – Costco

— zerohedge (@zerohedge) June 1, 2023

The firm reported its third quarter financials last week, headlined by a quarterly revenue of $53.65 billion, up from Q3 2022’s $52.60 billion. However, the retailer also ended with a lower net income of $1.30 billion in the three-month period, compared to $1.35 billion in the comparable period last year.

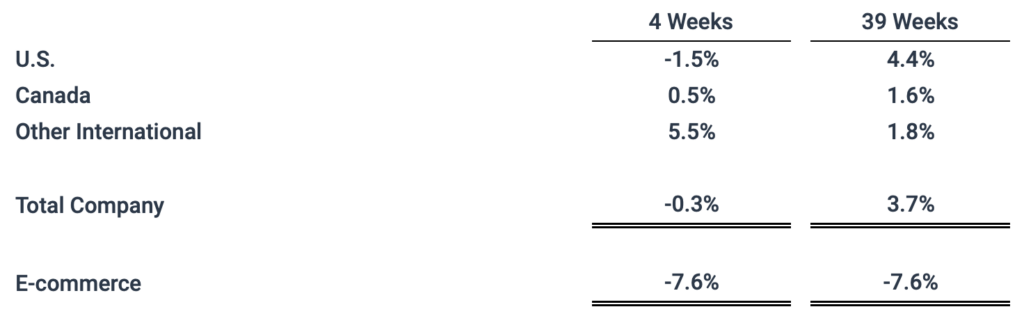

This is followed by the firm’s report on its May sales, recording a fall in comparable-store sales of 0.3% led by a decline of 1.5% in its US market. This compares to April sales which saw a comparable-store sales increase of 1.4%

Revenue for the month ended at $18.45 billion, an increase of 1.2 percent from $18.23 billion last year.

Source: Costco

“I think anecdotally, I heard a few months ago from our Head of Food and Sundries buyer, that we saw some switch even to some canned products, like canned chicken and canned tuna and things like that,” Galanti added.

The chief finance officer also said that a similar move is observed with Costco’s alter ego brand Kirkland Signature, noting that there was a 150 basis point increase in private label sales penetration year-over-year last quarter, which fell to a 120 basis point increase in the recent quarter.

“If you go back over the last 10 years, my guess is that on a year-over-year basis, maybe we’ve gone from, I’m guessing, 22% or 23% to 25% or 26%. So call it, 300 basis points over 10 years or eight years. So 30 to 50 basis points versus 120 and 150 in the last couple of quarters. So yes, that would, again, at least anecdotally, suggest that we’ve seen people looking for better bargains,” he said.

Last week, both Dollar General and Dollar Tree slashed their annual outlook, leading to plunges in their respective shares. The decline is owed to consumers focusing on procuring necessities and less of discretionary items.

Not all retailers are in trouble. Walmart benefits from the shift to food and essentials since it can reach a broad range of customers, and groceries and other non-discretionary products account for roughly half of its revenue. It claims that affluent households purchase at its outlets more frequently.

Costco last traded at $514.84 on the Nasdaq.

Information for this briefing was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.