FULL DISCLOSURE: This is sponsored content for Plurilock.

The rise of artificial intelligence has been fantastic for the market caps of ‘picks and shovels’ companies that are affected by the industry. The eye-popping rise of Nvidia’s stock price is directly a result of their production of the graphic processing units that are so important to the huge computing demands of the data centers that AI relies on.

What other industry sees the rise of AI as a huge once-in-a-generation happening? The industry of crime. Cybersecurity Ventures states that victims of cybercrime lost $6 trillion in 2021. The potential impact of cybercrime is significant, with damages estimated to reach $10.5 trillion annually by 2025, a 300% increase from 2015, according to McKinsey.

The growth of cybersecurity

The global cybersecurity market as a result is experiencing notable growth, a trend that is expected to continue in the coming years. In 2023, the global cybersecurity market was valued at about $172.32 billion. By 2030, it is projected to reach $424.97 billion, growing at a CAGR of 13.8%, according to Fortune Business Insights.

Another projection estimates the market will grow from $182.8 billion in 2024 to $314.3 billion by 2029, with a CAGR of 11.4%, as reported by Mordor Intelligence. Additionally, Cybersecurity Ventures forecasts cumulative cybersecurity spending to total $1.75 trillion between 2021 and 2025.

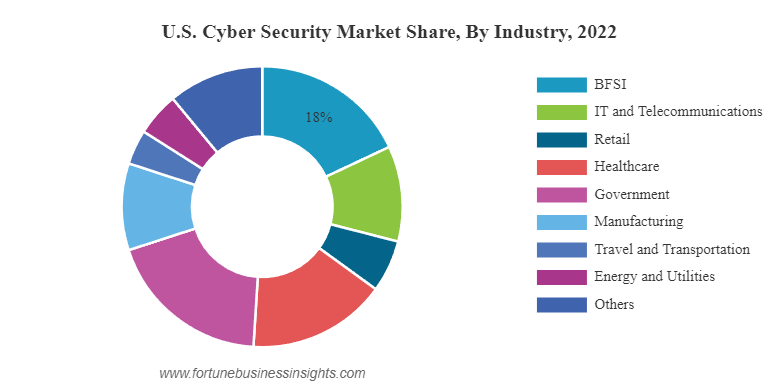

North America holds the largest market share due to widespread digital technology use and strict cybersecurity regulations. Grand View Research reports that North America accounts for 34.9% of the market’s revenue. The market here is driven by advanced technology infrastructure and prevalent cyber threats. Meanwhile, Asia-Pacific is anticipated to be the fastest-growing region, with countries like India, China, and South Korea leading the charge due to increased government investments and rising cybersecurity threats, as noted by Fortune Business Insights. Europe is also expected to see significant growth, spurred by increasing digital transformation and cloud adoption across industries.

In the Banking, Financial Services, and Insurance (BFSI) sector, there is a significant adoption of cybersecurity solutions, driven by the need to protect sensitive financial data and comply with regulatory standards. The healthcare sector is projected to expand rapidly due to the increasing incidence of cyber-attacks targeting sensitive patient information and healthcare infrastructure.

The growth of the cybersecurity market is primarily driven by several factors. The increasing frequency and sophistication of cyber-attacks necessitate robust cybersecurity measures. As more industries adopt digital technologies, the need for cybersecurity solutions grows.

Stringent regulatory requirements across various industries push organizations to invest in cybersecurity. Additionally, the adoption of cloud-based cybersecurity solutions is on the rise due to their scalability, flexibility, and cost-effectiveness.

Major cybersecurity players

Major players in the cybersecurity industry, like CrowdStrike (NASDAQ: CRWD), Fortinet (NASDAQ: FTNT), and Palo Alto Networks (NASDAQ: PANW), have made significant strides with their innovative solutions. CrowdStrike, in particular, stands out with its CrowdStrike Falcon platform, which provides comprehensive protection for endpoints, cloud workloads, identities, and data. This innovation has earned CrowdStrike a leader position in the Gartner Magic Quadrant for Endpoint Protection Platforms for four consecutive years, thanks to its high scores in Vision and Innovation.

Financially, CrowdStrike’s growth has been impressive. In Q1 2024, the company reported total revenue of $692.6 million, a 42% increase from $487.8 million in Q1 2023. Their subscription revenue also grew by 42%, reaching $651.2 million, up from $459.8 million in Q1 2023.

Additionally, their annual recurring revenue (ARR) grew 42% year-over-year to $2.73 billion, with $174.2 million in net new ARR added in the quarter. This strong financial performance underscores CrowdStrike’s solid market position and growth trajectory.

Cybersecurity’s small caps

The cybersecurity landscape is becoming more diverse with the rise of small-cap companies. These emerging players are driven by the increasing demand for specialized security solutions and the ever-evolving nature of cyber threats.

Unlike their larger counterparts, small-cap companies often focus on niche technologies, offering innovative approaches to specific security challenges. Their agility and specialized expertise allow them to address gaps in the market, making them essential contributors to the cybersecurity ecosystem. As they grow and develop, these companies add vibrancy and competition, pushing the industry forward with fresh ideas and solutions.

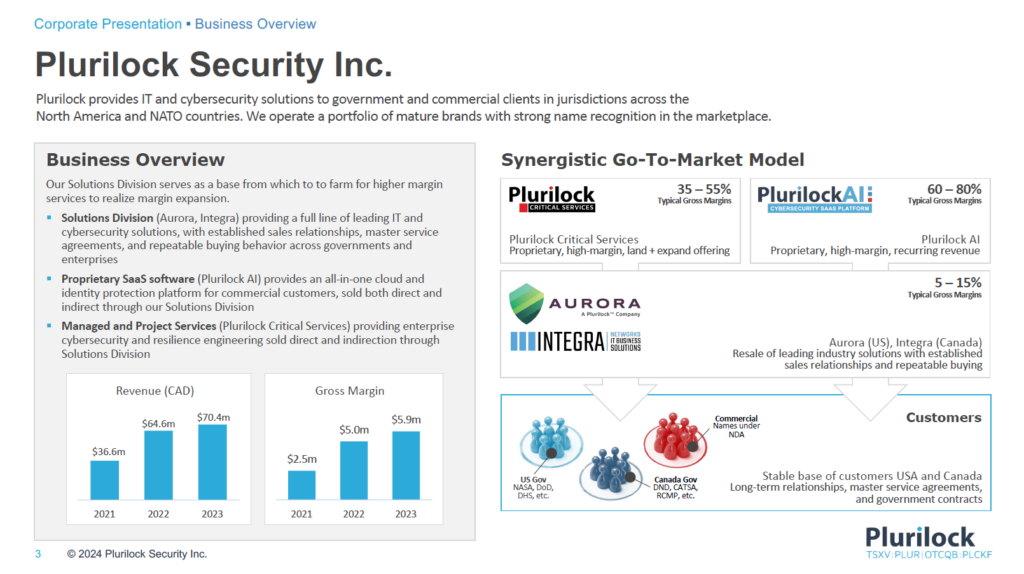

Plurilock Security (TSXV: PLUR) is a standout in terms of North American cybersecurity consolidator that holds patented software in data security, artificial intelligence safety, and identity safety.

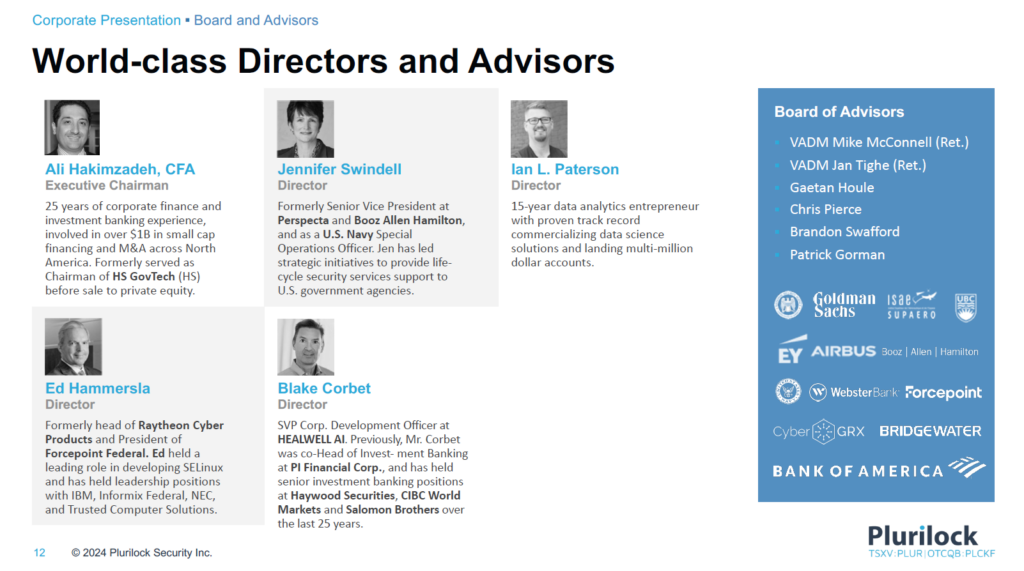

Besides their product offering, what distinguishes Plurilock from other smaller players is a board of directors and board of advisors that is second to none. There are former leaders here from top military military and intelligence contractors, such as Booz Allen Hamilton, Raytheon Cyber Products, from US Naval Operations & Intelligence, and the former top Chief Security Officer at multinationals including Airbus, Bombardier & Bell Canada.

Other executives include the former top US Chief Information Security Officer at financial powerhouses that include Bank of America-Merrill Lynch & Bridgewater – and among government agency leaders, they even boast a former Vice Admiral & Director of the National Security Agency.

Gaining the trust of the US Department of Defense and intelligence agencies is no easy task – yet the company has managed to do so, as evidenced by their laundry list of top-tier clientele. The executives Plurilock has brought on board are likely responsible for the very high level of customers and Tier-1 Partners they are now generating.

Cybersecurity is clearly a huge and fast-growing industry. If cybersecurity is not yet on your radar of investing interest, it probably is a space worth doing a deep dive into.

FULL DISCLOSURE: Plurilock Security is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Plurilock Security. The author has been compensated to cover Plurilock Security on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.