Curaleaf Holdings (CSE: CURA) announced that they would be reporting their third quarter financial results on Monday, November 8th after the markets close. The average revenue estimate between 15 analysts is US$339.95 million, while EBITDA is expected to be US$98.68 million with 14 analysts estimates.

There are currently 15 analysts who cover Curaleaf with an average 12-month price target of C$27.48, or a 116% upside. Out of the 15 analysts, 5 have strong buy ratings and 10 have buy ratings. The street high sits at C$32.25 from Stifel-GMP while the lowest comes in at C$23.50.

In Haywood Capital Market’s third quarter preview, they reiterate their buy rating but lower their 12-month price target to C$23.50 from C$28, as they lower the overall growth expectations slightly.

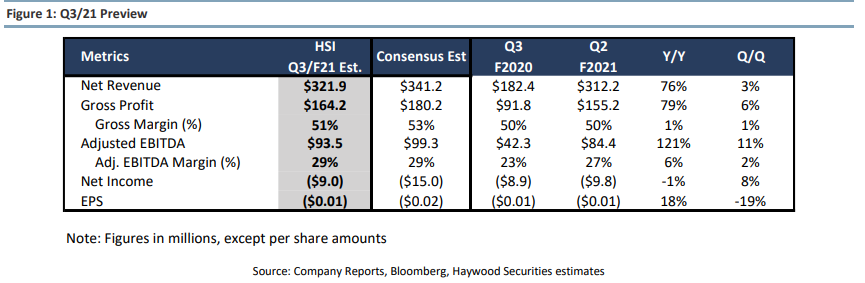

For this quarter, Haywood’s revenue estimate is slightly below the consensus. They expect revenue to be US$321.9 million, or 3% growth sequentially to a new record quarter. They believe that gross margins and EBITDA margins will remain relatively flat as they believe that the cost-saving management has announced will be partially offset by an increase in supply costs.

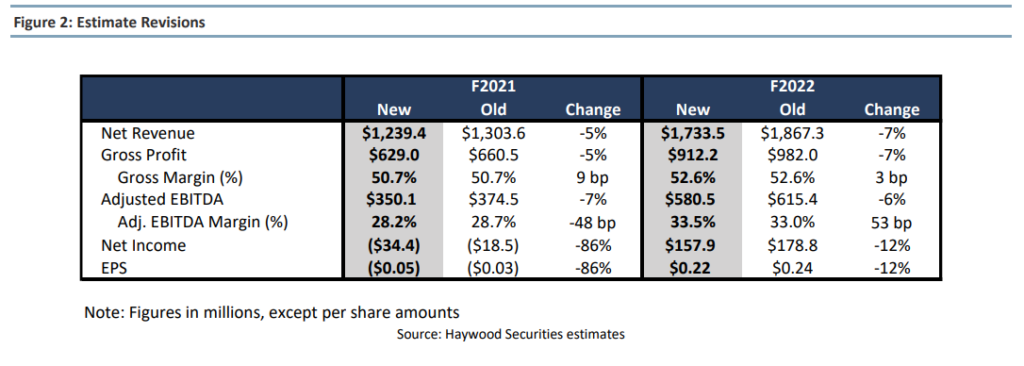

Below you can see Haywood’s updated 2021 and 2022 estimates. The firm still believes that Curaleaf will hit its 2021 full-year revenue guidance of $1.2 – $1.3 billion but have elected, “to take a more conservative outlook to our growth expectations for 2022.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

US Cannabis, Momentum, With Lots of Hurdles

The US Cannabis market has been a confusing ride for investors to comprehend. We have...