On November 7, the Federal Reserve Bank of New York published its Quarterly Report on Household Debt and Credit for the third quarter of 2023. The report contained some troubling details about U.S. borrowers, particularly regarding credit card debt.

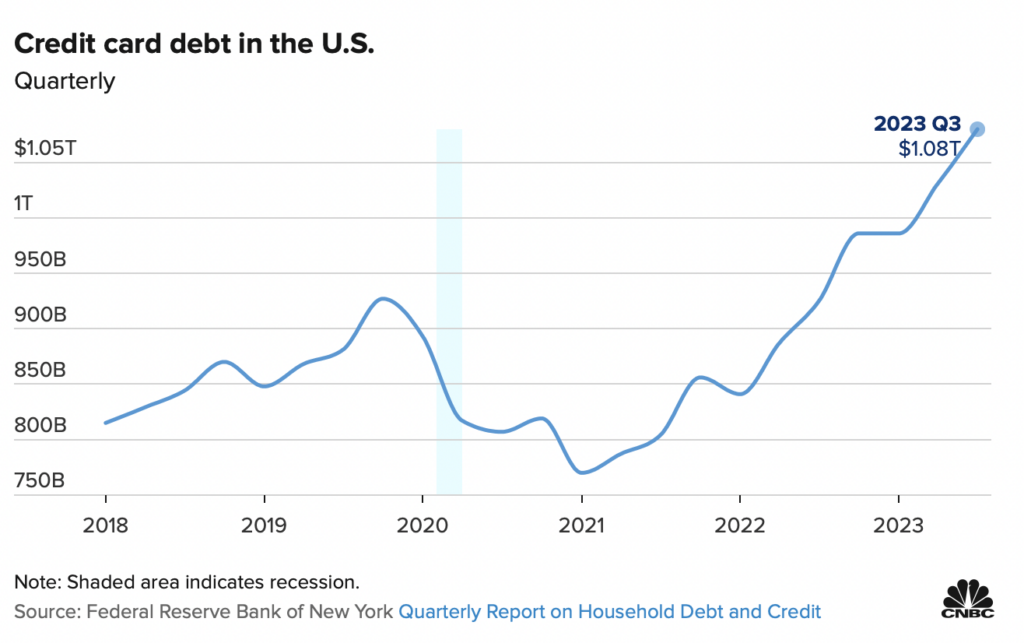

Total U.S. credit card debt reached US$1.08 trillion as of September 30, 2023. Over the twelve months ended September 30, 2023, aggregate card balances rose US$154 billion, the largest nominal year-over-year increase since the New York Fed began tracking the data in 1999. The Fed did note that the jump in balances was linked to “strong consumer spending and real GDP growth,” but the magnitude of the increase in credit card balances suggests that many in the U.S. are using credit cards to temporarily subsidize perhaps unsustainable lifestyles.

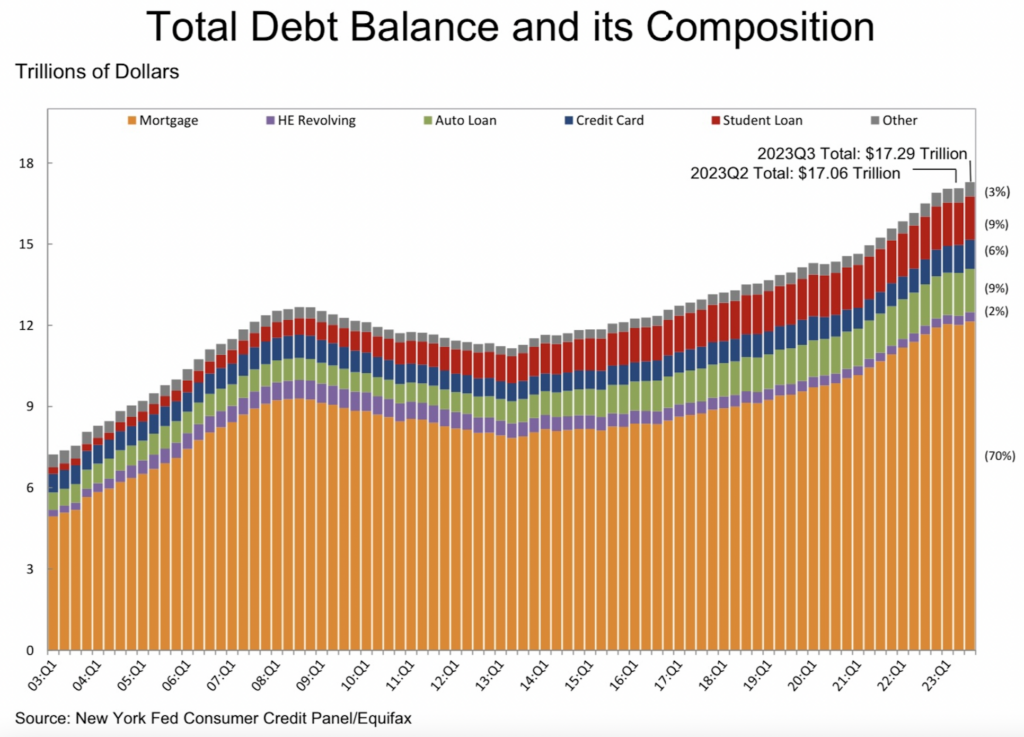

As an aside, total U.S. consumer debt reached US$17.29 trillion as of September 30, 2023. About 70% of this debt is mortgage debt.

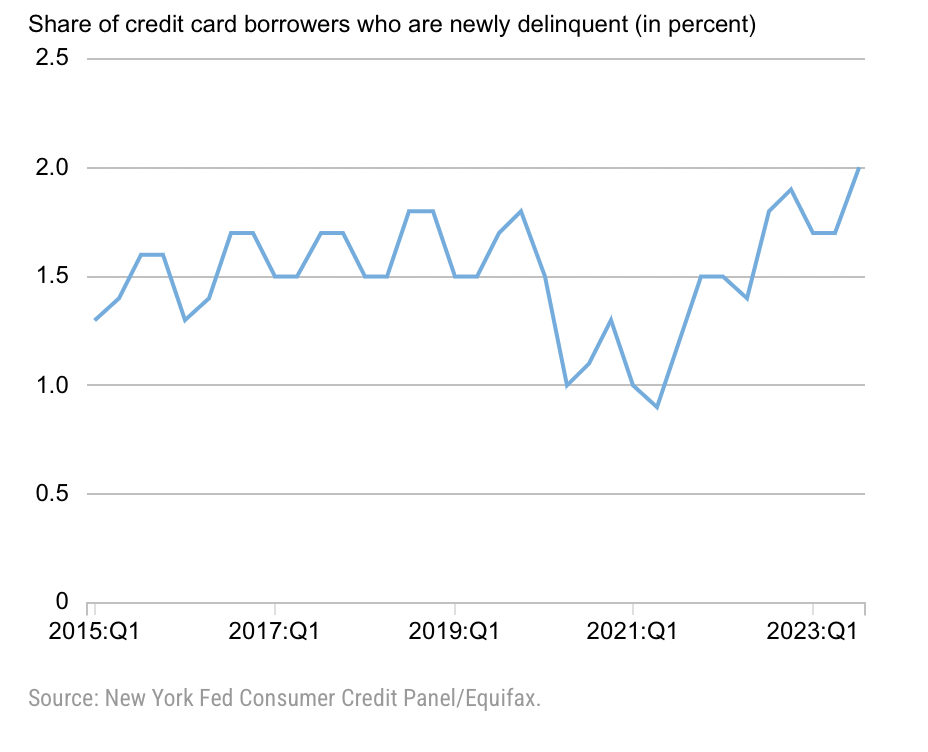

About 2.0% of credit card users became newly delinquent (thirty days or more past due on at least one account) in 3Q 2023. This percentage represents the highest level since at least 2015 and, importantly, exceeds pre-pandemic readings in 2019. A concern is that new delinquencies will probably rise even further this quarter as new credit card delinquencies historically peak in the fourth quarter before declining in the first and second quarters. Note the seasonal trends in the below graph.

Of course, a significant reason for the difficulty in making credit card payments is the staggering amount of interest and fees that card issuers charge customers. On October 25, the Consumer Financial Protection Bureau released data that in 2022 U.S. consumers were socked with US$105 billion and US$25 billion in credit card interest and fees, respectively. Credit card interest is likely to be higher in 2023 than in 2022 as the Fed did not begin raising short-term interest rates until mid-March 2022.

READ: Credit Card Debt Hits New All-Time High in Canada

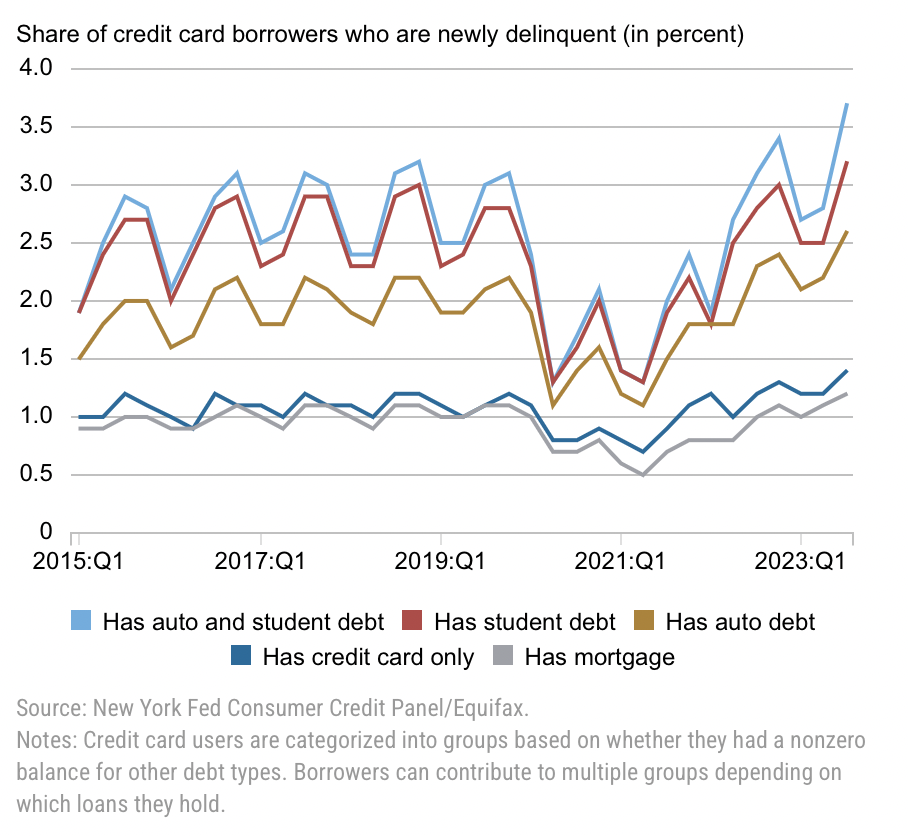

The number of newly delinquent credit card users who also are servicing auto loans and student loans – indeed, required student loan payments just restarted this fall – has risen especially quickly. About 3.7% of credit card holders with these other debts became at least thirty days late on at least one card for the first time in 3Q 2023. This reading is a full 0.6 percentage points higher than it was in 2019, the last year before COVID hit. Unfortunately, the burden of having now to begin repaying student loans after having been excused from doing so for 3+ years could very well cause this data series to trend much higher in 4Q 2023.

Information for this story was found via the New York Fed and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.