After Curaleaf’s (CSE: CURA) record-breaking second-quarter numbers, analysts have upgraded their twelve-month price targets. Curaleaf reported revenue of $117.5 million versus Refinitiv’s consensus estimate of $108.7 million. Managed revenue came in at $121.4 million, and pro-forma revenue was $165.4 million. The pro-forma revenue consists of revenue that came from Arrow Alternative Care and GR Companies. Curaleaf reported a $0.00 earnings per share, above the estimate of -$0.03.

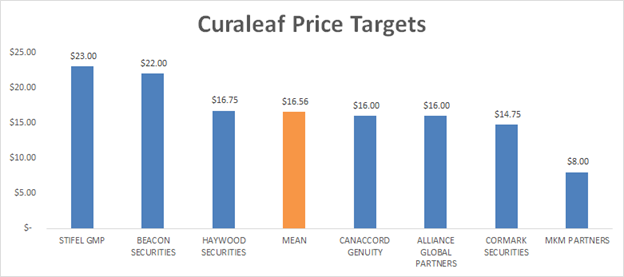

Two analysts have changed their twelve-month price target on Curaleaf, while one analyst has upgraded his recommendation on Curaleaf.

- Cormark upgrades Curaleaf to buy from neutral

- Canaccord Genuity raises price target to C$16 from C$15

- Haywood Securities raises target price to C$16.75 from C$11.75

Ten analysts have recommendations and price targets on the stock. Two analysts have strong buy recommendations, seven analysts have buy recommendations, and one analyst has a hold recommendation. The mean 12-month price target is C$16.56 or a ~43 upside. The highest price target comes from Andrew Partheniou from Stifel GMP with a C$23 price target or a 98% upside. The lowest comes from William J Kirk from MKM Partners, who has a C$8 price target and is the only analyst to have a hold recommendation.

Canaccord Genuity’s Matt Bottomley upgraded his price target on Curaleaf, which is their top cannabis pick, to C$16 and reiterated their speculative buy recommendation. Bottomley says that “growth was supported both organically and through the first full quarter of contribution from Select and the closing acquisitions in Connecticut and Maine.” Thus, Curaleaf’s retail and wholesale channels increased by 17% and 63% quarter over quarter, respectively.

Bottomley notes that with the management commentary in the news release stating that revenues would have been U$26 million higher if it wasn’t for state-mandated retail shutdowns, that they currently have a revenue run-rate that is above U$750 million which the analyst identifies as “making CURA by far the largest global cannabis company by revenues.”

Canaccord also says that Curaleaf has an “attractive balance sheet vs. most MSO peers,” with Curaleaf’s U$132 million in cash, while the company raised another U$67 million via private placements and sale leasebacks. Alongside increasing his price target because of management commentary and the third-quarter guidance of managed revenue between U$190 million and U$200 million, Bottomley has updated their 2020 and 2021 full-year estimates. He now expects pro-forma revenue to come in at U$797.5 million and U$1.3 billion, respectively.

Andrew Partheniou of Stifel GMP also commented on the quarter, stating, “Q2 surprise EBITDA strength despite weak MA/NV”. Within the note, he reiterates his Buy recommendation and C$23 12-month price target. Partheniou highlighted the adjusted EBITDA of U$28 million above the street estimate of U$20 million or a 40% beat.

Stifel also stated, “debit cards icing on the productivity cake” as he points out that management has reported customer basket sizes have increased by roughly 20% quarter over quarter, without a material decline in the frequency of the visits. And just like Canaccord, Stifel has changed their 2020 and 2021 full-year revenue estimates. The firm now expects Curaleaf to hit U$682.9 million and U$1.3 billion in revenue, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.